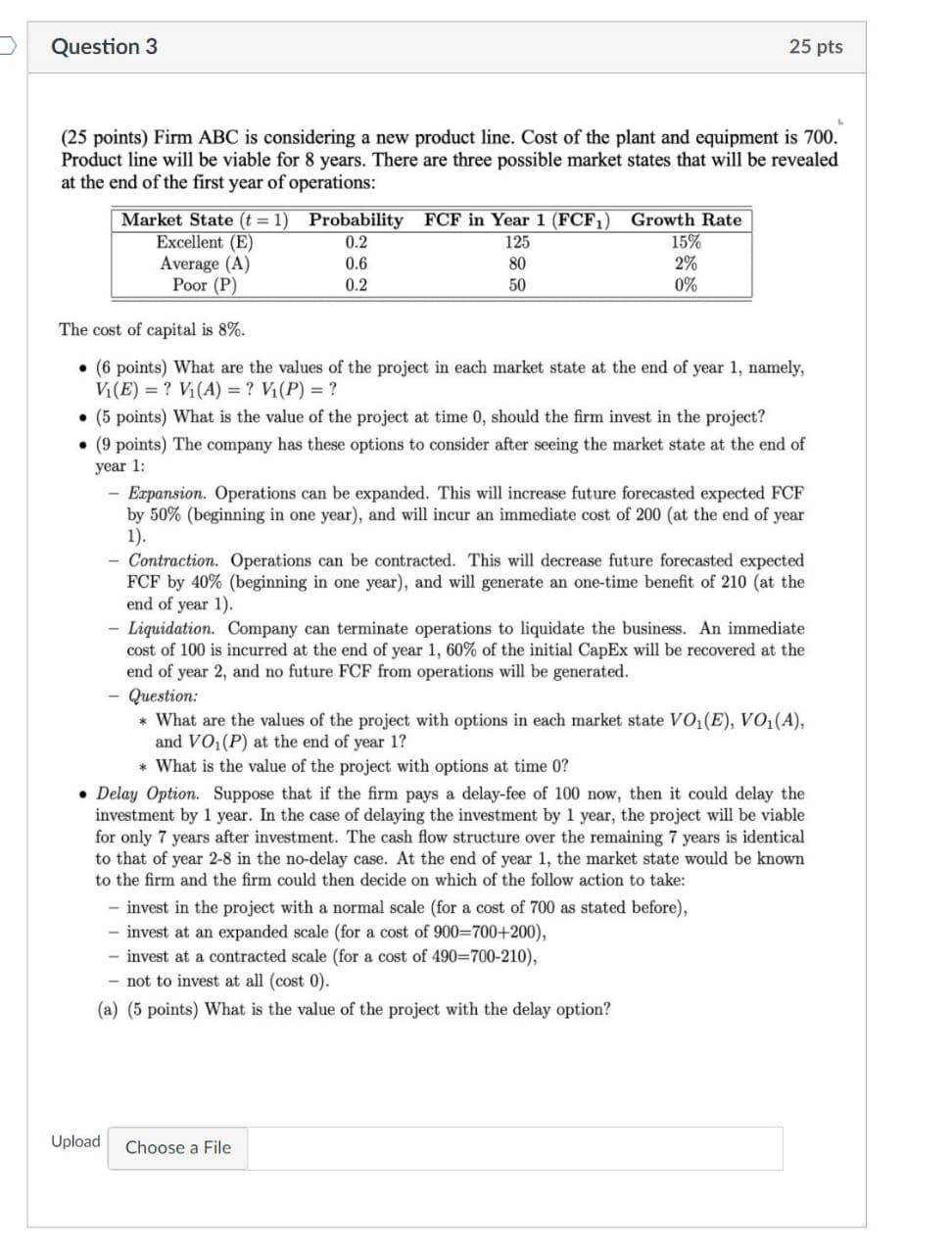

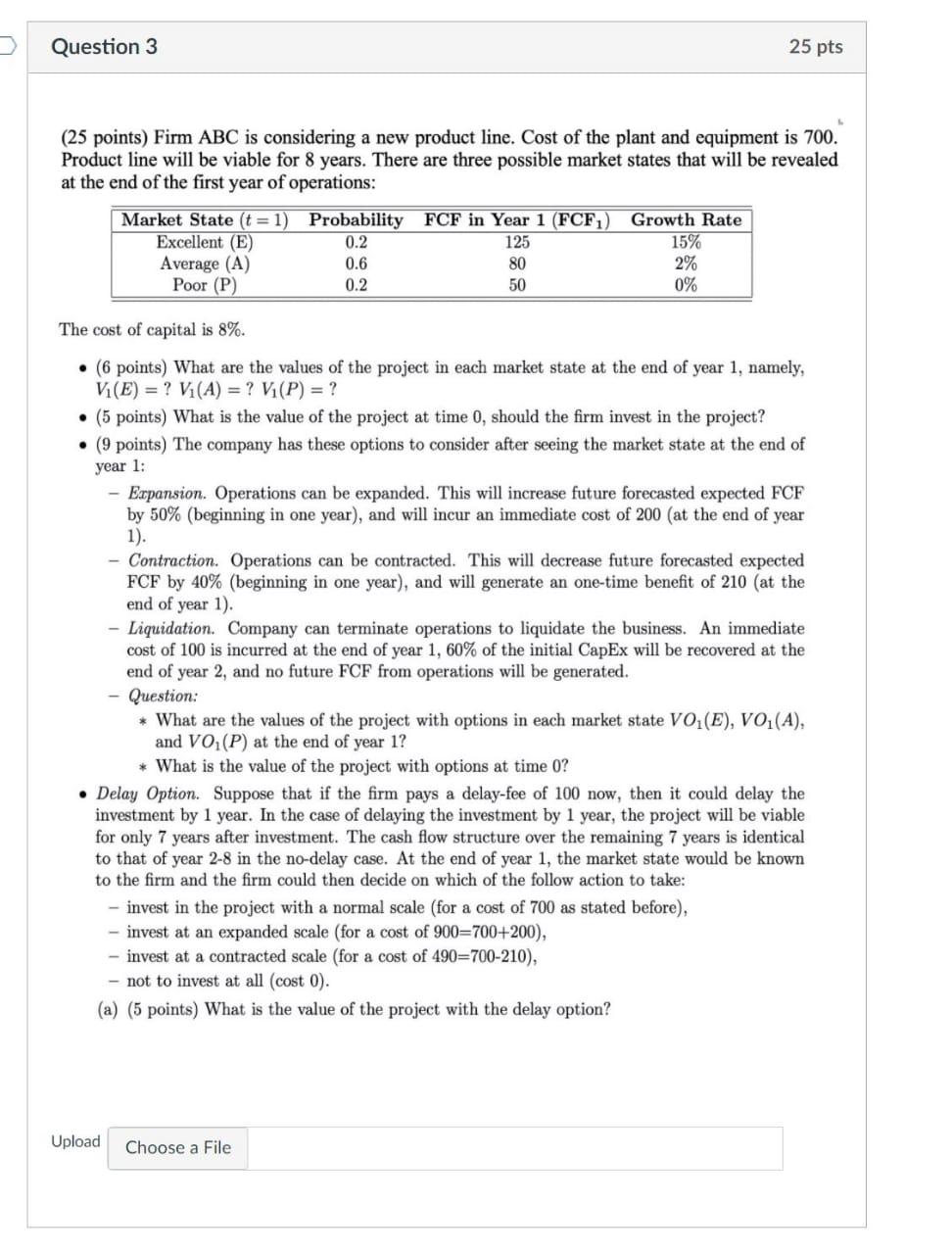

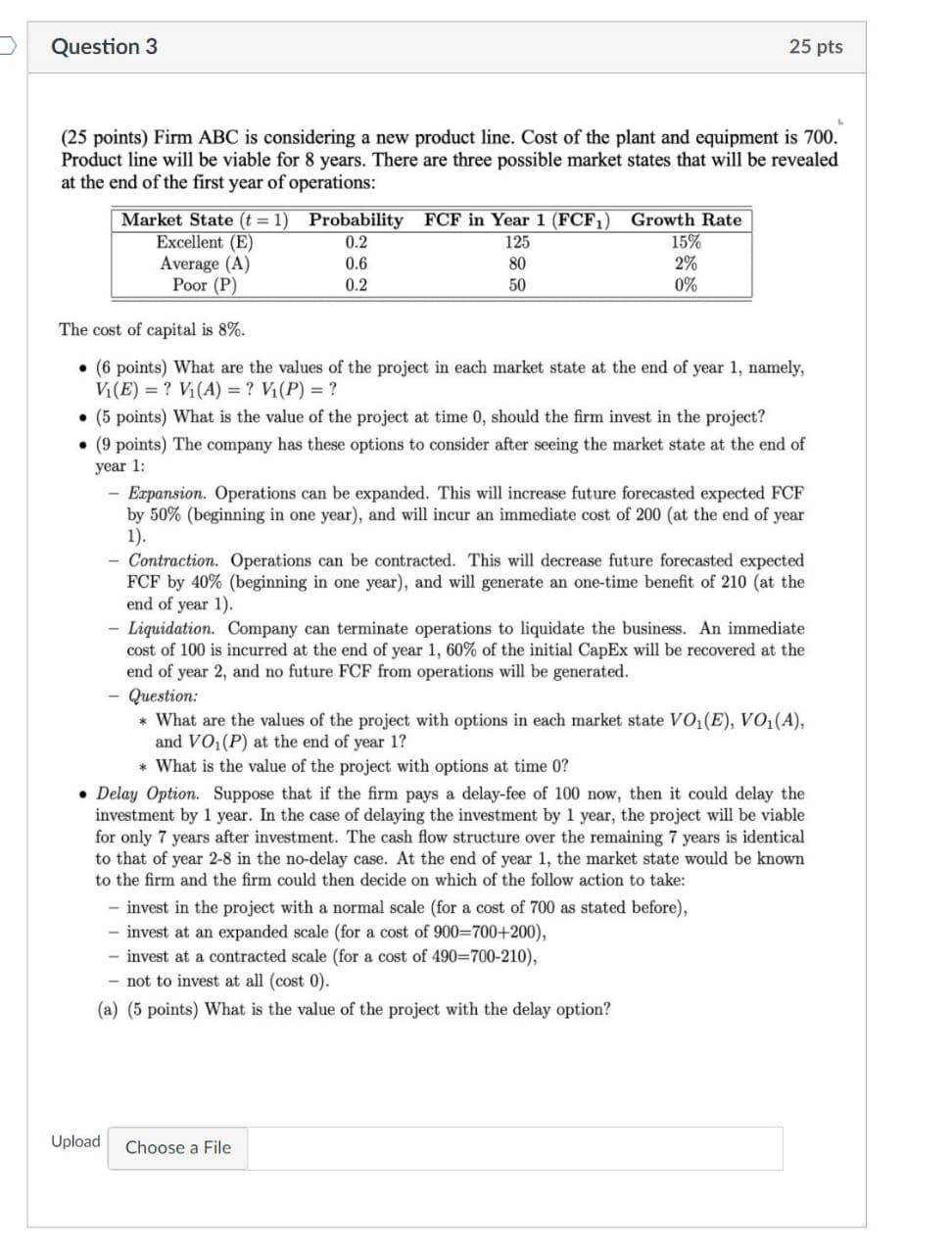

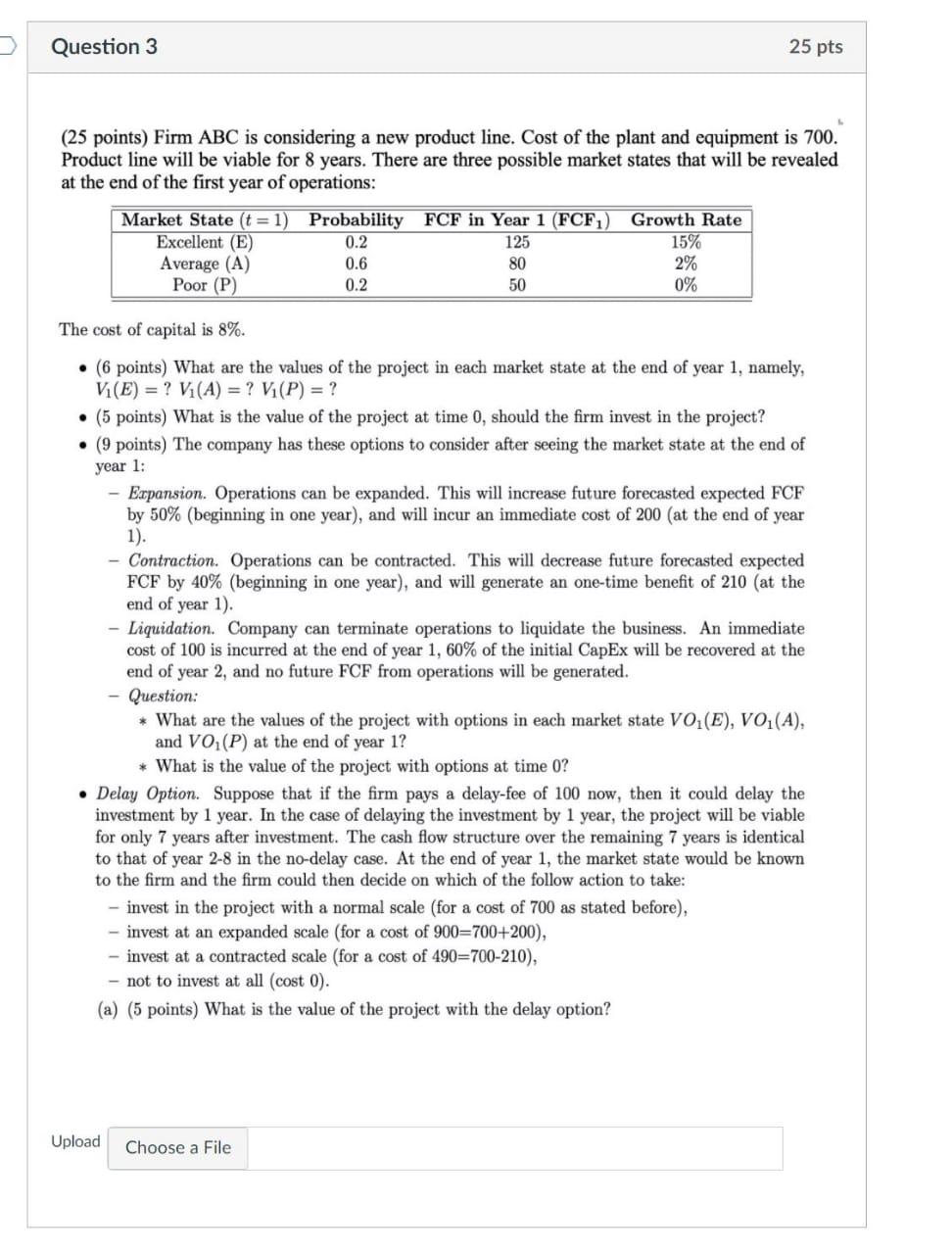

> Question 3 25 pts (25 points) Firm ABC is considering a new product line. Cost of the plant and equipment is 700. Product line will be viable for 8 years. There are three possible market states that will be revealed at the end of the first year of operations: Market State (t = 1) Probability FCF in Year 1 (FCF) Growth Rate Excellent (E) 0.2 125 15% Average (A) 0.6 80 2% Poor (P) 0.2 50 0% The cost of capital is 8%. . (6 points) What are the values of the project in each market state at the end of year 1, namely, VI(E) = ? Vi(A) = ? V(P) = ? (5 points) What is the value of the project at time 0, should the firm invest in the project? (9 points) The company has these options to consider after seeing the market state at the end of year 1: Expansion. Operations can be expanded. This will increase