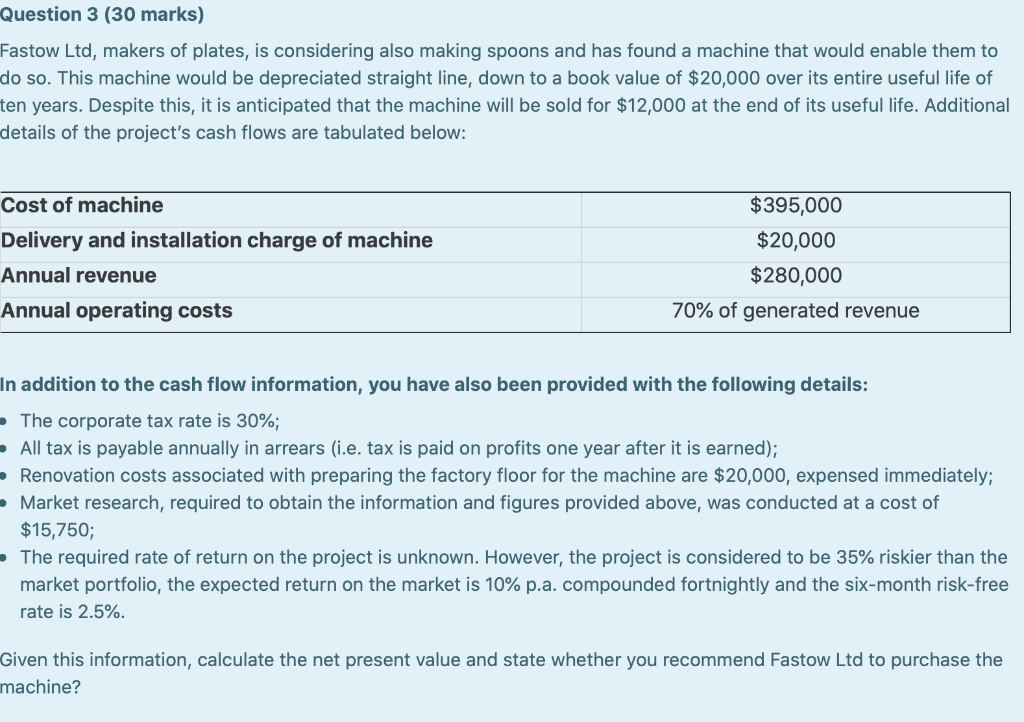

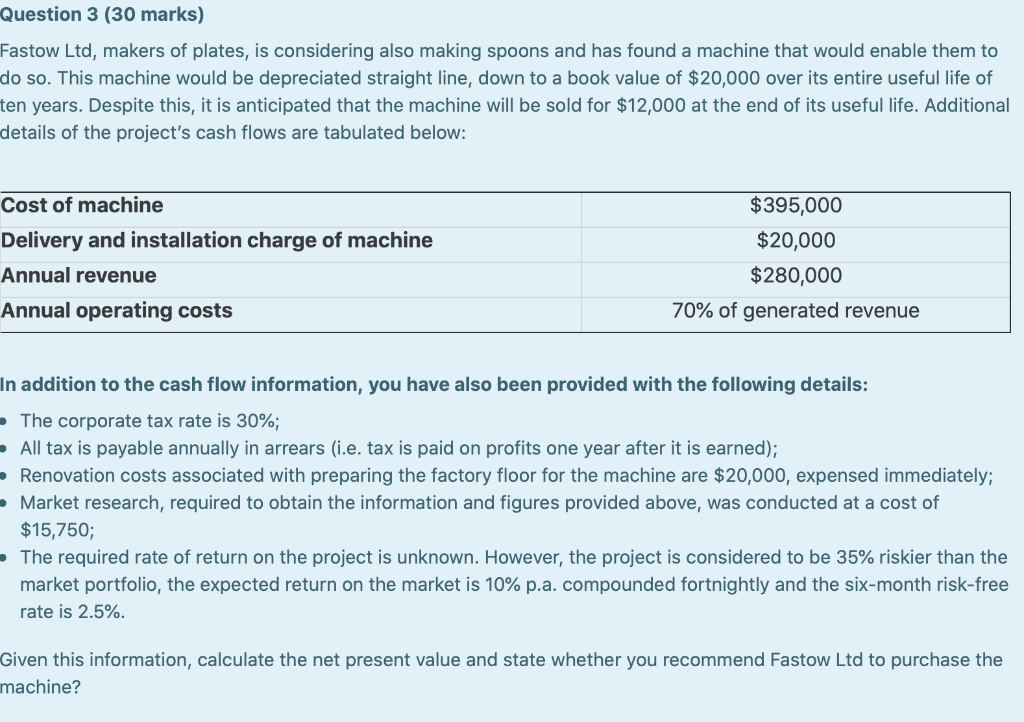

Question 3 (30 marks) Fastow Ltd, makers of plates, is considering also making spoons and has found a machine that would enable them to do so. This machine would be depreciated straight line, down to a book value of $20,000 over its entire useful life of ten years. Despite this, it is anticipated that the machine will be sold for $12,000 at the end of its useful life. Additional details of the project's cash flows are tabulated below: Cost of machine Delivery and installation charge of machine Annual revenue Annual operating costs $395,000 $20,000 $280,000 70% of generated revenue In addition to the cash flow information, you have also been provided with the following details: The corporate tax rate is 30%; All tax is payable annually in arrears (i.e. tax is paid on profits one year after it is earned); Renovation costs associated with preparing the factory floor for the machine are $20,000, expensed immediately; Market research, required to obtain the information and figures provided above, was conducted at a cost of $15,750; The required rate of return on the project is unknown. However, the project is considered to be 35% riskier than the market portfolio, the expected return on the market is 10% p.a. compounded fortnightly and the six-month risk-free rate is 2.5% Given this information, calculate the net present value and state whether you recommend Fastow Ltd to purchase the machine? Question 3 (30 marks) Fastow Ltd, makers of plates, is considering also making spoons and has found a machine that would enable them to do so. This machine would be depreciated straight line, down to a book value of $20,000 over its entire useful life of ten years. Despite this, it is anticipated that the machine will be sold for $12,000 at the end of its useful life. Additional details of the project's cash flows are tabulated below: Cost of machine Delivery and installation charge of machine Annual revenue Annual operating costs $395,000 $20,000 $280,000 70% of generated revenue In addition to the cash flow information, you have also been provided with the following details: The corporate tax rate is 30%; All tax is payable annually in arrears (i.e. tax is paid on profits one year after it is earned); Renovation costs associated with preparing the factory floor for the machine are $20,000, expensed immediately; Market research, required to obtain the information and figures provided above, was conducted at a cost of $15,750; The required rate of return on the project is unknown. However, the project is considered to be 35% riskier than the market portfolio, the expected return on the market is 10% p.a. compounded fortnightly and the six-month risk-free rate is 2.5% Given this information, calculate the net present value and state whether you recommend Fastow Ltd to purchase the machine