Answered step by step

Verified Expert Solution

Question

1 Approved Answer

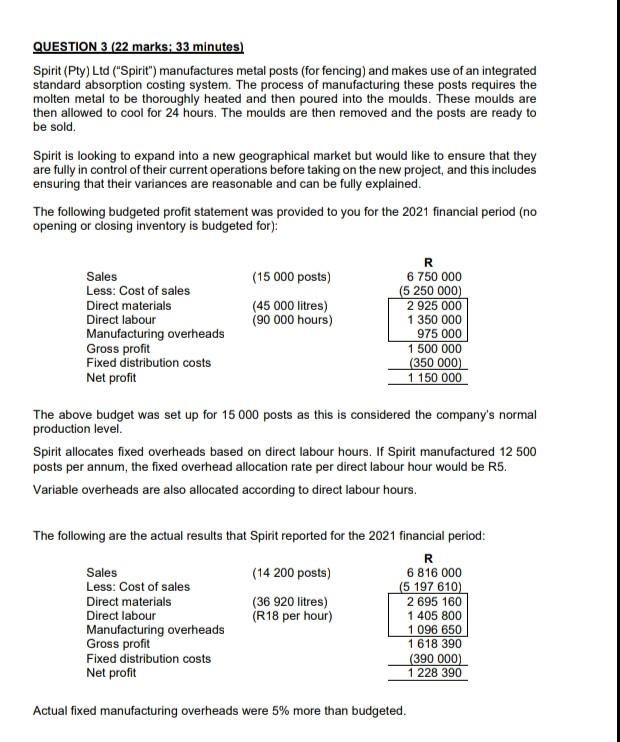

QUESTION 3 (22 marks: 33 minutes) Spirit (Pty) Ltd (Spirit) manufactures metal posts (for fencing) and makes use of an integrated standard absorption costing system.

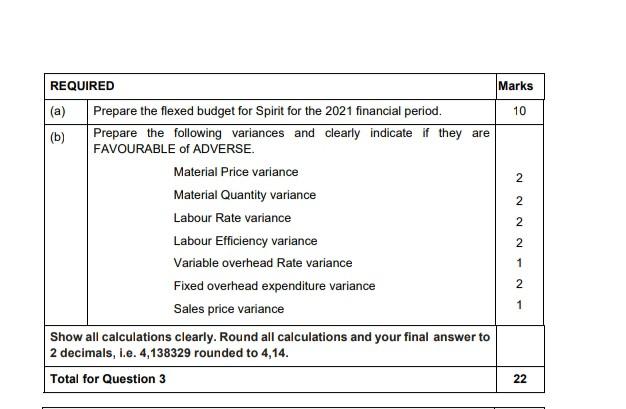

QUESTION 3 (22 marks: 33 minutes) Spirit (Pty) Ltd ("Spirit") manufactures metal posts (for fencing) and makes use of an integrated standard absorption costing system. The process of manufacturing these posts requires the molten metal to be thoroughly heated and then poured into the moulds. These moulds are then allowed to cool for 24 hours. The moulds are then removed and the posts are ready to be sold. Spirit is looking to expand into a new geographical market but would like to ensure that they are fully in control of their current operations before taking on the new project, and this includes ensuring that their variances are reasonable and can be fully explained. The following budgeted profit statement was provided to you for the 2021 financial period (no opening or closing inventory is budgeted for): Sales Less: Cost of sales Direct materials Direct labour Manufacturing overheads Gross profit Fixed distribution costs Net profit (15 000 posts) (45 000 litres) (90 000 hours) R 6 750 000 (5 250 000) 2 925 000 1 350 000 975 000 1 500 000 (350 000) 1 150 000 The above budget was set up for 15 000 posts as this is considered the company's normal production level. Spirit allocates fixed overheads based on direct labour hours. If Spirit manufactured 12 500 posts per annum, the fixed overhead allocation rate per direct labour hour would be R5. Variable overheads are also allocated according to direct labour hours. The following are the actual results that Spirit reported for the 2021 financial period: R Sales (14 200 posts) 6 816 000 Less: Cost of sales (5 197 610) Direct materials (36 920 litres) 2 695 160 Direct labour (R18 per hour) 1 405 800 Manufacturing overheads 1 096 650 Gross profit 1 618 390 Fixed distribution costs (390 000) Net profit 1 228 390 Actual fixed manufacturing overheads were 5% more than budgeted. Marks 10 REQUIRED (a) Prepare the flexed budget for Spirit for the 2021 financial period. (b) Prepare the following variances and clearly indicate if they are FAVOURABLE of ADVERSE. Material Price variance Material Quantity variance Labour Rate variance Labour Efficiency variance Variable overhead Rate variance Fixed overhead expenditure variance Sales price variance Show all calculations clearly. Round all calculations and your final answer to 2 decimals, i.e. 4,138329 rounded to 4,14. Total for Question 3 NNN NN 1 22

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started