Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 (20 Points): Paul lives in Sydney Australia. His favorite niece, Natalie, has been accepted into a special 3-year degree program offered at

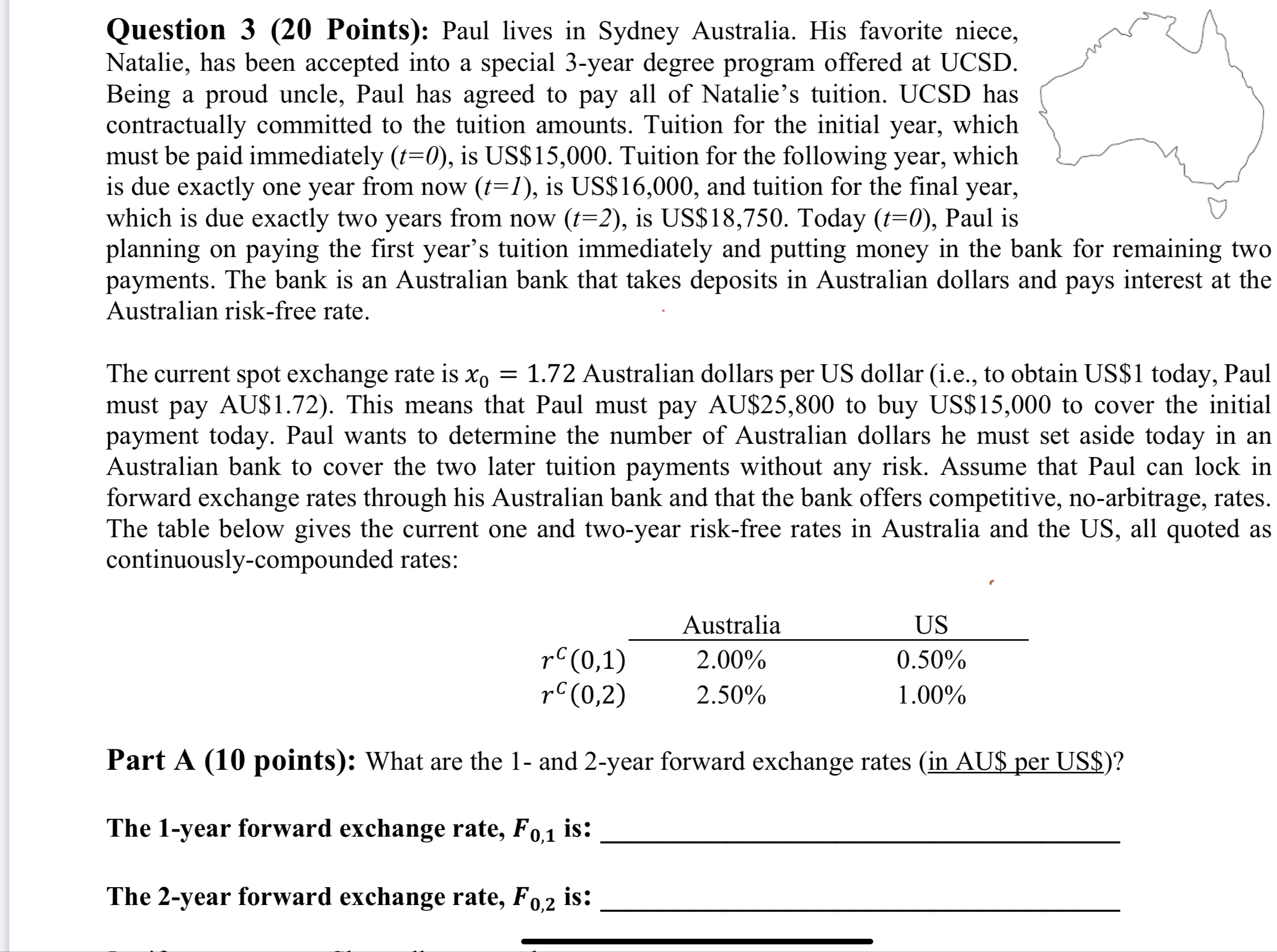

Question 3 (20 Points): Paul lives in Sydney Australia. His favorite niece, Natalie, has been accepted into a special 3-year degree program offered at UCSD. Being a proud uncle, Paul has agreed to pay all of Natalie's tuition. UCSD has contractually committed to the tuition amounts. Tuition for the initial year, which must be paid immediately (t=0), is US$15,000. Tuition for the following year, which is due exactly one year from now (t=1), is US$16,000, and tuition for the final year, which is due exactly two years from now (t=2), is US$18,750. Today (t=0), Paul is planning on paying the first year's tuition immediately and putting money in the bank for remaining two payments. The bank is an Australian bank that takes deposits in Australian dollars and pays interest at the Australian risk-free rate. The current spot exchange rate is x0 = 1.72 Australian dollars per US dollar (i.e., to obtain US$1 today, Paul must pay AU$1.72). This means that Paul must pay AU$25,800 to buy US$15,000 to cover the initial payment today. Paul wants to determine the number of Australian dollars he must set aside today in an Australian bank to cover the two later tuition payments without any risk. Assume that Paul can lock in forward exchange rates through his Australian bank and that the bank offers competitive, no-arbitrage, rates. The table below gives the current one and two-year risk-free rates in Australia and the US, all quoted as continuously-compounded rates: Australia US rc (0,1) 2.00% 0.50% rc (0,2) 2.50% 1.00% Part A (10 points): What are the 1- and 2-year forward exchange rates (in AU$ per US$)? The 1-year forward exchange rate, F0,1 is: The 2-year forward exchange rate, F02 is:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate the 1year and 2year forward exchange rates we can use the formula for the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started