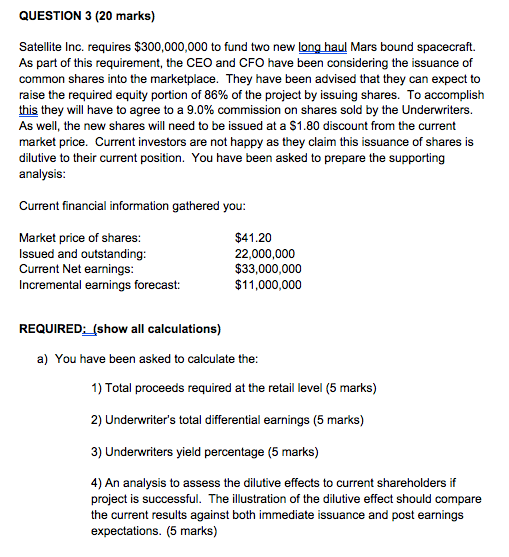

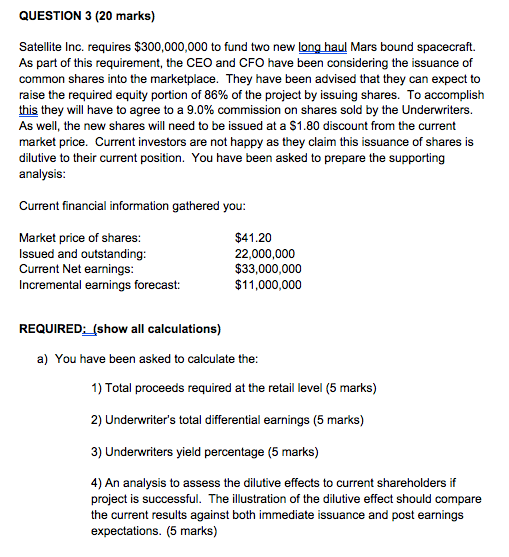

QUESTION 3 (20 marks) Satellite Inc. requires $300,000,000 to fund two new long haul Mars bound spacecraft. As part of this requirement, the CEO and CFO have been considering the issuance of common shares into the marketplace. They have been advised that they can expect to raise the required equity portion of 86% of the project by issuing shares. To accomplish this they will have to agree to a 9.0% commission on shares sold by the Underwriters. As well, the new shares will need to be issued at a $1.80 discount from the current market price. Current investors are not happy as they claim this issuance of shares is dilutive to their current position. You have been asked to prepare the supporting analysis: Current financial information gathered you: Market price of shares: Issued and outstanding: Current Net earnings: Incremental earnings forecast: $41.20 22,000,000 $33,000,000 $11,000,000 REQUIRED: (show all calculations) a) You have been asked to calculate the: 1) Total proceeds required at the retail level (5 marks) 2) Underwriter's total differential earnings (5 marks) 3) Underwriters yield percentage (5 marks) 4) An analysis to assess the dilutive effects to current shareholders if project is successful. The illustration of the dilutive effect should compare the current results against both immediate issuance and post earnings expectations. (5 marks) QUESTION 3 (20 marks) Satellite Inc. requires $300,000,000 to fund two new long haul Mars bound spacecraft. As part of this requirement, the CEO and CFO have been considering the issuance of common shares into the marketplace. They have been advised that they can expect to raise the required equity portion of 86% of the project by issuing shares. To accomplish this they will have to agree to a 9.0% commission on shares sold by the Underwriters. As well, the new shares will need to be issued at a $1.80 discount from the current market price. Current investors are not happy as they claim this issuance of shares is dilutive to their current position. You have been asked to prepare the supporting analysis: Current financial information gathered you: Market price of shares: Issued and outstanding: Current Net earnings: Incremental earnings forecast: $41.20 22,000,000 $33,000,000 $11,000,000 REQUIRED: (show all calculations) a) You have been asked to calculate the: 1) Total proceeds required at the retail level (5 marks) 2) Underwriter's total differential earnings (5 marks) 3) Underwriters yield percentage (5 marks) 4) An analysis to assess the dilutive effects to current shareholders if project is successful. The illustration of the dilutive effect should compare the current results against both immediate issuance and post earnings expectations