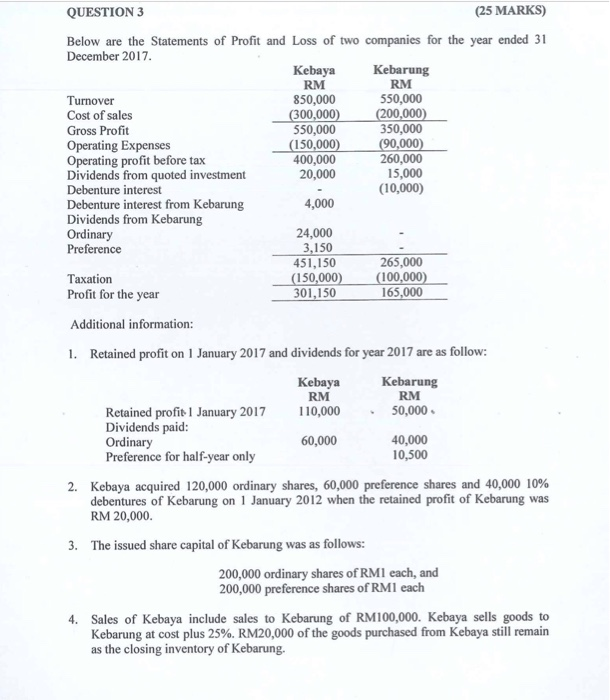

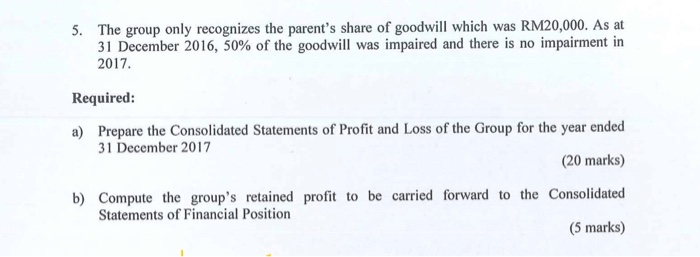

QUESTION 3 (25 MARKS) Below are the Statements of Profit and Loss of two companies for the year ended 31 December 2017 Kebaya Kebarung RM RM Turnover 850,000 550,000 Cost of sales (300,000) (200,000) Gross Profit 550,000 350,000 Operating Expenses (150,000) (90,000) Operating profit before tax 400,000 260,000 Dividends from quoted investment 20,000 15,000 Debenture interest (10,000) Debenture interest from Kebarung 4,000 Dividends from Kebarung Ordinary 24,000 Preference 3,150 451,150 265,000 Taxation (150,000) (100,000) Profit for the year 301,150 165,000 Additional information: 1. Retained profit on 1 January 2017 and dividends for year 2017 are as follow: Kebaya RM 110,000 Kebarung RM 50,000 - Retained profit 1 January 2017 Dividends paid: Ordinary Preference for half-year only 60,000 40,000 10,500 2. Kebaya acquired 120,000 ordinary shares, 60,000 preference shares and 40,000 10% debentures of Kebarung on 1 January 2012 when the retained profit of Kebarung was RM 20,000. 3. The issued share capital of Kebarung was as follows: 200,000 ordinary shares of RMI each, and 200,000 preference shares of RMI each 4. Sales of Kebaya include sales to Kebarung of RM100,000. Kebaya sells goods to Kebarung at cost plus 25%. RM20,000 of the goods purchased from Kebaya still remain as the closing inventory of Kebarung. 5. The group only recognizes the parent's share of goodwill which was RM20,000. As at 31 December 2016, 50% of the goodwill was impaired and there is no impairment in 2017. Required: a) Prepare the Consolidated Statements of Profit and Loss of the Group for the year ended 31 December 2017 (20 marks) b) Compute the group's retained profit to be carried forward to the Consolidated Statements of Financial Position (5 marks) QUESTION 3 (25 MARKS) Below are the Statements of Profit and Loss of two companies for the year ended 31 December 2017 Kebaya Kebarung RM RM Turnover 850,000 550,000 Cost of sales (300,000) (200,000) Gross Profit 550,000 350,000 Operating Expenses (150,000) (90,000) Operating profit before tax 400,000 260,000 Dividends from quoted investment 20,000 15,000 Debenture interest (10,000) Debenture interest from Kebarung 4,000 Dividends from Kebarung Ordinary 24,000 Preference 3,150 451,150 265,000 Taxation (150,000) (100,000) Profit for the year 301,150 165,000 Additional information: 1. Retained profit on 1 January 2017 and dividends for year 2017 are as follow: Kebaya RM 110,000 Kebarung RM 50,000 - Retained profit 1 January 2017 Dividends paid: Ordinary Preference for half-year only 60,000 40,000 10,500 2. Kebaya acquired 120,000 ordinary shares, 60,000 preference shares and 40,000 10% debentures of Kebarung on 1 January 2012 when the retained profit of Kebarung was RM 20,000. 3. The issued share capital of Kebarung was as follows: 200,000 ordinary shares of RMI each, and 200,000 preference shares of RMI each 4. Sales of Kebaya include sales to Kebarung of RM100,000. Kebaya sells goods to Kebarung at cost plus 25%. RM20,000 of the goods purchased from Kebaya still remain as the closing inventory of Kebarung. 5. The group only recognizes the parent's share of goodwill which was RM20,000. As at 31 December 2016, 50% of the goodwill was impaired and there is no impairment in 2017. Required: a) Prepare the Consolidated Statements of Profit and Loss of the Group for the year ended 31 December 2017 (20 marks) b) Compute the group's retained profit to be carried forward to the Consolidated Statements of Financial Position