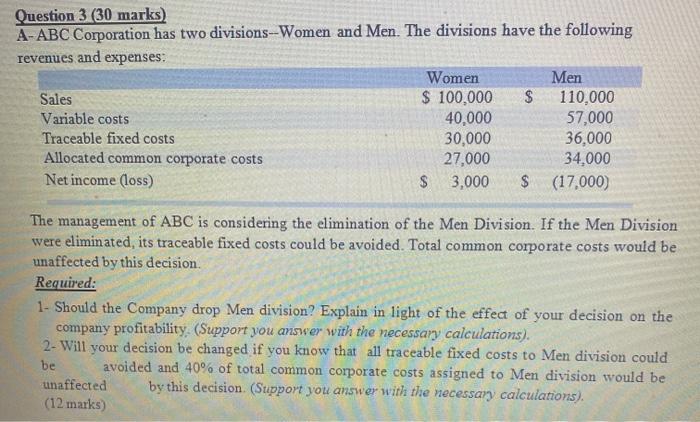

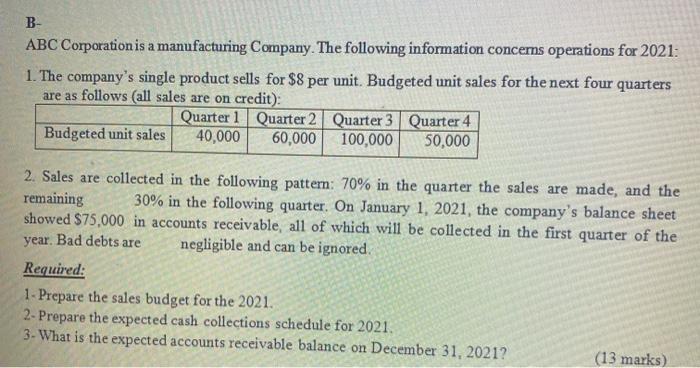

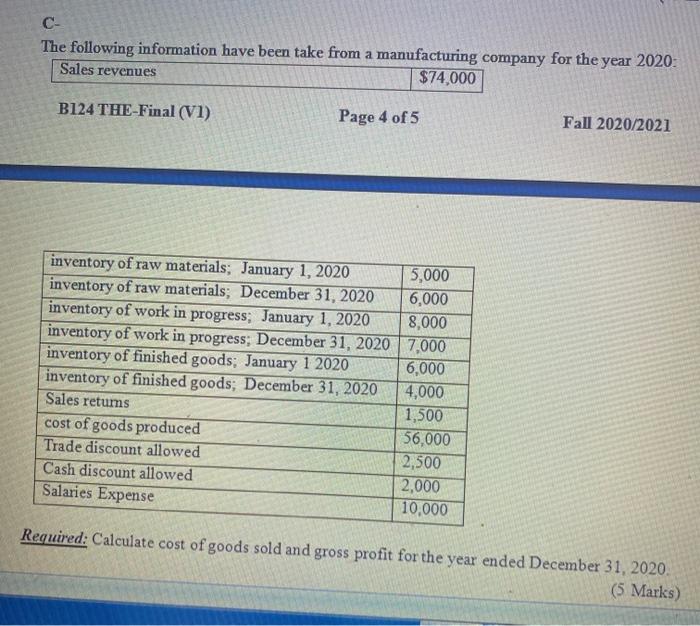

Question 3 (30 marks) A-ABC Corporation has two divisions--Women and Men. The divisions have the following revenues and expenses: Women Men Sales $ 100,000 $ 110,000 Variable costs 40,000 57,000 Traceable fixed costs 30,000 36,000 Allocated common corporate costs 27,000 34.000 Net income (loss) $ 3,000 $ (17,000) The management of ABC is considering the elimination of the Men Division. If the Men Division were eliminated, its traceable fixed costs could be avoided. Total common corporate costs would be unaffected by this decision. Required: 1- Should the Company drop Men division? Explain in light of the effect of your decision on the company profitability (Support you answer with the necessary calculations). 2. Will your decision be changed if you know that all traceable fixed costs to Men division could be avoided and 40% of total common corporate costs assigned to Men division would be unaffected by this decision (Support you answer with the necessary calculations). (12 marks) B- ABC Corporation is a manufacturing Company. The following information concerns operations for 2021: 1. The company's single product sells for $8 per unit. Budgeted unit sales for the next four quarters are as follows (all sales are on credit): Quarter 1 Quarter 2 Quarter 3 Quarter 4 Budgeted unit sales 40,000 60,000 100,000 50,000 2. Sales are collected in the following pattern: 70% in the quarter the sales are made, and the remaining 30% in the following quarter. On January 1, 2021, the company's balance sheet showed $75,000 in accounts receivable, all of which will be collected in the first quarter of the year. Bad debts are negligible and can be ignored. Required: 1- Prepare the sales budget for the 2021. 2- Prepare the expected cash collections schedule for 2021. 3- What is the expected accounts receivable balance on December 31, 2021? (13 marks) The following information have been take from a manufacturing company for the year 2020: Sales revenues $74,000 B124 THE-Final (V1) Page 4 of 5 Fall 2020/2021 inventory of raw materials; January 1, 2020 5,000 inventory of raw materials; December 31, 2020 6,000 inventory of work in progress; January 1, 2020 8,000 inventory of work in progress, December 31, 2020 7.000 inventory of finished goods; January 1 2020 6,000 inventory of finished goods, December 31, 2020 4,000 Sales retums 1,500 cost of goods produced 56,000 Trade discount allowed 2,500 Cash discount allowed 2,000 Salaries Expense 10,000 Required: Calculate cost of goods sold and gross profit for the year ended December 31, 2020