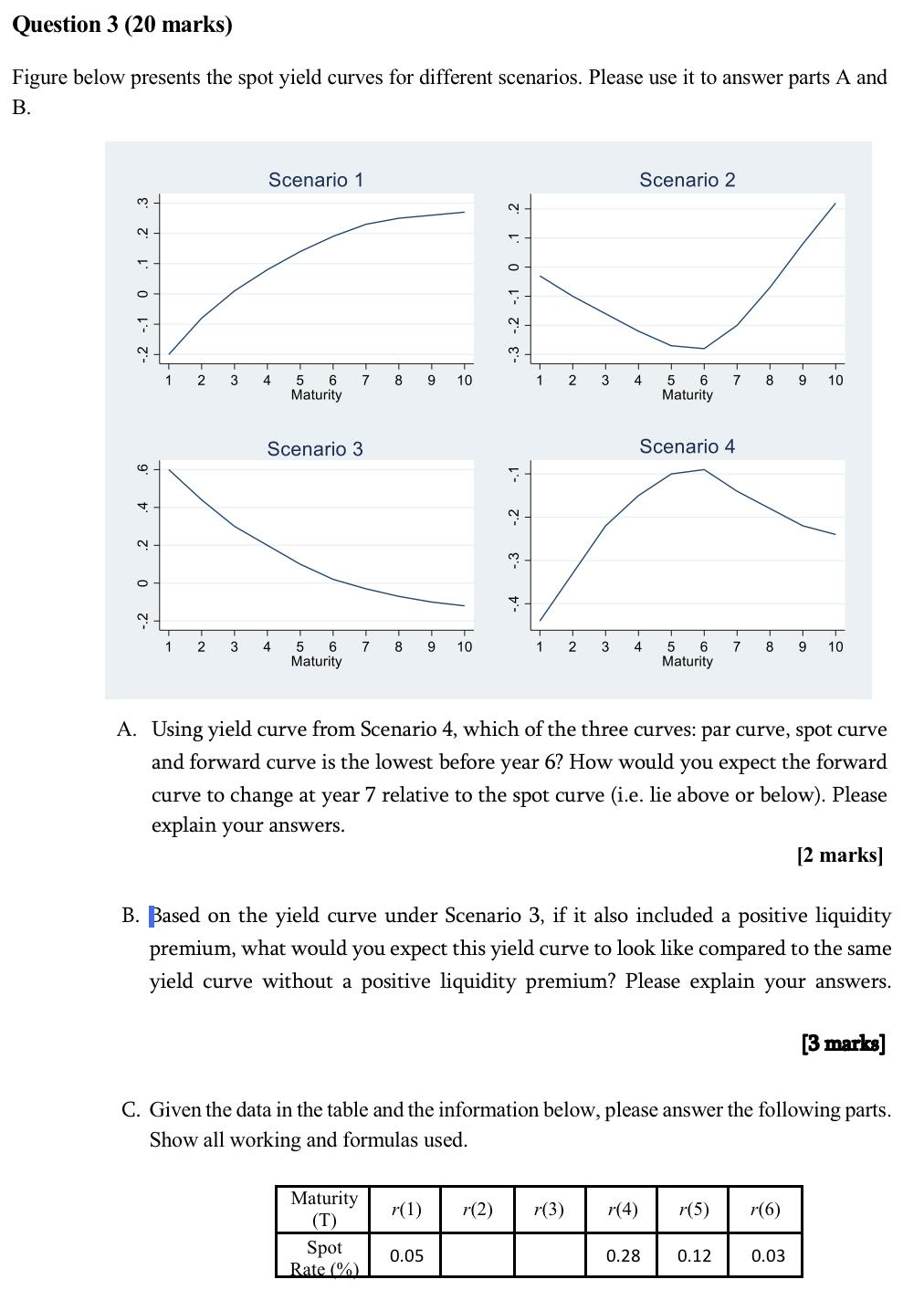

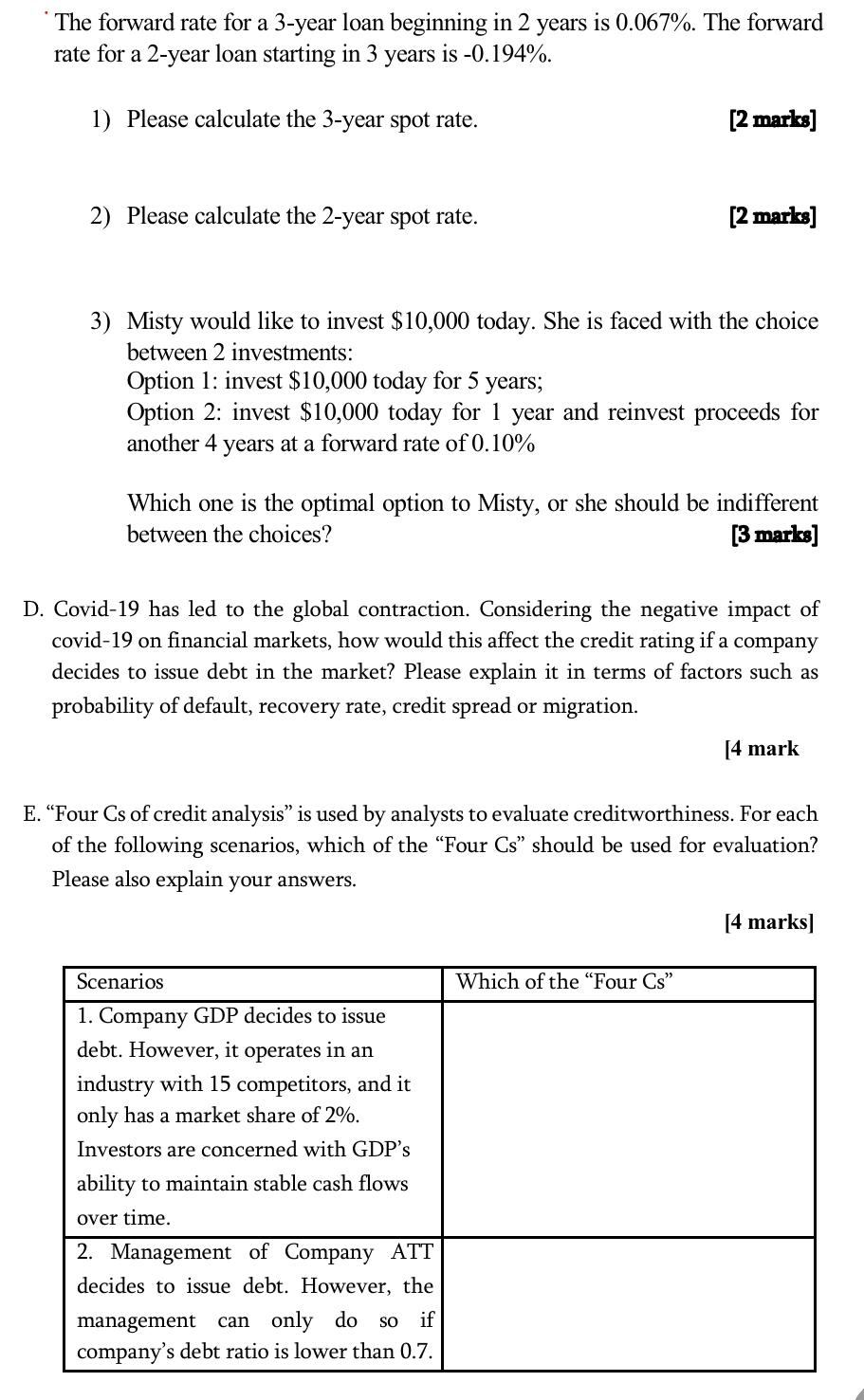

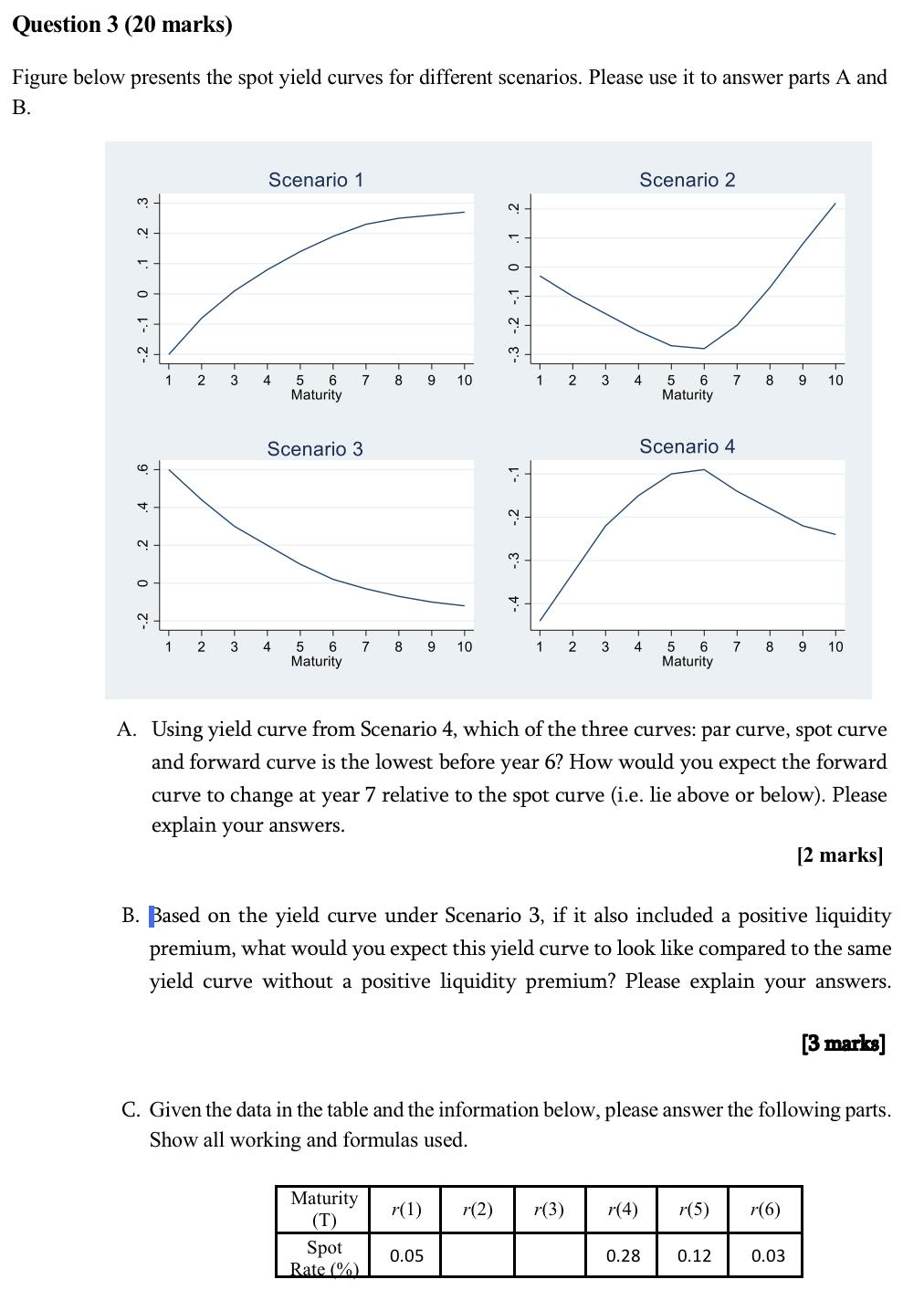

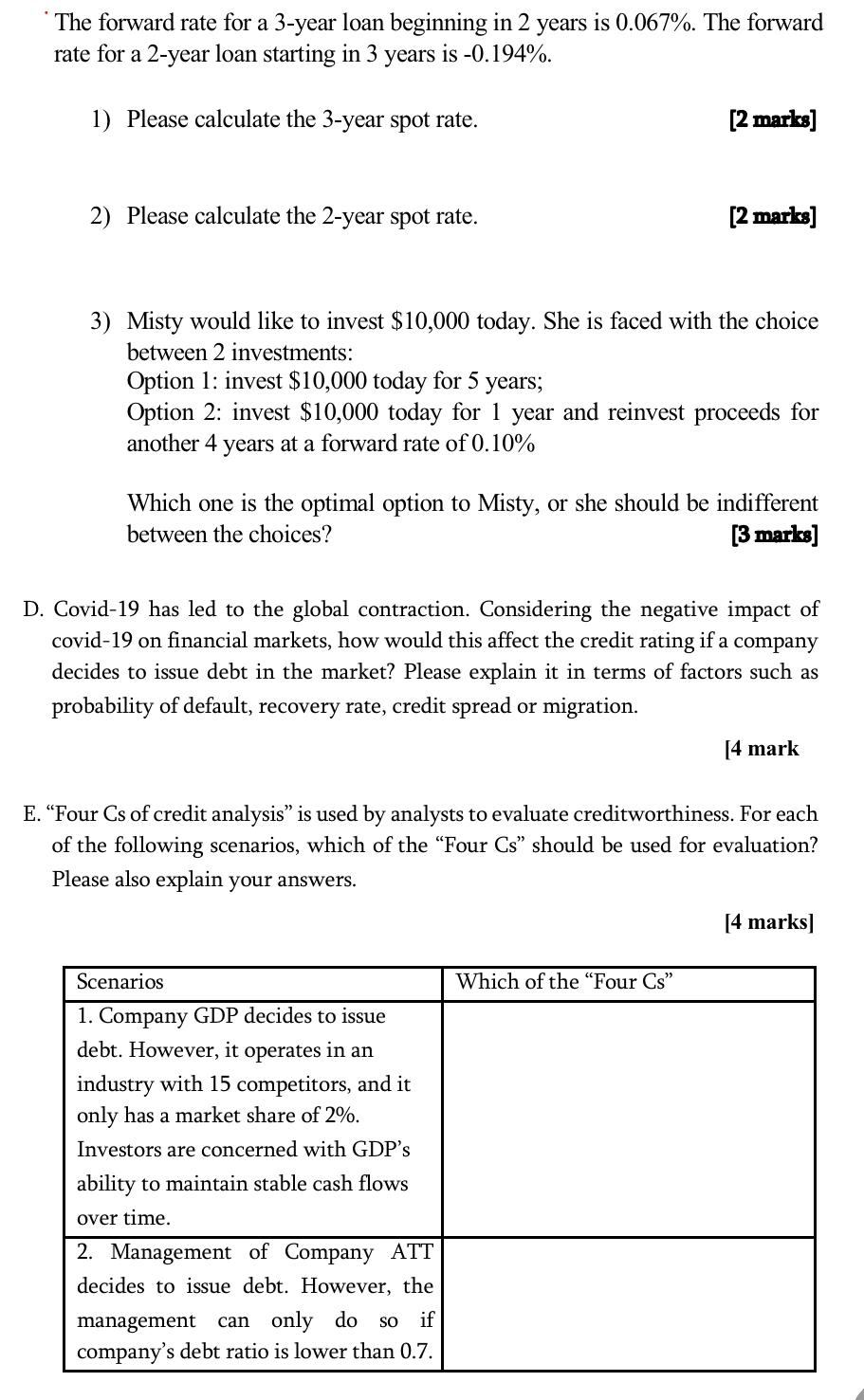

Question 3 (20 marks) Figure below presents the spot yield curves for different scenarios. Please use it to answer parts A and B. Scenario 1 Scenario 2 .1.2 2 -1 0 .1 .2 .3 --3 -2 -1 0 2 3 4 7 8 9 10 1 2 3 4 7 8 9 10 5 6 Maturity 5 6 Maturity Scenario 3 Scenario 4 -.1 + 3 0 -.4 T 1 1 2 3 4 7 8 9 10 1 2 3 4 7 8 9 10 5 6 Maturity 5 6 Maturity A. Using yield curve from Scenario 4, which of the three curves: par curve, spot curve and forward curve is the lowest before year 6? How would you expect the forward curve to change at year 7 relative to the spot curve (i.e. lie above or below). Please explain your answers. [2 marks] B. Based on the yield curve under Scenario 3, if it also included a positive liquidity premium, what would you expect this yield curve to look like compared to the same yield curve without a positive liquidity premium? Please explain your answers. [3 marks] C. Given the data in