Answered step by step

Verified Expert Solution

Question

1 Approved Answer

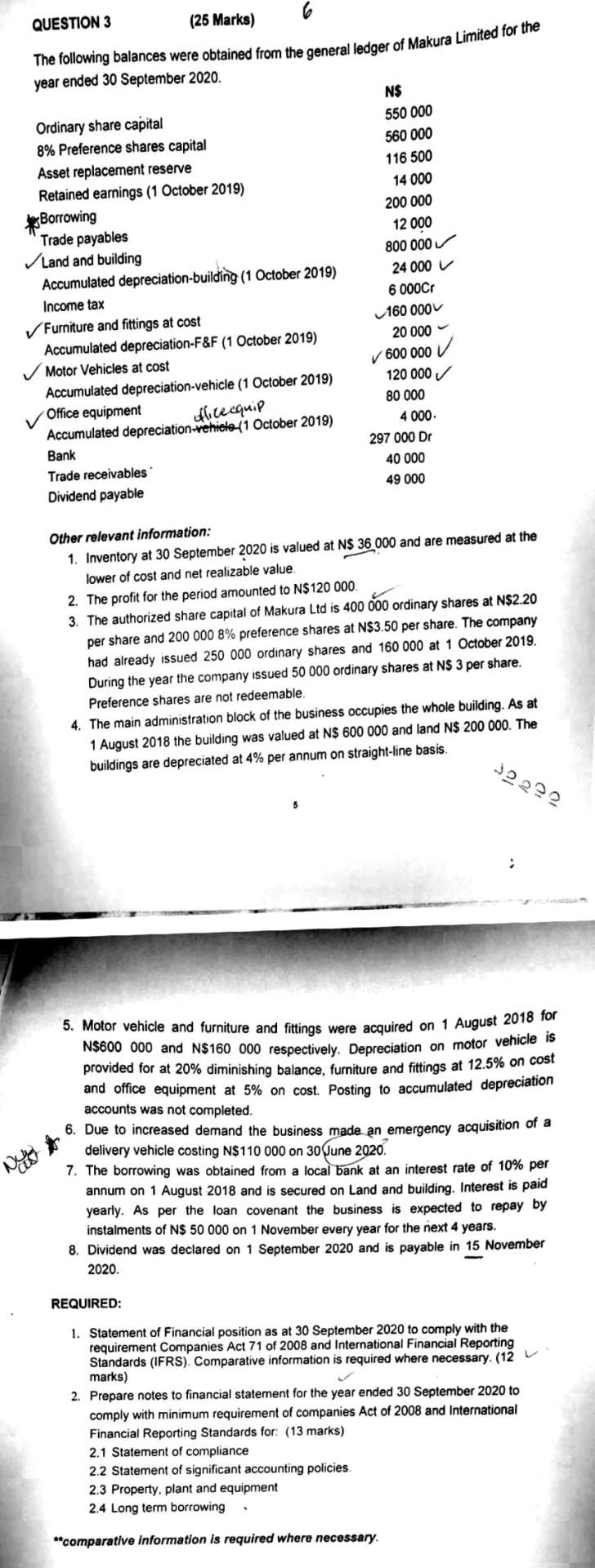

QUESTION 3 (26 Marks) The following balances were obtained from the general ledger of Makura Limited for the year ended 30 September 2020. Ordinary share

