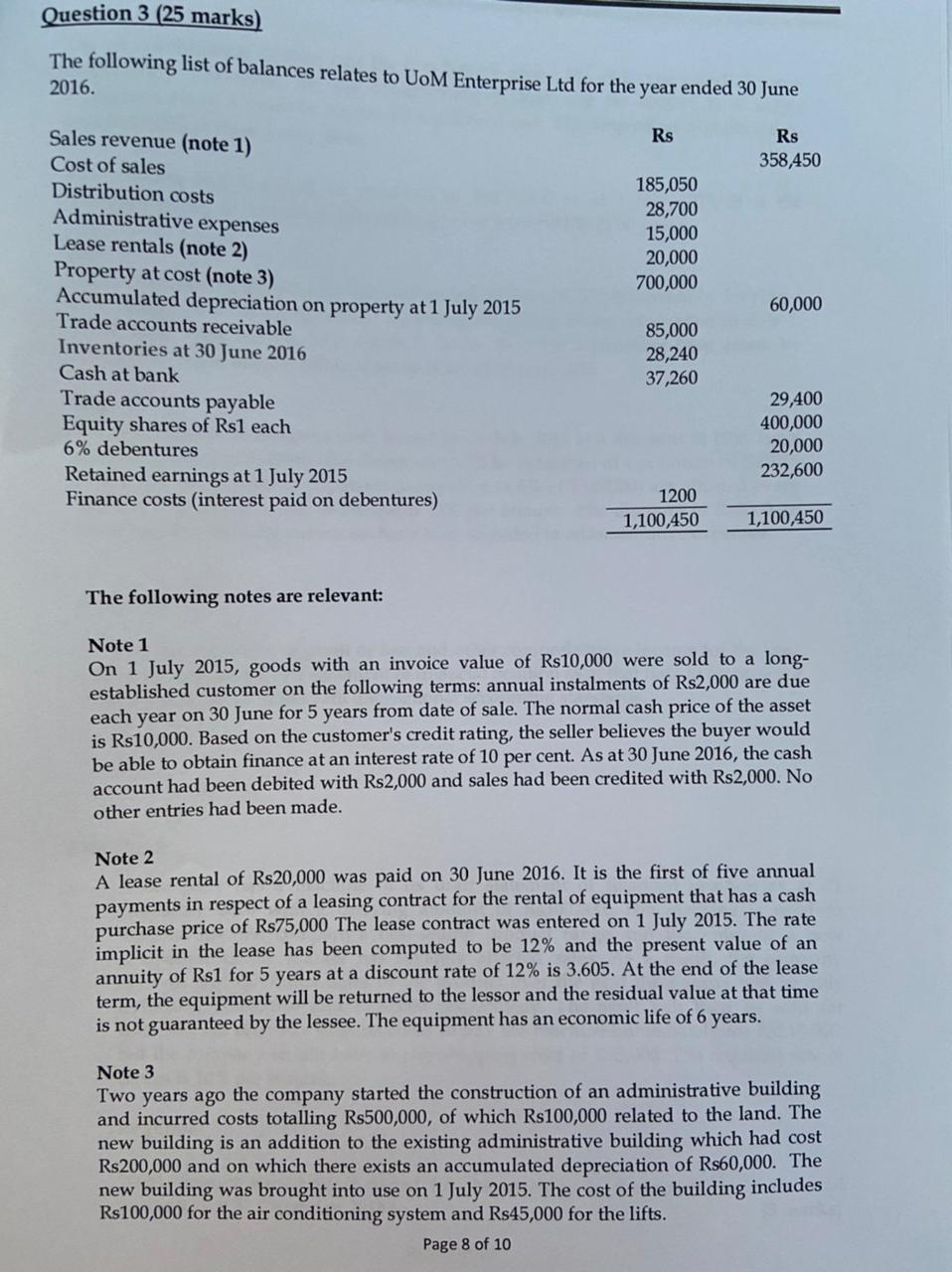

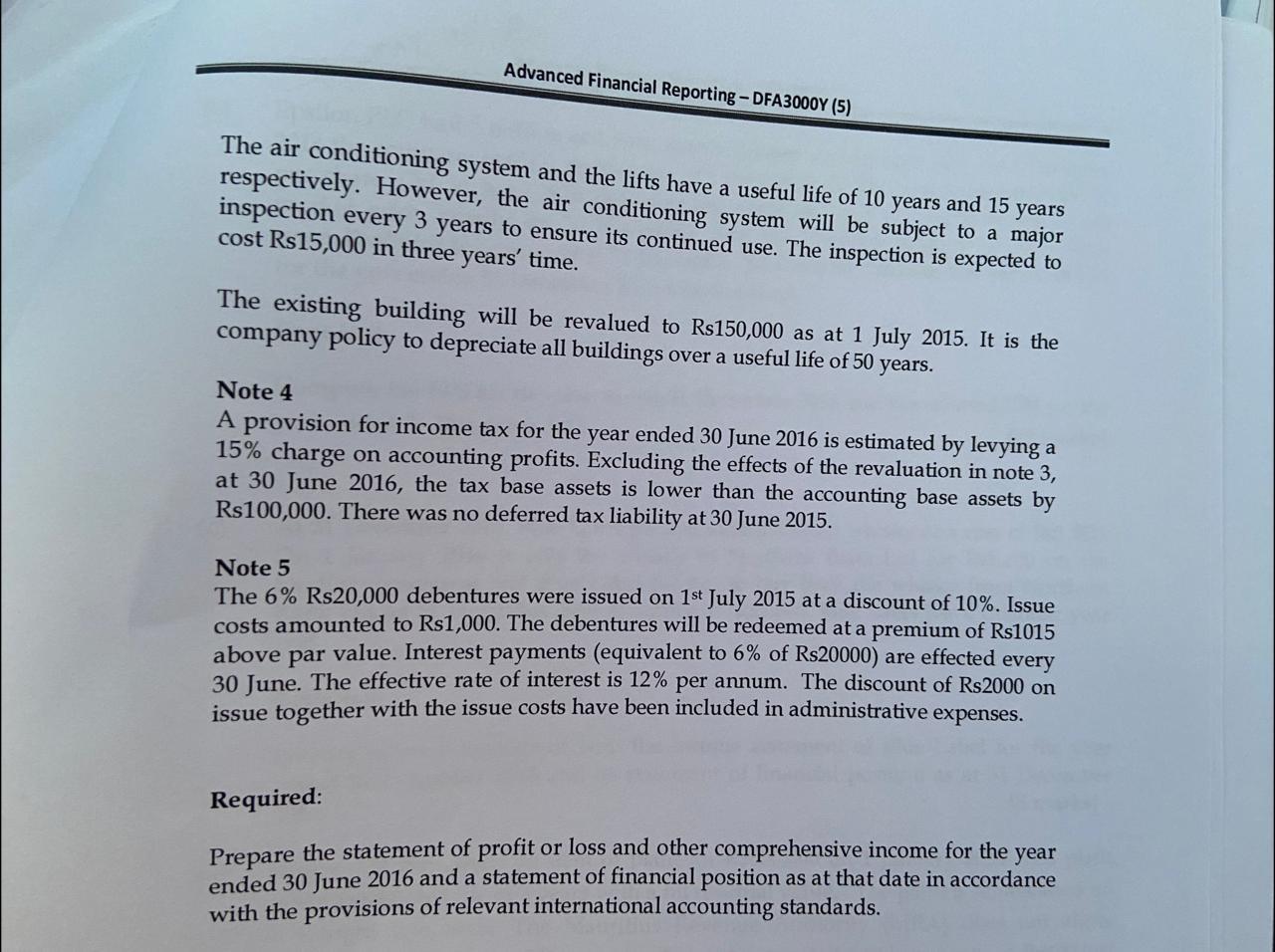

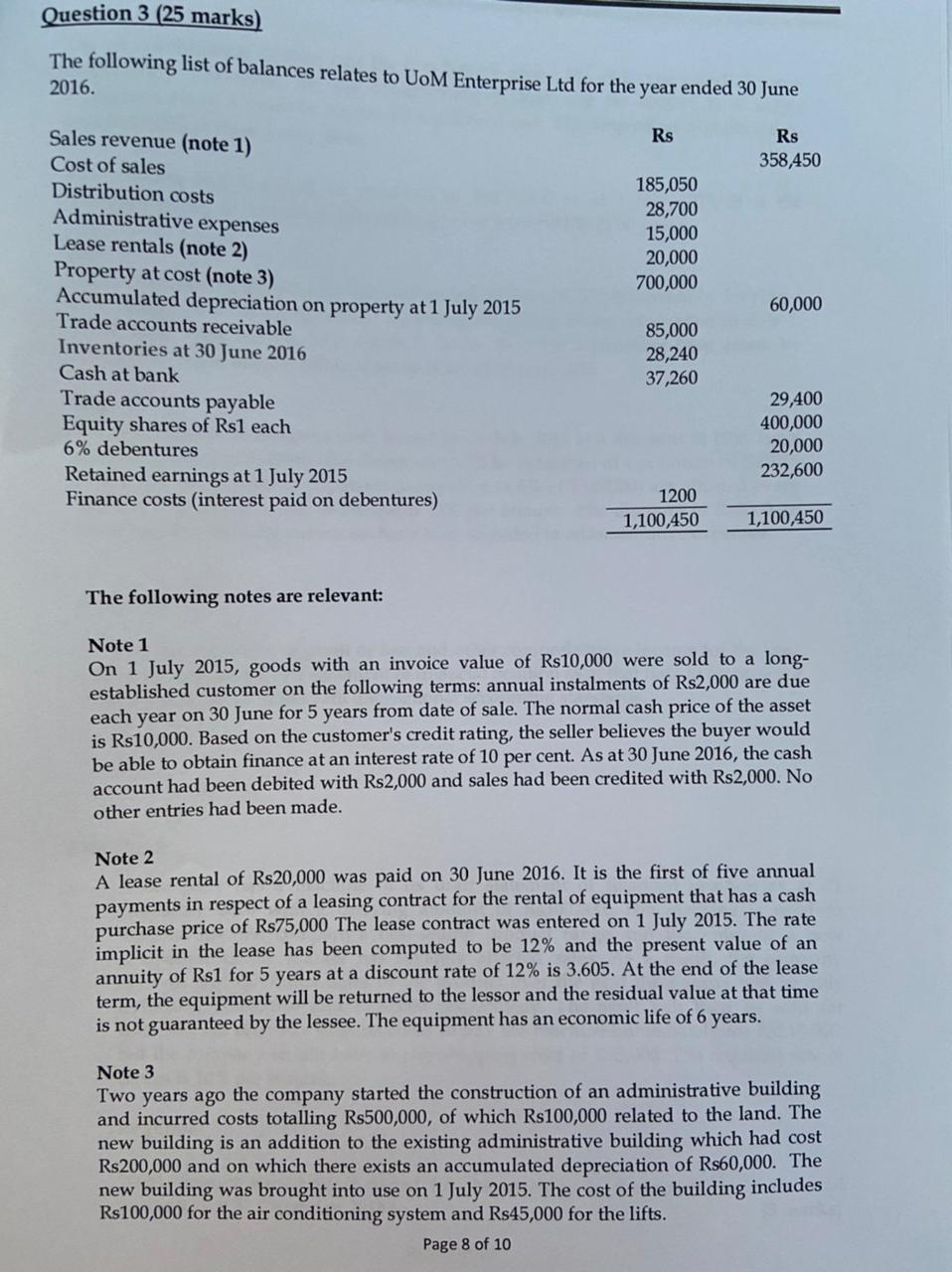

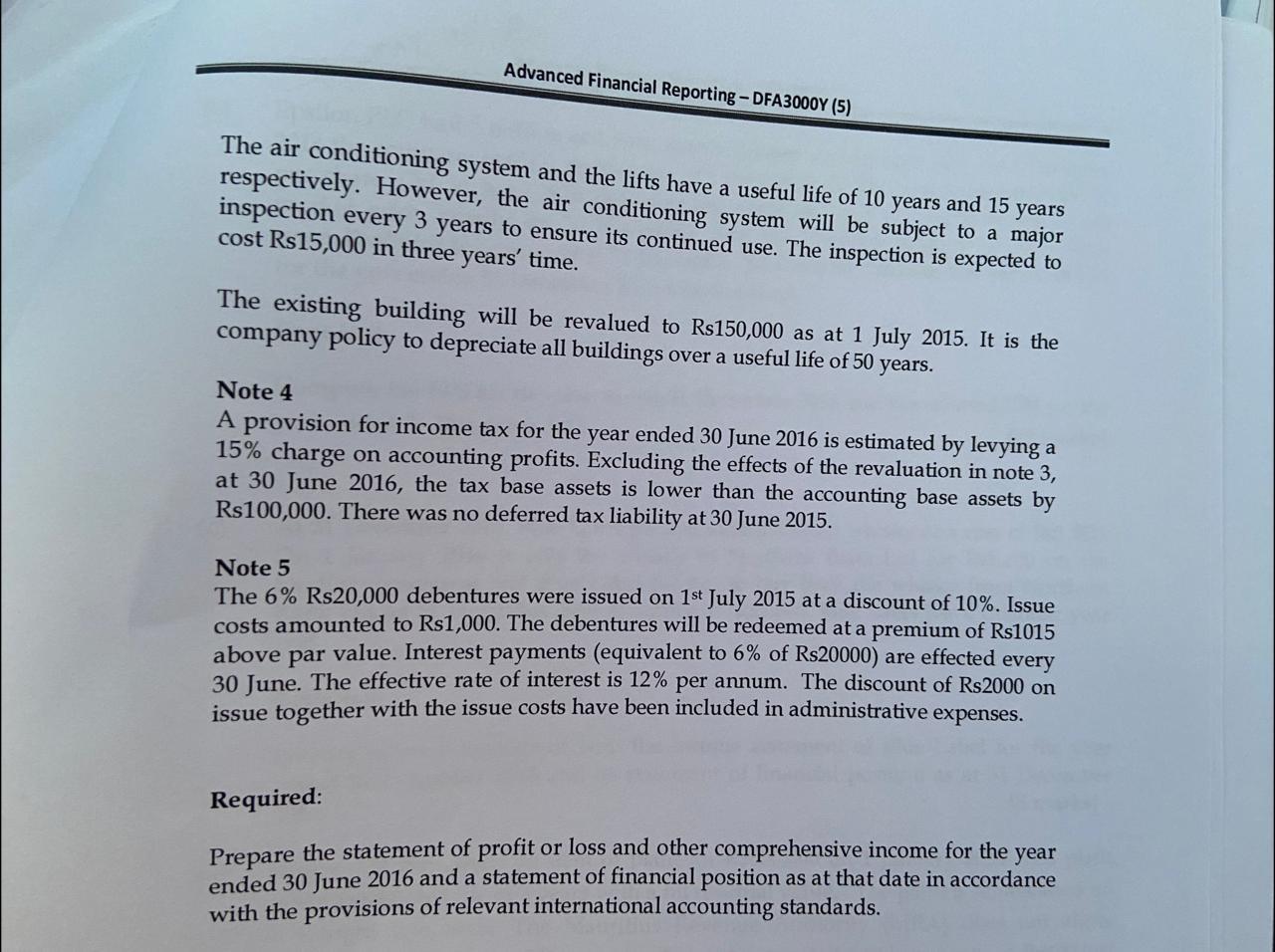

Question 3 (25 marks) The following list of balances relates to UOM Enterprise Ltd for the year ended 30 June 2016. Rs Rs 358,450 185,050 28,700 15,000 20,000 700,000 60,000 Sales revenue (note 1) Cost of sales Distribution costs Administrative expenses Lease rentals (note 2) Property at cost (note 3) Accumulated depreciation on property at 1 July 2015 Trade accounts receivable Inventories at 30 June 2016 Cash at bank Trade accounts payable Equity shares of Rs1 each 6% debentures Retained earnings at 1 July 2015 Finance costs interest paid on debentures) 85,000 28,240 37,260 29,400 400,000 20,000 232,600 1200 1,100,450 1,100,450 The following notes are relevant: Note 1 On 1 July 2015, goods with an invoice value of Rs10,000 were sold to a long- established customer on the following terms: annual instalments of