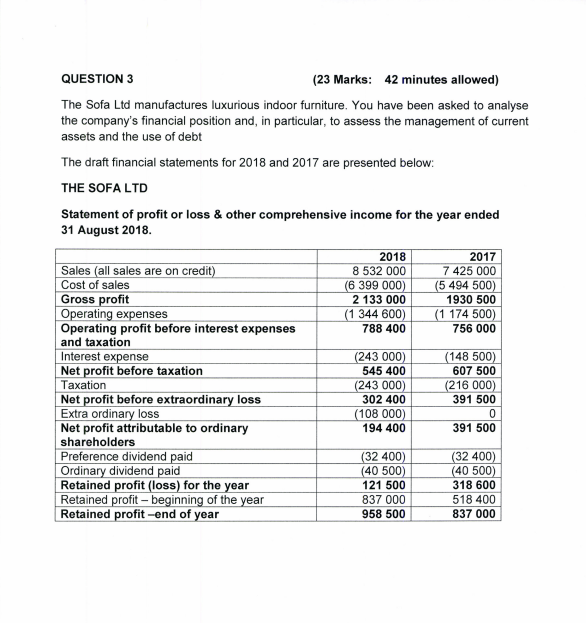

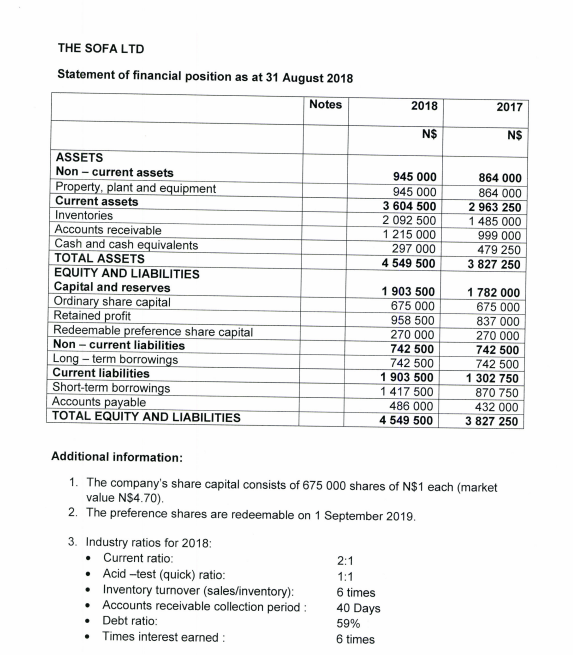

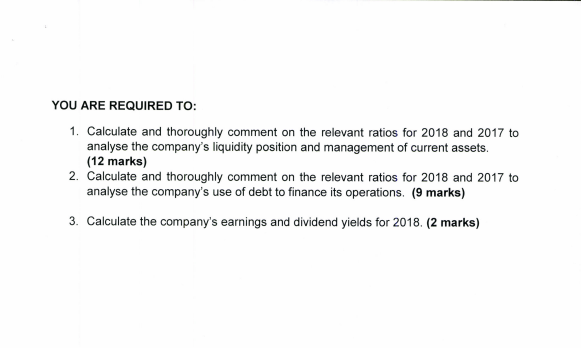

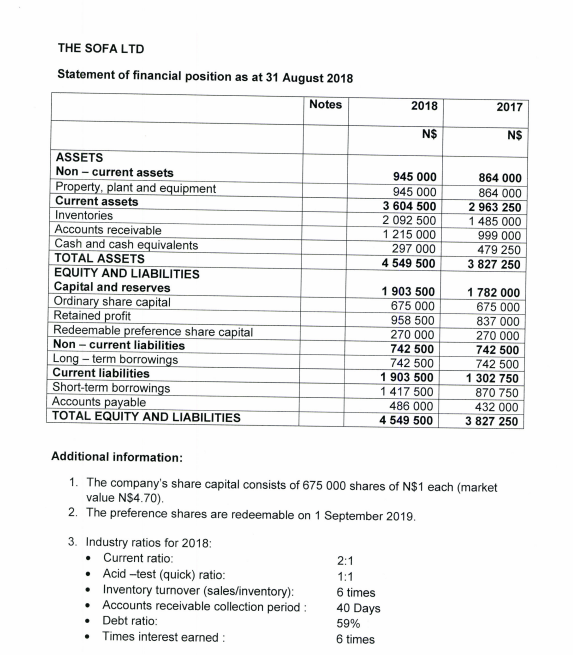

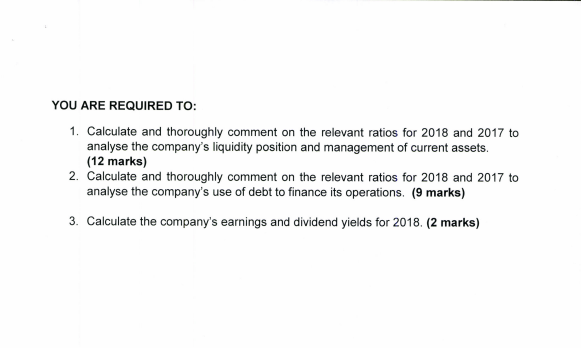

QUESTION 3 (23 Marks: 42 minutes allowed) The Sofa Ltd manufactures luxurious indoor furniture. You have been asked to analyse the company's financial position and, in particular, to assess the management of current assets and the use of debt The draft financial statements for 2018 and 2017 are presented below: THE SOFA LTD Statement of profit or loss & other comprehensive income for the year ended 31 August 2018 2018 8 532 000 (6 399 000) 2 133 000 (1 344 600) 788 400 2017 7 425 000 (5 494 500) 1930 500 (1 174 500) 756 000 Sales (all sales are on credit) Cost of sales Gross profit Operating expenses Operating profit before interest expenses and taxation Interest expense Net profit before taxation Taxation Net profit before extraordinary loss Extra ordinary loss Net profit attributable to ordinary shareholders Preference dividend paid Ordinary dividend paid Retained profit (loss) for the year Retained profit - beginning of the year Retained profit-end of year (243 000) 545 400 (243 000) 302 400 (108 000) 194 400 (148 500) 607 500 (216 000) 391 500 0 391 500 (32 400) (40 500) 121 500 837 000 958 500 (32 400) (40 500) 318 600 518 400 837 000 THE SOFA LTD Statement of financial position as at 31 August 2018 Notes 2018 2017 N$ N$ 945 000 945 000 3 604 500 2 092 500 1 215 000 297 000 4 549 500 864 000 864 000 2 963 250 1 485 000 999 000 479 250 3 827 250 ASSETS Non-current assets Property, plant and equipment Current assets Inventories Accounts receivable Cash and cash equivalents TOTAL ASSETS EQUITY AND LIABILITIES Capital and reserves Ordinary share capital Retained profit Redeemable preference share capital Non-current liabilities Long-term borrowings Current liabilities Short-term borrowings Accounts payable TOTAL EQUITY AND LIABILITIES 1 903 500 675 000 958 500 270 000 742 500 742 500 1 903 500 1 417 500 486 000 4 549 500 1 782 000 675 000 837 000 270 000 742 500 742 500 1 302 750 870 750 432 000 3 827 250 Additional information: 1. The company's share capital consists of 675 000 shares of N$1 each (market value N$4.70). 2. The preference shares are redeemable on 1 September 2019. 3. Industry ratios for 2018: Current ratio: Acid-test (quick) ratio: Inventory turnover (sales/inventory): 6 times Accounts receivable collection period : 40 Days Debt ratio: 59% Times interest earned 6 times 2:1 1:1 YOU ARE REQUIRED TO: 1. Calculate and thoroughly comment on the relevant ratios for 2018 and 2017 to analyse the company's liquidity position and management of current assets. (12 marks) 2. Calculate and thoroughly comment on the relevant ratios for 2018 and 2017 to analyse the company's use of debt to finance