QUESTION 3 (26 Marks) The following balances were obtained from the general ledger of Makura Limited for the year ended 30 September 2020. Ordinary share capital 8% Preference shares capital Asset replacement reserve Retained earnings (1 October 2019) po Borrowing Trade payables Land and building Accumulated depreciation-building (1 October 2019) Income tax Furniture and fittings at cost Accumulated depreciation-F&F (1 October 2019) Motor Vehicles at cost Accumulated depreciation-vehicle (1 October 2019) Office equipment office equip Accumulated depreciation-vehicle-/1 October 2019) Bank Trade receivables Dividend payable NS 550 000 560 000 116 500 14 000 200 000 12 000 800 000 24 000 6 000CT 160 000 20 000 600 000 V 120 000 80 000 4 000 297 000 Dr 40 000 49 000 Other relevant information: 1. Inventory at 30 September 2020 is valued at N$ 36 000 and are measured at the lower of cost and net realizable value 2. The profit for the period amounted to N$ 120 000 3. The authorized share capital of Makura Ltd is 400 000 ordinary shares at N$2.20 per share and 200 000 8% preference shares at N$3.50 per share. The company had already issued 250 000 ordinary shares and 160 000 at 1 October 2019. During the year the company issued 50 000 ordinary shares at NS 3 per share. Preference shares are not redeemable 4. The main administration block of the business occupies the whole building. As at 1 August 2018 the building was valued at N$ 600 000 and land N$ 200 000. The buildings are depreciated at 4% per annum on straight-line basis. 5. Motor vehicle and furniture and fittings were acquired on 1 August 2018 for N$600 000 and N$160 000 respectively. Depreciation on motor vehicle is provided for at 20% diminishing balance, furniture and fittings at 12.5% on cost and office equipment at 5% on cost. Posting to accumulated depreciation accounts was not completed. 6. Due to increased demand the business made an emergency acquisition of a delivery vehicle costing N$110 000 on 30 June 2020. 7. The borrowing was obtained from a local bank at an interest rate of 10% per annum on 1 August 2018 and is secured on Land and building. Interest is paid yearly. As per the loan covenant the business is expected to repay by instalments of N$ 50 000 on 1 November every year for the next 4 years. 8. Dividend was declared on 1 September 2020 and is payable in 15 November 2020. REQUIRED: 1. Statement of Financial position as at 30 September 2020 to comply with the requirement Companies Act 71 of 2008 and International Financial Reporting Standards (IFRS). Comparative information is required where necessary (12 marks) 2. Prepare notes to financial statement for the year ended 30 September 2020 to comply with minimum requirement of companies Act of 2008 and International Financial Reporting Standards for: (13 marks) 2.1 Statement of compliance 2.2 Statement of significant accounting policies 2.3 Property, plant and equipment 2.4 Long term borrowing **comparative information is required where necessary. QUESTION 3 (26 Marks) The following balances were obtained from the general ledger of Makura Limited for the year ended 30 September 2020. Ordinary share capital 8% Preference shares capital Asset replacement reserve Retained earnings (1 October 2019) po Borrowing Trade payables Land and building Accumulated depreciation-building (1 October 2019) Income tax Furniture and fittings at cost Accumulated depreciation-F&F (1 October 2019) Motor Vehicles at cost Accumulated depreciation-vehicle (1 October 2019) Office equipment office equip Accumulated depreciation-vehicle-/1 October 2019) Bank Trade receivables Dividend payable NS 550 000 560 000 116 500 14 000 200 000 12 000 800 000 24 000 6 000CT 160 000 20 000 600 000 V 120 000 80 000 4 000 297 000 Dr 40 000 49 000 Other relevant information: 1. Inventory at 30 September 2020 is valued at N$ 36 000 and are measured at the lower of cost and net realizable value 2. The profit for the period amounted to N$ 120 000 3. The authorized share capital of Makura Ltd is 400 000 ordinary shares at N$2.20 per share and 200 000 8% preference shares at N$3.50 per share. The company had already issued 250 000 ordinary shares and 160 000 at 1 October 2019. During the year the company issued 50 000 ordinary shares at NS 3 per share. Preference shares are not redeemable 4. The main administration block of the business occupies the whole building. As at 1 August 2018 the building was valued at N$ 600 000 and land N$ 200 000. The buildings are depreciated at 4% per annum on straight-line basis. 5. Motor vehicle and furniture and fittings were acquired on 1 August 2018 for N$600 000 and N$160 000 respectively. Depreciation on motor vehicle is provided for at 20% diminishing balance, furniture and fittings at 12.5% on cost and office equipment at 5% on cost. Posting to accumulated depreciation accounts was not completed. 6. Due to increased demand the business made an emergency acquisition of a delivery vehicle costing N$110 000 on 30 June 2020. 7. The borrowing was obtained from a local bank at an interest rate of 10% per annum on 1 August 2018 and is secured on Land and building. Interest is paid yearly. As per the loan covenant the business is expected to repay by instalments of N$ 50 000 on 1 November every year for the next 4 years. 8. Dividend was declared on 1 September 2020 and is payable in 15 November 2020. REQUIRED: 1. Statement of Financial position as at 30 September 2020 to comply with the requirement Companies Act 71 of 2008 and International Financial Reporting Standards (IFRS). Comparative information is required where necessary (12 marks) 2. Prepare notes to financial statement for the year ended 30 September 2020 to comply with minimum requirement of companies Act of 2008 and International Financial Reporting Standards for: (13 marks) 2.1 Statement of compliance 2.2 Statement of significant accounting policies 2.3 Property, plant and equipment 2.4 Long term borrowing **comparative information is required where necessary

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started