future forecasted expected FCF by 50% (beginning in one year), and will incur an immediate cost of 200 (at the end of year 1). Contraction. Operations can be contracted. This will decrease future forecasted expected FCF by 40% (beginning in one year), and will generate an one-time benefit of 210 (at the end of year 1). - Liquidation. Company can terminate operations to liquidate the business. An immediate cost of 100 is incurred at the end of year 1, 60% of the initial CapEx will be recovered at the end of year 2, and no future FCF from operations will be generated. Question: * What are the values of the project with options in each market state VO2(E), VO(A), and VO(P) at the end of year 1? * What is the value of the project with options at time 0? Delay Option. Suppose that if the firm pays a delay-fee of 100 now, then it could delay the investment by 1 year. In the case of delaying the investment by 1 year, the project will be viable for only 7 years after investment. The cash flow structure over the remaining 7 years is identical to that of year 2-8 in the no-delay case. At the end of year 1, the market state would be known to the firm and the firm could then decide on which of the follow action to take: invest in the project with a normal scale (for a cost of 700 as stated before), - invest at an expanded scale (for a cost of 900=700+200), - invest at a contracted scale (for a cost of 490=700-210), - not to invest at all cost 0). (a) (5 points) What is the value of the project with the delay option? Upload Choose a File > Question 3 25 pts (25 points) Firm ABC is considering a new product line. Cost of the plant and equipment is 700. Product line will be viable for 8 years. There are three possible market states that will be revealed at the end of the first year of operations: Market State (t = 1) Probability FCF in Year 1 (FCF) Growth Rate Excellent (E) 0.2 125 15% Average (A) 0.6 80 2% Poor (P) 0.2 50 0% The cost