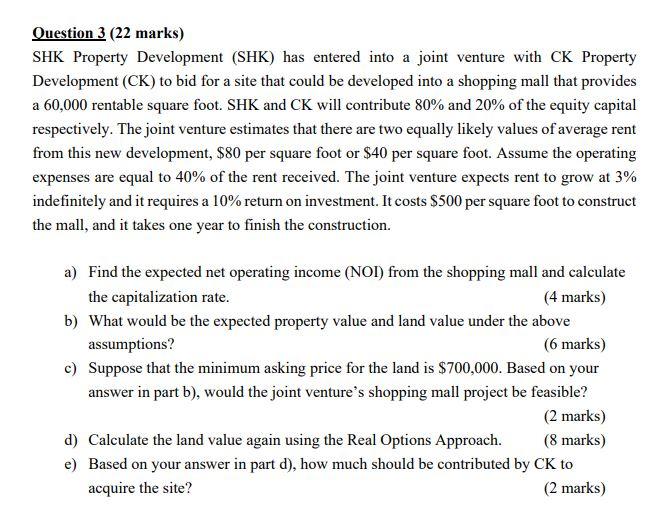

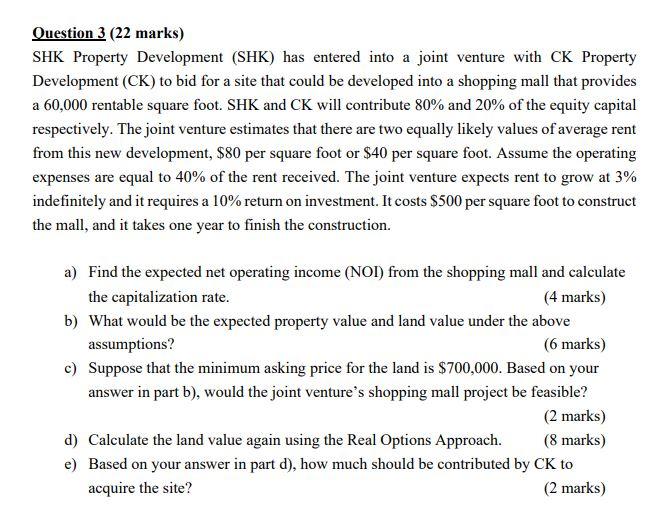

Question 3 (22 marks) SHK Property Development (SHK) has entered into a joint venture with CK Property Development (CK) to bid for a site that could be developed into a shopping mall that provides a 60,000 rentable square foot. SHK and CK will contribute 80% and 20% of the equity capital respectively. The joint venture estimates that there are two equally likely values of average rent from this new development, $80 per square foot or $40 per square foot. Assume the operating expenses are equal to 40% of the rent received. The joint venture expects rent to grow at 3% indefinitely and it requires a 10% return on investment. It costs $500 per square foot to construct the mall, and it takes one year to finish the construction. a) Find the expected net operating income (NOI) from the shopping mall and calculate the capitalization rate. (4 marks) b) What would be the expected property value and land value under the above assumptions? (6 marks) c) Suppose that the minimum asking price for the land is $700,000. Based on your answer in part b), would the joint venture's shopping mall project be feasible? (2 marks) d) Calculate the land value again using the Real Options Approach. (8 marks) e) Based on your answer in part d), how much should be contributed by CK to acquire the site? (2 marks) Question 3 (22 marks) SHK Property Development (SHK) has entered into a joint venture with CK Property Development (CK) to bid for a site that could be developed into a shopping mall that provides a 60,000 rentable square foot. SHK and CK will contribute 80% and 20% of the equity capital respectively. The joint venture estimates that there are two equally likely values of average rent from this new development, $80 per square foot or $40 per square foot. Assume the operating expenses are equal to 40% of the rent received. The joint venture expects rent to grow at 3% indefinitely and it requires a 10% return on investment. It costs $500 per square foot to construct the mall, and it takes one year to finish the construction. a) Find the expected net operating income (NOI) from the shopping mall and calculate the capitalization rate. (4 marks) b) What would be the expected property value and land value under the above assumptions? (6 marks) c) Suppose that the minimum asking price for the land is $700,000. Based on your answer in part b), would the joint venture's shopping mall project be feasible? (2 marks) d) Calculate the land value again using the Real Options Approach. (8 marks) e) Based on your answer in part d), how much should be contributed by CK to acquire the site? (2 marks)