its operations. (9 marks) 3. Calculate the company's earnings and dividend yields for 2018. (2 marks) QUESTION 3 (23 Marks: 42 minutes allowed) The Sofa Ltd manufactures luxurious indoor furniture. You have been asked to analyse the company's financial position and, in particular, to assess the management of current assets and the use of debt The draft financial statements for 2018 and 2017 are presented below: THE SOFA LTD Statement of profit or loss & other comprehensive income for the year ended 31 August 2018 2018 8 532 000 (6 399 000) 2 133 000 (1 344 600) 788 400 2017 7 425 000 (5 494 500) 1930 500 (1 174 500) 756 000 Sales (all sales are on credit) Cost of sales Gross profit Operating expenses Operating profit before interest expenses and taxation Interest expense Net profit before taxation Taxation Net profit before extraordinary loss Extra ordinary loss Net profit attributable to ordinary shareholders Preference dividend paid Ordinary dividend paid Retained profit (loss) for the year Retained profit - beginning of the year Retained profit-end of year (243 000) 545 400 (243 000) 302 400 (108 000) 194 400 (148 500) 607 500 (216 000) 391 500 0 391 500 (32 400) (40 500) 121 500 837 000 958 500 (32 400) (40 500) 318 600 518 400 837 000 THE SOFA LTD Statement of financial position as at 31 August 2018 Notes 2018 2017 N$ N$ 945 000 945 000 3 604 500 2 092 500 1 215 000 297 000 4 549 500 864 000 864 000 2 963 250 1 485 000 999 000 479 250 3 827 250 ASSETS Non-current assets Property, plant and equipment Current assets Inventories Accounts receivable Cash and cash equivalents TOTAL ASSETS EQUITY AND LIABILITIES Capital and reserves Ordinary share capital Retained profit Redeemable preference share capital Non-current liabilities Long-term borrowings Current liabilities Short-term borrowings Accounts payable TOTAL EQUITY AND LIABILITIES 1 903 500 675 000 958 500 270 000 742 500 742 500 1 903 500 1 417 500 486 000 4 549 500 1 782 000 675 000 837 000 270 000 742 500 742 500 1 302 750 870 750 432 000 3 827 250 Additional information: 1. The company's share capital consists of 675 000 shares of N$1 each (market value N$4.70). 2. The preference shares are redeemable on 1 September 2019. 3. Industry ratios for 2018: Current ratio: Acid-test (quick) ratio: Inventory turnover (sales/inventory): 6 times Accounts receivable collection period : 40 Days Debt ratio: 59% Times interest earned 6 times 2:1 1:1 YOU ARE REQUIRED TO: 1. Calculate and thoroughly comment on the relevant ratios for 2018 and 2017 to analyse the company's liquidity position and management of current assets. (12 marks) 2. Calculate and thoroughly comment on the relevant ratios for 2018 and 2017 to analyse the company's use of debt to finance its operations. (9 marks) 3. Calculate the company's earnings and dividend yields for 2018. (2 marks)