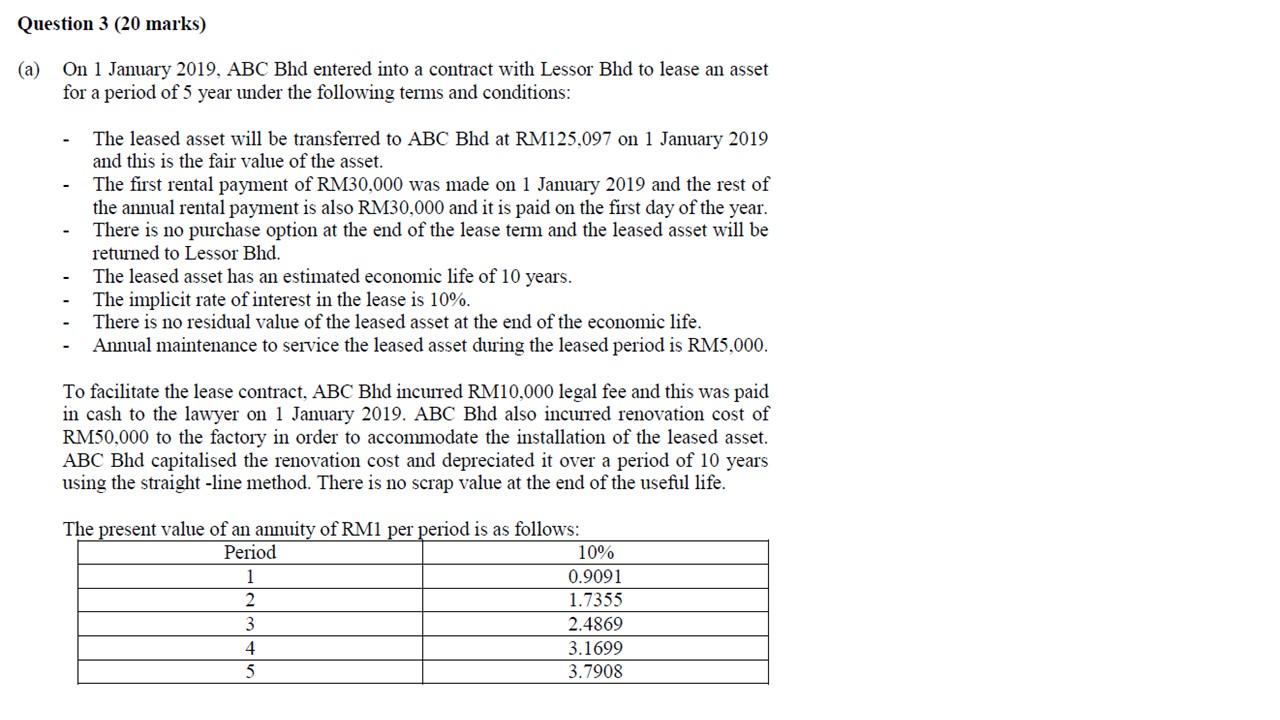

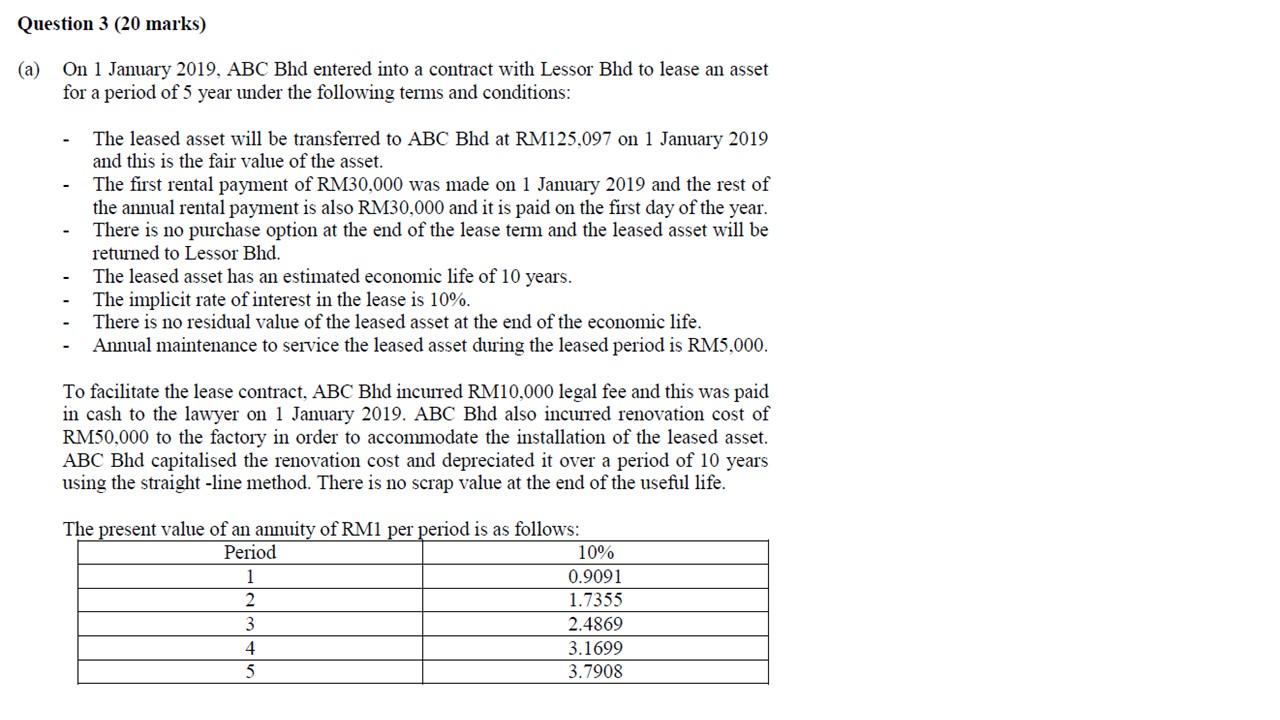

Question 3 (20 marks) (a) On 1 January 2019, ABC Bhd entered into a contract with Lessor Bhd to lease an asset for a period of 5 year under the following terms and conditions: The leased asset will be transferred to ABC Bhd at RM125,097 on 1 January 2019 and this is the fair value of the asset. The first rental payment of RM30,000 was made on 1 January 2019 and the rest of the annual rental payment is also RM30,000 and it is paid on the first day of the year. There is no purchase option at the end of the lease term and the leased asset will be returned to Lessor Bhd. The leased asset has an estimated economic life of 10 years. The implicit rate of interest in the lease is 10%. There is no residual value of the leased asset at the end of the economic life. Annual maintenance to service the leased asset during the leased period is RM5,000. To facilitate the lease contract, ABC Bhd incurred RM10,000 legal fee and this was paid in cash to the lawyer on 1 January 2019. ABC Bhd also incuired renovation cost of RM50,000 to the factory in order to accommodate the installation of the leased asset. ABC Bhd capitalised the renovation cost and depreciated it over a period of 10 years using the straight-line method. There is no scrap value at the end of the useful life. The present value of an annuity of RM1 per period is as follows: Period 10% 1 0.9091 2 1.7355 3 2.4869 4 3.1699 5 3.7908 Required: In connection with the above lease transaction, prepare the relevant extracts for following statements of ABC Bhd for the year ended 31 December 2019: (1) The statement of profit and loss. (7 marks) (ii) The statement of financial position. (8 marks) Note: You are required to show all the workings. (b) Mr Chan, the finance director is suggesting to the board of directors to finance the purchase of assets through leasing. Since the board of directors are not literate in accounting and finance, as an assistant of Mr Chan you are required to prepare a summary on how leasing works based on the present accounting standard in Malaysia. In your summary you are required to highlight 3 advantages of using leasing as a way to strengthen