Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 3: (3 points each section, a total of 9 points) (a) Your analysis predicts that energy stocks will outperform the stock market in the

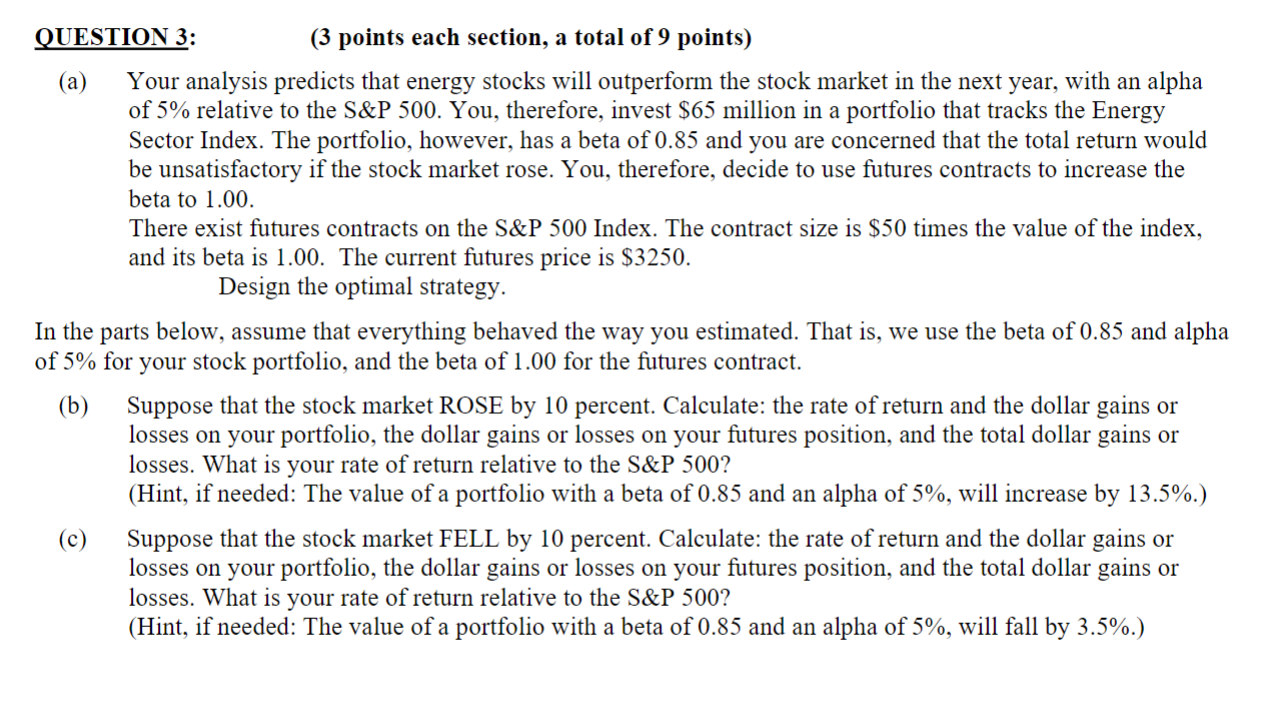

QUESTION 3: (3 points each section, a total of 9 points) (a) Your analysis predicts that energy stocks will outperform the stock market in the next year, with an alpha of 5\% relative to the S\&P 500. You, therefore, invest $65 million in a portfolio that tracks the Energy Sector Index. The portfolio, however, has a beta of 0.85 and you are concerned that the total return would be unsatisfactory if the stock market rose. You, therefore, decide to use futures contracts to increase the beta to 1.00 . There exist futures contracts on the S\&P 500 Index. The contract size is $50 times the value of the index, and its beta is 1.00 . The current futures price is $3250. Design the optimal strategy. In the parts below, assume that everything behaved the way you estimated. That is, we use the beta of 0.85 and alpha of 5% for your stock portfolio, and the beta of 1.00 for the futures contract. (b) Suppose that the stock market ROSE by 10 percent. Calculate: the rate of return and the dollar gains or losses on your portfolio, the dollar gains or losses on your futures position, and the total dollar gains or losses. What is your rate of return relative to the S\&P 500? (Hint, if needed: The value of a portfolio with a beta of 0.85 and an alpha of 5%, will increase by 13.5%.) (c) Suppose that the stock market FELL by 10 percent. Calculate: the rate of return and the dollar gains or losses on your portfolio, the dollar gains or losses on your futures position, and the total dollar gains or losses. What is your rate of return relative to the S\&P 500? (Hint, if needed: The value of a portfolio with a beta of 0.85 and an alpha of 5%, will fall by 3.5%.)

QUESTION 3: (3 points each section, a total of 9 points) (a) Your analysis predicts that energy stocks will outperform the stock market in the next year, with an alpha of 5\% relative to the S\&P 500. You, therefore, invest $65 million in a portfolio that tracks the Energy Sector Index. The portfolio, however, has a beta of 0.85 and you are concerned that the total return would be unsatisfactory if the stock market rose. You, therefore, decide to use futures contracts to increase the beta to 1.00 . There exist futures contracts on the S\&P 500 Index. The contract size is $50 times the value of the index, and its beta is 1.00 . The current futures price is $3250. Design the optimal strategy. In the parts below, assume that everything behaved the way you estimated. That is, we use the beta of 0.85 and alpha of 5% for your stock portfolio, and the beta of 1.00 for the futures contract. (b) Suppose that the stock market ROSE by 10 percent. Calculate: the rate of return and the dollar gains or losses on your portfolio, the dollar gains or losses on your futures position, and the total dollar gains or losses. What is your rate of return relative to the S\&P 500? (Hint, if needed: The value of a portfolio with a beta of 0.85 and an alpha of 5%, will increase by 13.5%.) (c) Suppose that the stock market FELL by 10 percent. Calculate: the rate of return and the dollar gains or losses on your portfolio, the dollar gains or losses on your futures position, and the total dollar gains or losses. What is your rate of return relative to the S\&P 500? (Hint, if needed: The value of a portfolio with a beta of 0.85 and an alpha of 5%, will fall by 3.5%.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started