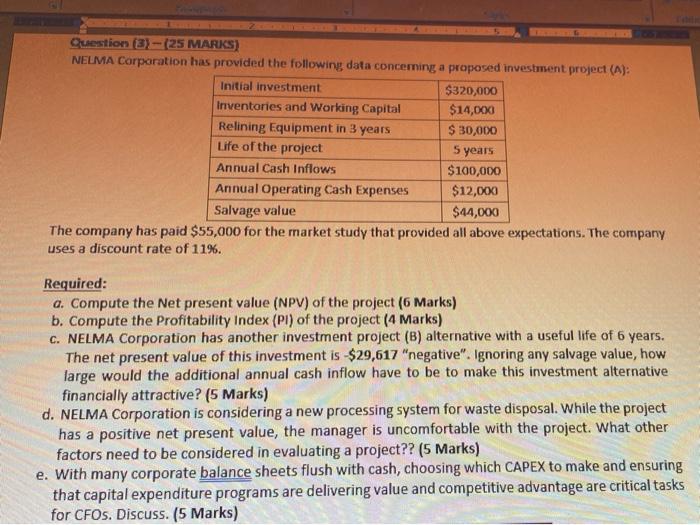

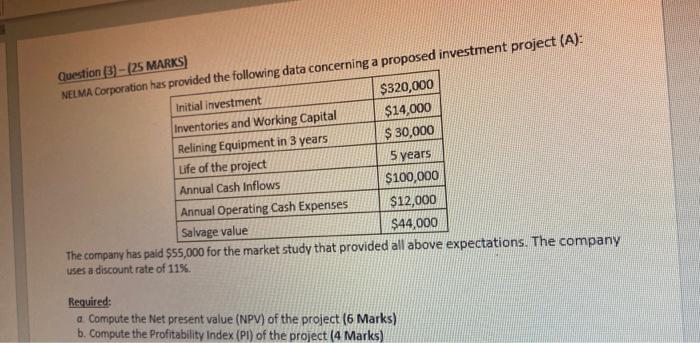

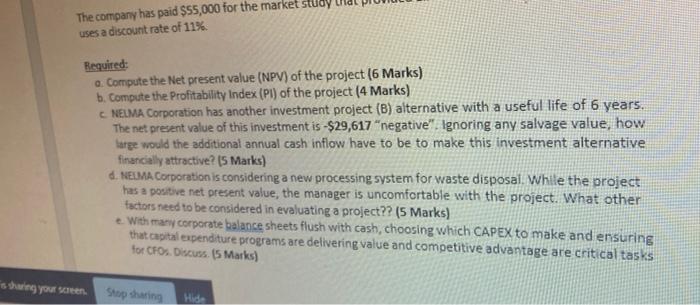

Question (3) - (25 MARKS) NELMA Corporation has provided the following data concerning a proposed investment project (A): Initial investment $320,000 Inventories and Working Capital $14,000 Relining Equipment in 3 years $ 30,000 Life of the project 5 years Annual Cash Inflows $100,000 Annual Operating Cash Expenses $12,000 Salvage value $44,000 The company has paid $55,000 for the market study that provided all above expectations. The company uses a discount rate of 11%. Required: a. Compute the Net present value (NPV) of the project (6 Marks) b. Compute the Profitability Index (PI) of the project ( 4 Marks) C. NELMA Corporation has another investment project (B) alternative with a useful life of 6 years. The net present value of this investment is $29,617 "negative". Ignoring any salvage value, how large would the additional annual cash inflow have to be to make this investment alternative financially attractive? (5 Marks) d. NELMA Corporation is considering a new processing system for waste disposal. While the project has a positive net present value, the manager is uncomfortable with the project. What other factors need to be considered in evaluating a project?? (5 Marks) e. With many corporate balance sheets flush with cash, choosing which CAPEX to make and ensuring that capital expenditure programs are delivering value and competitive advantage are critical tasks for CFOs. Discuss. (5 Marks) Normal CODE Styles * No Spac. Find - 6c Replace Select Editing Question (3) - (25 MARKS) NEMA Corporation has provided the following data concerning a proposed investment project (A Initial investment $320,000 Inventories and Working Capital $14,000 Relining Equipment in 3 years $ 30,000 Vo. Life of the project 5 years Annual Cash Inflows $100,000 Annual Operating Cash Expenses $12,000 Salvage value $44,000 The company has paid $55,000 for the market study that provided all above expectations. The company sunt rate of 115 om the list present value (NPV) of the project (6 Marks) Com the Profitability Index (Pl) of the project (4 Marks) NEMA Corporation has another investment project (B) alternative with a useful life of 6 years. The present value of this investment is-529,617 "negative" ignoring any salvage value, how w would the annual cash inflow have to be to make this investment alternative Secve? (5 Marks) Corportion is considering a new processing system for waste disposal. While the project so wulut, the manager is uncomfortable with the project. What other to be considered in evaluating a project?? 15 Marks) Nors sheets flush with cash, choosing which CAPEX to make and ensuring entre propre delivering value and competitive advantage are critical tasks oli Marley 370 Clear D Focus CB 5 years Question (3) - (25 MARKS) NELMA Corporation has provided the following data concerning a proposed investment project (A): Initial investment $320,000 Inventories and Working Capital $14,000 Relining Equipment in 3 years $ 30,000 Life of the project Annual Cash Inflows $100,000 Annual Operating Cash Expenses $12,000 Salvage value $44,000 The company has paid $55,000 for the market study that provided all above expectations. The company uses a discount rate of 11% Required: a compute the Net present value (NPV) of the project (6 Marks) b. Compute the Profitability Index (Pl) of the project (4 Marks) The company has paid $55,000 for the market study uses a discount rate of 11% Required a. Compute the Net present value (NPV) of the project (6 Marks) b. Compute the Profitability Index (Pl) of the project (4 Marks) NELMA Corporation has another investment project (B) alternative with a useful life of 6 years. The net present value of this investment is -$29,617 "negative" Ignoring any salvage value, how large would the additional annual cash inflow have to be to make this investment alternative financially attractive? (5 Marks) d. NELMA Corporation is considering a new processing system for waste disposal. While the project has a positive net present value, the manager is uncomfortable with the project. What other factors need to be considered in evaluating a project?? (5 Marks) With many corporate balance sheets flush with cash, choosing which CAPEX to make and ensuring that capital penditure programs are delivering value and competitive advantage are critical tasks for CFOs Discuss (5 Marks) sharing your screen Stop sharing Hide