the financial position of the company. (5 marks) Question 3 (20 marks) (a) On 1 January 2019, ABC Bhd entered into a contract with Lessor Bhd to lease an asset for a period of 5 year under the following terms and conditions: The leased asset will be transferred to ABC Bhd at RM125,097 on 1 January 2019 and this is the fair value of the asset. The first rental payment of RM30,000 was made on 1 January 2019 and the rest of the annual rental payment is also RM30,000 and it is paid on the first day of the year. There is no purchase option at the end of the lease term and the leased asset will be returned to Lessor Bhd. The leased asset has an estimated economic life of 10 years. The implicit rate of interest in the lease is 10%. There is no residual value of the leased asset at the end of the economic life. Annual maintenance to service the leased asset during the leased period is RM5,000. To facilitate the lease contract, ABC Bhd incurred RM10,000 legal fee and this was paid in cash to the lawyer on 1 January 2019. ABC Bhd also incuired renovation cost of RM50,000 to the factory in order to accommodate the installation of the leased asset. ABC Bhd capitalised the renovation cost and depreciated it over a period of 10 years using the straight-line method. There is no scrap value at the end of the useful life. The present value of an annuity of RM1 per period is as follows: Period 10% 1 0.9091 2 1.7355 3 2.4869 4 3.1699 5 3.7908 Required: In connection with the above lease transaction, prepare the relevant extracts for following statements of ABC Bhd for the year ended 31 December 2019: (1) The statement of profit and loss. (7 marks) (ii) The statement of financial position. (8 marks) Note: You are required to show all the workings. (b) Mr Chan, the finance director is suggesting to the board of directors to finance the purchase of assets through leasing. Since the board of directors are not literate in accounting and finance, as an assistant of Mr Chan you are required to prepare a summary on how leasing works based on the present accounting standard in Malaysia. In your summary you are required to highlight 3 advantages of using leasing as a way to strengthen the financial position of the company