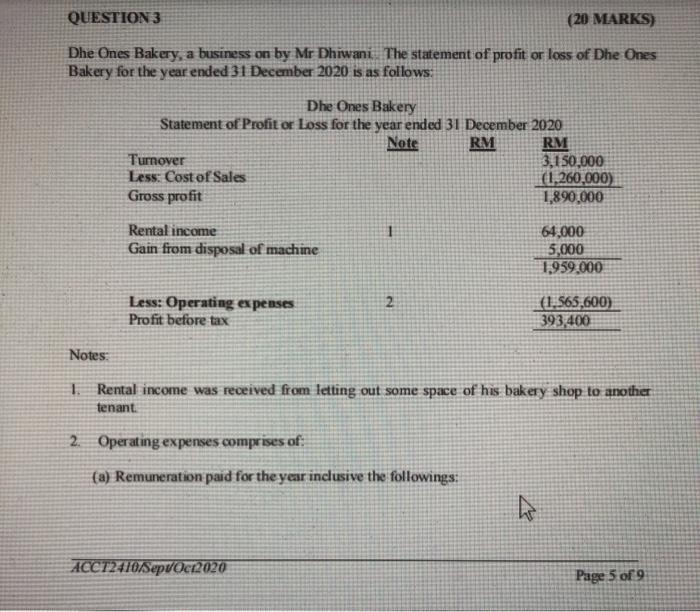

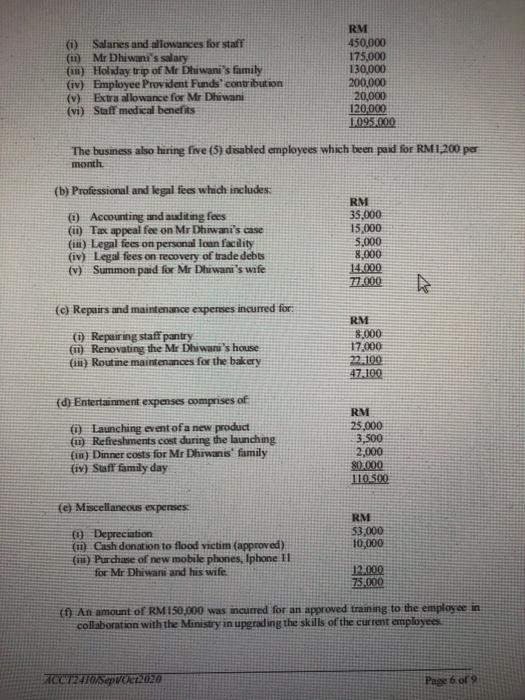

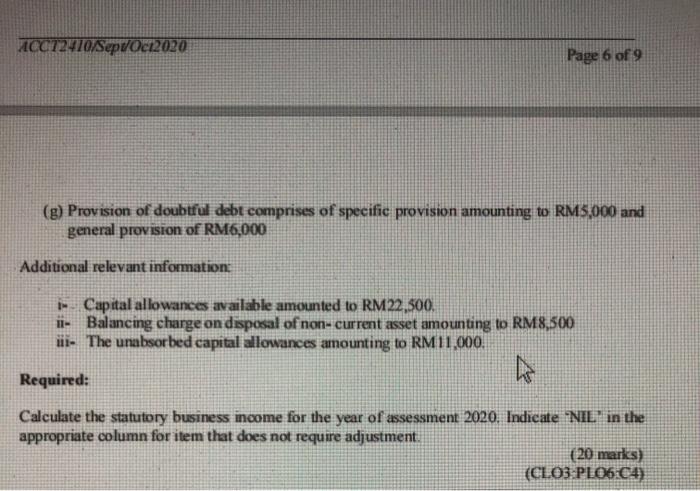

QUESTION 3 (20 MARKS) Dhe Ones Bakery, a business on by Mr Dhiwani. The statement of profit or loss of Dhe Ones Bakery for the year ended 31 December 2020 is as follows: Dhe Ones Bakery Statement of Profit or Loss for the year ended 31 December 2020 Note RM RM Turnover 3,150,000 Less: Cost of Sales (1.260,000) Gross profit 1,890.000 Rental income Gain from disposal of machine 64,000 5,000 1,959,000 2 Less: Operating expenses Profit before tax (1.565,600) 393,400 Notes 1. Rental income was received from letting out some space of his bakery shop to another tenant 2. Operating expenses comprises of: (a) Remuneration paid for the year inclusive the followings: ACCT2410/Sep Oct2020 Page 5 of 9 RM (i) Salanes and allowances for staff (1) Mr Dhiwani's salary in Holiday trip of Mr Dhiwani's family (iv) Employee Provident Funds contribution (v) Extra allowance for Mr Dhiwani (vi) Staff medical benefits 450,000 175.000 130,000 200.000 20,000 120,000 1095.000 The business also hiring five (5) disabled employees which been paid for RM1,200 per month (b) Professional and legal fees which includes: (0) Accounting and auditing fees Tax cal fee on Mr Dhiwani's case (it) Legal fees on personal loan facility (iv) Legal fees on recovery of trade debts (v) Summon paid for Mr Dhiwani's wife RM 35,000 15,000 5,000 8,000 45000 (c) Repairs and maintenance expenses incurred for (1) Repairing staff pantry (1) Renovating the Mr Dhiwaru's house (ii) Routine maintenances for the bakery RM 8.000 17.000 22.100 47.100 (d) Entertainment expenses comprises of Launching event of a new product (1) Refreshments cost during the launching Eu) Dinner costs for Mr Dhiwanis family (iv) Staff family day RM 25,000 3,500 2,000 80.000 110 500 {e) Miscellaneous expenses RM 53,000 10.000 Depreciation ii) Cash donation to flood victim (approved) (it) Purchase of new mobile phones, Iphone 11 for Mr Dhiwani and his wife 12.000 75.000 {f} An amount of RM150.000 was incurred for an approved training to the employee in collaboration with the Ministry in upgrading the skills of the current employees ACYOY2470/Sept.2020 Page 6 of 9 ACC72470/Sep/Oct2020 Page 6 of 9 (g) Provision of doubtful debt comprises of specific provision amounting to RM5,000 and general provision of RM6,000 Additional relevant information - Capital allowances available amounted to RM 22,500. - Balancing charge on disposal of non-current asset amounting to RM8,500 t- The unabsorbed capital allowances amounting to RM11,000. Required: Calculate the statutory business income for the year of assessment 2020. Indicate "NIL in the appropriate column for