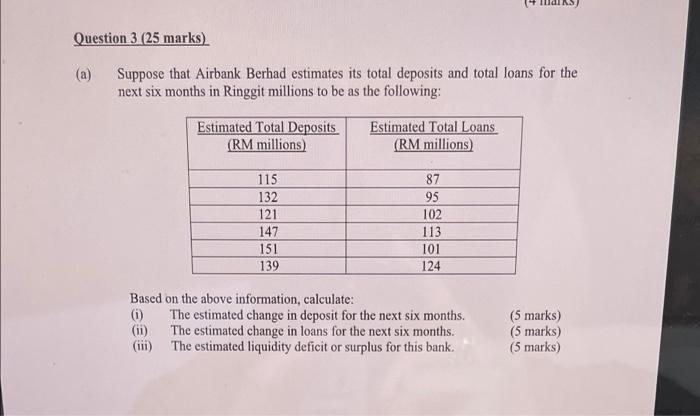

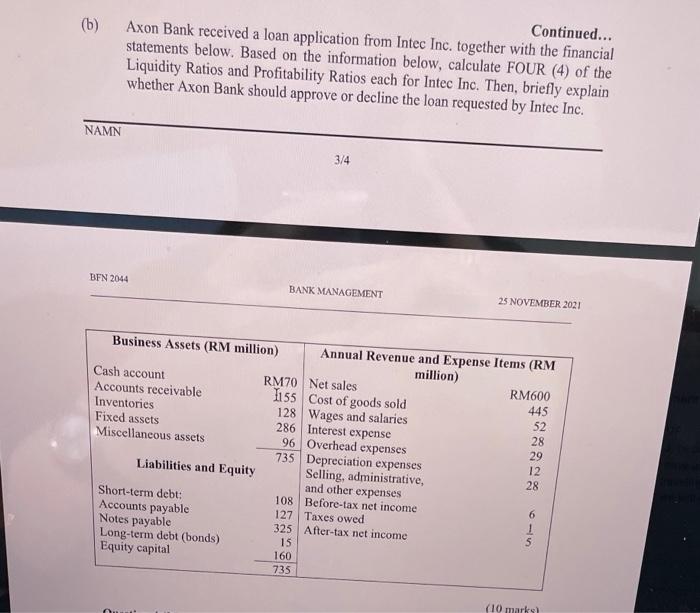

Question 3 (25 marks) (a) Suppose that Airbank Berhad estimates its total deposits and total loans for the next six months in Ringgit millions to be as the following: Estimated Total Deposits (RM millions) Estimated Total Loans (RM millions) 115 132 121 147 151 139 87 95 102 113 101 124 Based on the above information, calculate: (1) The estimated change in deposit for the next six months. (11) The estimated change in loans for the next six months. (iii) The estimated liquidity deficit or surplus for this bank. (5 marks) (5 marks) (5 marks) (b) Continued... Axon Bank received a loan application from Intec Inc. together with the financial statements below. Based on the information below, calculate FOUR (4) of the Liquidity Ratios and Profitability Ratios each for Intec Inc. Then, briefly explain whether Axon Bank should approve or decline the loan requested by Intec Inc. NAMN 3/4 BEN 2014 BANK MANAGEMENT 25 NOVEMBER 2021 Business Assets (RM million) Annual Revenue and Expense Items (RM million) Cash account RM70 Net sales RM600 Accounts receivable 1155 Cost of goods sold Inventories 128 Wages and salaries Fixed assets 286 Interest expense Miscellaneous assets 96 Overhead expenses 735 Depreciation expenses Liabilities and Equity Selling, administrative, 28 and other expenses Short-term debt: 108 Before-tax net income Accounts payable 127 Taxes owed Notes payable 325 After-tax net income Long-term debt (bonds) Equity capital 735 445 52 28 29 12 6 15 160 (10 marks Question 3 (25 marks) (a) Suppose that Airbank Berhad estimates its total deposits and total loans for the next six months in Ringgit millions to be as the following: Estimated Total Deposits (RM millions) Estimated Total Loans (RM millions) 115 132 121 147 151 139 87 95 102 113 101 124 Based on the above information, calculate: (1) The estimated change in deposit for the next six months. (11) The estimated change in loans for the next six months. (iii) The estimated liquidity deficit or surplus for this bank. (5 marks) (5 marks) (5 marks) (b) Continued... Axon Bank received a loan application from Intec Inc. together with the financial statements below. Based on the information below, calculate FOUR (4) of the Liquidity Ratios and Profitability Ratios each for Intec Inc. Then, briefly explain whether Axon Bank should approve or decline the loan requested by Intec Inc. NAMN 3/4 BEN 2014 BANK MANAGEMENT 25 NOVEMBER 2021 Business Assets (RM million) Annual Revenue and Expense Items (RM million) Cash account RM70 Net sales RM600 Accounts receivable 1155 Cost of goods sold Inventories 128 Wages and salaries Fixed assets 286 Interest expense Miscellaneous assets 96 Overhead expenses 735 Depreciation expenses Liabilities and Equity Selling, administrative, 28 and other expenses Short-term debt: 108 Before-tax net income Accounts payable 127 Taxes owed Notes payable 325 After-tax net income Long-term debt (bonds) Equity capital 735 445 52 28 29 12 6 15 160 (10 marks