the table and the information below, please answer the following parts. Show all working and formulas used. r(1) r(2) r(3) r(5) r(6) Maturity (T) Spot Rate 1 ca 0.05 0.28 0.12 0.03 * The forward rate for a 3-year loan beginning in 2 years is 0.067%. The forward rate for a 2-year loan starting in 3 years is -0.194%. 1) Please calculate the 3-year spot rate. [2 marks] 2) Please calculate the 2-year spot rate. [2 marks] 3) Misty would like to invest $10,000 today. She is faced with the choice between 2 investments: Option 1: invest $10,000 today for 5 years, Option 2: invest $10,000 today for 1 year and reinvest proceeds for another 4 years at a forward rate of 0.10% Which one is the optimal option to Misty, or she should be indifferent between the choices? [3 marks] D. Covid-19 has led to the global contraction. Considering the negative impact of covid-19 on financial markets, how would this affect the credit rating if a company decides to issue debt in the market? Please explain it in terms of factors such as probability of default, recovery rate, credit spread or migration. [4 mark E. Four Cs of credit analysis is used by analysts to evaluate creditworthiness. For each of the following scenarios, which of the Four Cs should be used for evaluation? Please also explain your answers. [4 marks] Scenarios Which of the "Four Cs" 1. Company GDP decides to issue debt. However, it operates in an industry with 15 competitors, and it only has a market share of 2%. Investors are concerned with GDP's ability to maintain stable cash flows over time. 2. Management of Company ATT decides to issue debt. However, the management can only do so if company's debt ratio is lower than 0.7. Question 3 (20 marks) Figure below presents the spot yield curves for different scenarios. Please use it to answer parts A and B. Scenario 1 Scenario 2 .1.2 2 -1 0 .1 .2 .3 --3 -2 -1 0 2 3 4 7 8 9 10 1 2 3 4 7 8 9 10 5 6 Maturity 5 6 Maturity Scenario 3 Scenario 4 -.1 + 3 0 -.4 T 1 1 2 3 4 7 8 9 10 1 2 3 4 7 8 9 10 5 6 Maturity 5 6 Maturity A. Using yield curve from Scenario 4, which of the three curves: par curve, spot curve and forward curve is