of capital is 8%. . (6 points) What are the values of the project in each market state at the end of year 1, namely, VI(E) = ? Vi(A) = ? V(P) = ? (5 points) What is the value of the project at time 0, should the firm invest in the project? (9 points) The company has these options to consider after seeing the market state at the end of year 1: Expansion. Operations can be expanded. This will increase future forecasted expected FCF by 50% (beginning in one year), and will incur an immediate cost of 200 (at the end of year 1). Contraction. Operations can be contracted. This will decrease future forecasted expected FCF by 40% (beginning in one year), and will generate an one-time benefit of 210 (at the end of year 1). - Liquidation. Company can terminate operations to liquidate the business. An immediate cost of 100 is incurred at the end of year 1, 60% of the initial CapEx will be recovered at the end of year 2, and no future FCF from operations will be generated. Question: * What are the values of the project with options in each market state VO2(E), VO(A), and VO(P) at the end of year 1? * What is the value of the project with options at time 0? Delay Option. Suppose that if the firm pays a delay-fee of 100 now, then it could delay the investment by 1 year. In the case of delaying the investment by 1 year, the project will be viable for only 7 years after investment. The cash flow structure over the remaining 7 years is identical to that of year 2-8 in the no-delay case. At the end of year 1, the market state would be known to the firm and the firm could then decide on which of the follow action to take: invest in the project with a normal scale (for a cost of 700 as stated before), - invest at an expanded scale (for a cost of 900=700+200), - invest at a contracted scale (for a cost of 490=700-210), - not to invest at all cost 0). (a) (5 points) What is the value of the project with the delay option? Upload Choose a File