item that does not require adjustment. (20 marks) (CLO3 PL06 C4) QUESTION 3 (20 MARKS) Dhe Ones Bakery, a business on by Mr Dhiwani. The statement of profit or loss of Dhe Ones Bakery for the year ended 31 December 2020 is as follows: Dhe Ones Bakery Statement of Profit or Loss for the year ended 31 December 2020 Note RM RM Turnover 3,150,000 Less: Cost of Sales (1.260,000) Gross profit 1,890.000 Rental income Gain from disposal of machine 64,000 5,000 1,959,000 2 Less: Operating expenses Profit before tax (1.565,600) 393,400 Notes 1. Rental income was received from letting out some space of his bakery shop to another tenant 2. Operating expenses comprises of: (a) Remuneration paid for the year inclusive the followings: ACCT2410/Sep Oct2020 Page 5 of 9 RM (i) Salanes and allowances for staff (1) Mr Dhiwani's salary in Holiday trip of Mr Dhiwani's family (iv) Employee Provident Funds contribution (v) Extra allowance for Mr Dhiwani (vi) Staff medical benefits 450,000 175.000 130,000 200.000 20,000 120,000 1095.000 The business also hiring five (5) disabled employees which been paid for RM1,200 per month (b) Professional and legal fees which includes: (0) Accounting and auditing fees Tax cal fee on Mr Dhiwani's case (it) Legal fees on personal loan facility (iv) Legal fees on recovery of trade debts (v) Summon paid for Mr Dhiwani's wife RM 35,000 15,000 5,000 8,000 45000 (c) Repairs and maintenance expenses incurred for (1) Repairing staff pantry (1) Renovating the Mr Dhiwaru's house (ii) Routine maintenances for the bakery RM 8.000 17.000 22.100 47.100 (d) Entertainment expenses comprises of Launching event of a new product (1) Refreshments cost during the launching Eu) Dinner costs for Mr Dhiwanis family (iv) Staff family day RM 25,000 3,500 2,000 80.000 110 500 {e) Miscellaneous expenses RM 53,000 10.000 Depreciation ii) Cash donation to flood victim (approved) (it) Purchase of new mobile phones, Iphone 11 for Mr Dhiwani and his wife 12.000 75.000 {f} An amount of RM150.000 was incurred for an approved training to the employee in collaboration with the Ministry in upgrading the skills of the current employees ACYOY2470/Sept.2020 Page 6 of 9 ACC72470/Sep/Oct2020 Page 6 of 9 (g) Provision of doubtful debt comprises of specific provision amounting to RM5,000 and general provision of RM6,000 Additional relevant information - Capital allowances available amounted to RM 22,500. - Balancing charge on disposal of non-current asset amounting to RM8,500 t- The unabsorbed capital allowances amounting to RM11,000. Required: Calculate the statutory business income for the year of assessment 2020. Indicate "NIL in the appropriate column for item that does not require adjustment. (20 marks) (CLO3 PL06 C4)