the lowest before year 6? How would you expect the forward curve to change at year 7 relative to the spot curve (i.e. lie above or below). Please explain your answers. [2 marks] B. Based on the yield curve under Scenario 3, if it also included a positive liquidity premium, what would you expect this yield curve to look like compared to the same yield curve without a positive liquidity premium? Please explain your answers. [3 marks] C. Given the data in the table and the information below, please answer the following parts. Show all working and formulas used. r(1) r(2) r(3) r(5) r(6) Maturity (T) Spot Rate 1 ca 0.05 0.28 0.12 0.03 * The forward rate for a 3-year loan beginning in 2 years is 0.067%. The forward rate for a 2-year loan starting in 3 years is -0.194%. 1) Please calculate the 3-year spot rate. [2 marks] 2) Please calculate the 2-year spot rate. [2 marks] 3) Misty would like to invest $10,000 today. She is faced with the choice between 2 investments: Option 1: invest $10,000 today for 5 years, Option 2: invest $10,000 today for 1 year and reinvest proceeds for another 4 years at a forward rate of 0.10% Which one is the optimal option to Misty, or she should be indifferent between the choices? [3 marks] D. Covid-19 has led to the global contraction. Considering the negative impact of covid-19 on financial markets, how would this affect the credit rating if a company decides to issue debt in the market? Please explain it in terms of factors such as probability of default, recovery rate, credit spread or migration. [4 mark E. Four Cs of credit analysis is used by analysts to evaluate creditworthiness. For each of the following scenarios, which of the Four Cs should be used for evaluation? Please also explain your answers. [4 marks] Scenarios Which of the "Four Cs" 1. Company GDP decides to issue debt. However, it operates in an industry with 15 competitors, and it only has a market share of 2%. Investors are concerned with GDP's ability to maintain stable cash flows over time. 2. Management of Company ATT decides to issue debt. However, the management can only do so if company's debt ratio is lower than 0.7