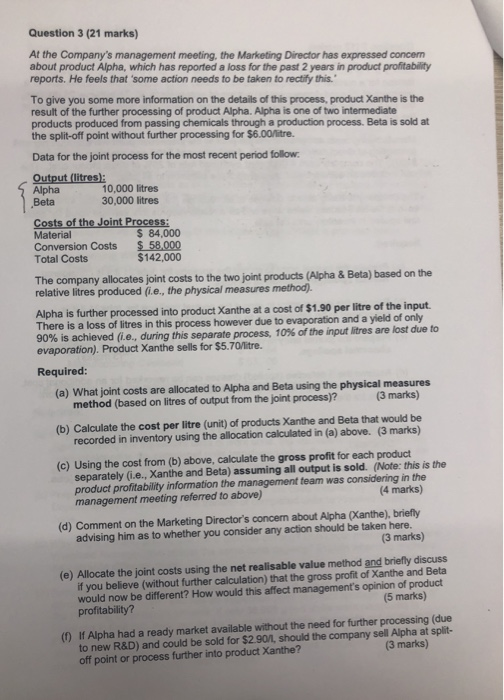

Question 3 (21 marks) At the Company's management meeting, the Marketing Director has expressed concen about product Alpha, which has reported a loss for the past 2 years in product profitability reports. He feels that 'some action needs to be taken to rectify this. To give you some more information on the details of this process, product Xanthe is the result of the further processing of product Alpha. Alpha is one of two intermediate products produced from passing chemicals through a production process. Beta is sold at the split-off point without further processing for $6.00itre. Data for the joint process for the most recent period follow Output (litres): Alpha Beta 10,000 litres 30,000 litres Costs of the Joint Process: Material Conversion Costs Total Costs $ 84,000 $ 58,000 $142,000 The company allocates joint costs to the two joint products (Alpha & Beta) based on the relative litres produced (i.e., the physical measures method). WO Alpha is further processed into product Xanthe at a cost of $1.90 per litre of the input. There is a loss of litres in this process however due to evaporation and a yield of only 90% is achieved (i.e., during this separate process, 10 % of the input litres are lost due to evaporation). Product Xanthe sells for $5.70itre. Required: (a) What joint costs are allocated to Alpha and Beta using the physical measures method (based on litres of output from the joint process)? (3 marks) (b) Calculate the cost per litre (unit) of products Xanthe and Beta that would be recorded in inventory using the allocation calculated in (a) above. (3 marks) (c) Using the cost from (b) above, calculate the gross profit for each product separately (i.e., Xanthe and Beta) assuming all output is sold. (Note: this is the product profitability information the management team was considering in the management meeting referred to above) (4 marks) (d) Comment on the Marketing Director's concem about Alpha (Xanthe), briefly advising him as to whether you consider any action should be taken here. (3 marks) (e) Allocate the joint costs using the net realisable value method and briefly discuss if you believe (without further calculation) that the gross profit of Xanthe and Beta would now be different? How would this affect management's opinion of product profitability? (5 marks) () If Alpha had a ready market available without the need for further processing (due to new R&D) and could be sold for $2.90/1, should the company sell Alpha at split- off point or process further into product Xanthe