Rs2,000 are due each year on 30 June for 5 years from date of sale. The normal cash price of the asset is Rs10,000. Based on the customer's credit rating, the seller believes the buyer would be able to obtain finance at an interest rate of 10 per cent. As at 30 June 2016, the cash account had been debited with Rs2,000 and sales had been credited with Rs2,000. No other entries had been made. Note 2 A lease rental of Rs 20,000 was paid on 30 June 2016. It is the first of five annual payments in respect of a leasing contract for the rental of equipment that has a cash purchase price of Rs75,000 The lease contract was entered on 1 July 2015. The rate implicit in the lease has been computed to be 12% and the present value of an annuity of Rs1 for 5 years at a discount rate of 12% is 3.605. At the end of the lease term, the equipment will be returned to the lessor and the residual value at that time is not guaranteed by the lessee. The equipment has an economic life of 6 years. Note 3 Two years ago the company started the construction of an administrative building and incurred costs totalling Rs500,000, of which Rs100,000 related to the land. The new building is an addition to the existing administrative building which had cost Rs200,000 and on which there exists an accumulated depreciation of Rs60,000. The new building was brought into use on 1 July 2015. The cost of the building includes Rs100,000 for the air conditioning system and Rs45,000 for the lifts. Page 8 of 10 Advanced Financial Reporting - DFA3000Y (5) The air conditioning system and the lifts have a useful life of 10 years and 15 years respectively. However, the air conditioning system will be subject to a major inspection every 3 years to ensure its continued use. The inspection is expected to cost Rs15,000 in three years' time. The existing building will be revalued to Rs150,000 as at 1 July 2015. It is the company policy to depreciate all buildings over a useful life of 50 years. Note 4 A provision for income tax for the year ended 30 June 2016 is estimated by levying a 15% charge on accounting profits. Excluding the effects of the revaluation in note 3, at 30 June 2016, the tax base assets is lower than the accounting base assets by Rs100,000. There was no deferred tax liability at 30 June 2015. Note 5 The 6% Rs20,000 debentures were issued on 1st July 2015 at a discount of 10%. Issue costs amounted to Rs1,000. The debentures will be redeemed at a premium of Rs1015 above par value. Interest payments (equivalent to 6% of Rs20000) are effected every 30 June. The effective rate of interest is 12% per annum. The discount of Rs2000 on issue together with the issue costs have been included in administrative expenses. Required: Prepare the statement of profit or loss and other comprehensive income for the year ended 30 June 2016 and a statement of financial position as at that date in accordance with the provisions of relevant international accounting standards