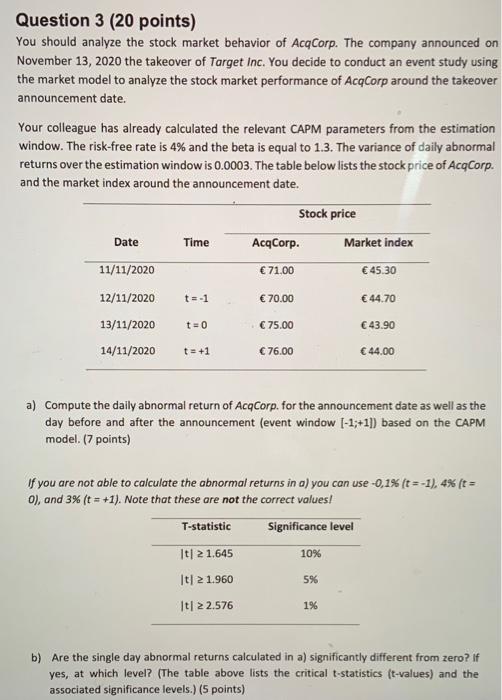

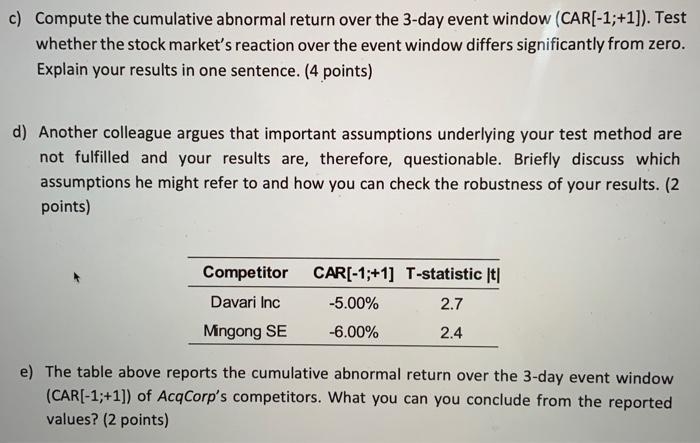

Question 3 (20 points) You should analyze the stock market behavior of AcqCorp. The company announced on November 13, 2020 the takeover of Target Inc. You decide to conduct an event study using the market model to analyze the stock market performance of AcqCorp around the takeover announcement date. Your colleague has already calculated the relevant CAPM parameters from the estimation window. The risk-free rate is 4% and the beta is equal to 1.3. The variance of daily abnormal returns over the estimation window is 0.0003. The table below lists the stock price of AcqCorp. and the market index around the announcement date. a) Compute the daily abnormal return of AcqCorp. for the announcement date as well as the day before and after the announcement (event window [1;+1]) based on the CAPM model. (7 points) If you are not able to calculate the abnormal returns in a) you can use 0,1%(t=1),4%(t= 0), and 3%(t=+1). Note that these are not the correct values! b) Are the single day abnormal returns calculated in a) significantly different from zero? If yes, at which level? (The table above lists the critical t-statistics ( t-values) and the associated significance levels.) (5 points) c) Compute the cumulative abnormal return over the 3 -day event window (CAR[-1;+1]). Test whether the stock market's reaction over the event window differs significantly from zero. Explain your results in one sentence. (4 points) d) Another colleague argues that important assumptions underlying your test method are not fulfilled and your results are, therefore, questionable. Briefly discuss which assumptions he might refer to and how you can check the robustness of your results. ( 2 points) e) The table above reports the cumulative abnormal return over the 3-day event window (CAR[-1;+1]) of AcqCorp's competitors. What you can you conclude from the reported values? ( 2 points) Question 3 (20 points) You should analyze the stock market behavior of AcqCorp. The company announced on November 13, 2020 the takeover of Target Inc. You decide to conduct an event study using the market model to analyze the stock market performance of AcqCorp around the takeover announcement date. Your colleague has already calculated the relevant CAPM parameters from the estimation window. The risk-free rate is 4% and the beta is equal to 1.3. The variance of daily abnormal returns over the estimation window is 0.0003. The table below lists the stock price of AcqCorp. and the market index around the announcement date. a) Compute the daily abnormal return of AcqCorp. for the announcement date as well as the day before and after the announcement (event window [1;+1]) based on the CAPM model. (7 points) If you are not able to calculate the abnormal returns in a) you can use 0,1%(t=1),4%(t= 0), and 3%(t=+1). Note that these are not the correct values! b) Are the single day abnormal returns calculated in a) significantly different from zero? If yes, at which level? (The table above lists the critical t-statistics ( t-values) and the associated significance levels.) (5 points) c) Compute the cumulative abnormal return over the 3 -day event window (CAR[-1;+1]). Test whether the stock market's reaction over the event window differs significantly from zero. Explain your results in one sentence. (4 points) d) Another colleague argues that important assumptions underlying your test method are not fulfilled and your results are, therefore, questionable. Briefly discuss which assumptions he might refer to and how you can check the robustness of your results. ( 2 points) e) The table above reports the cumulative abnormal return over the 3-day event window (CAR[-1;+1]) of AcqCorp's competitors. What you can you conclude from the reported values? ( 2 points)