Answered step by step

Verified Expert Solution

Question

1 Approved Answer

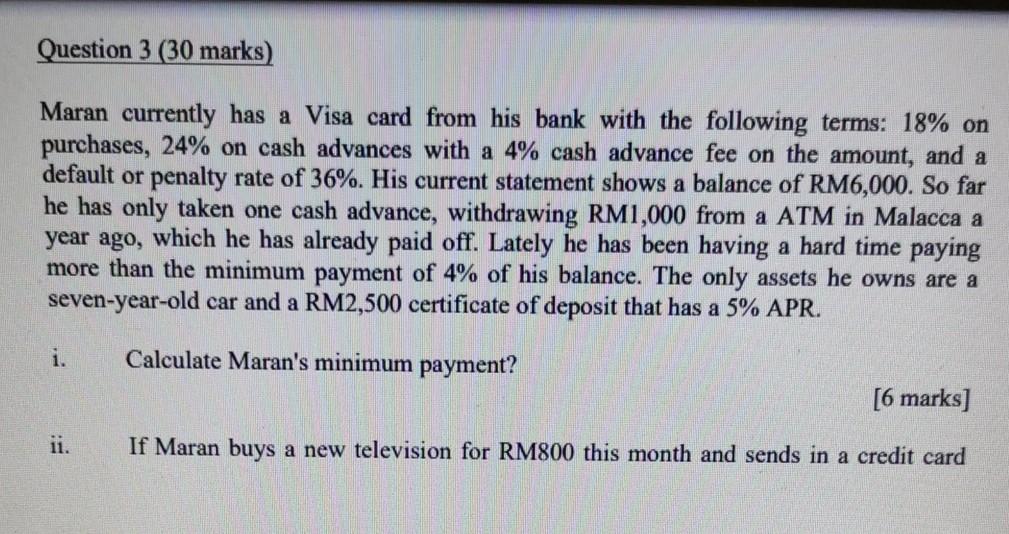

Question 3 (30 marks) Maran currently has a Visa card from his bank with the following terms: 18% on purchases, 24% on cash advances with

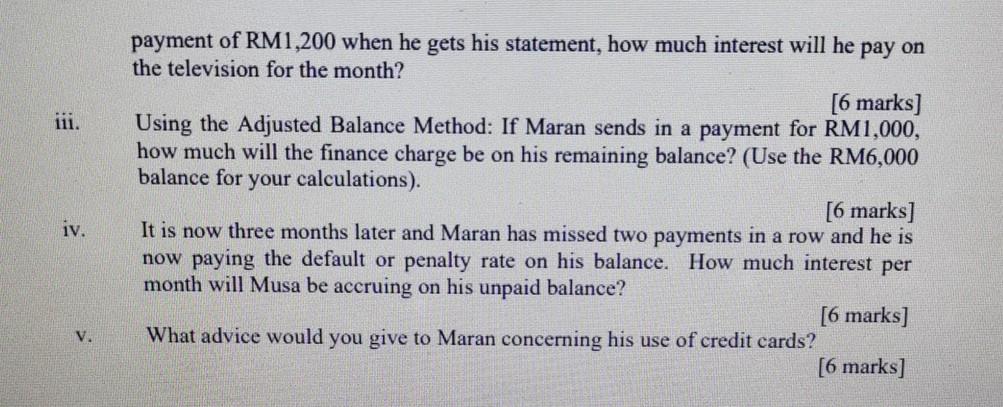

Question 3 (30 marks) Maran currently has a Visa card from his bank with the following terms: 18% on purchases, 24% on cash advances with a 4% cash advance fee on the amount, and a default or penalty rate of 36%. His current statement shows a balance of RM6,000. So far he has only taken one cash advance, withdrawing RM1,000 from a ATM in Malacca a year ago, which he has already paid off. Lately he has been having a hard time paying more than the minimum payment of 4% of his balance. The only assets he owns are a seven-year-old car and a RM2,500 certificate of deposit that has a 5% APR. 1. Calculate Maran's minimum payment? [6 marks] ii. If Maran buys a new television for RM800 this month and sends in a credit card payment of RM1,200 when he gets his statement, how much interest will he pay on the television for the month? [6 marks) Using the Adjusted Balance Method: If Maran sends in a payment for RM1,000, how much will the finance charge be on his remaining balance? (Use the RM6,000 balance for your calculations). [6 marks] It is now three months later and Maran has missed two payments in a row and he is now paying the default or penalty rate on his balance. How much interest per month will Musa be accruing on his unpaid balance? [6 marks] What advice would you give to Maran concerning his use of credit cards? [6 marks] iv. v. Question 3 (30 marks) Maran currently has a Visa card from his bank with the following terms: 18% on purchases, 24% on cash advances with a 4% cash advance fee on the amount, and a default or penalty rate of 36%. His current statement shows a balance of RM6,000. So far he has only taken one cash advance, withdrawing RM1,000 from a ATM in Malacca a year ago, which he has already paid off. Lately he has been having a hard time paying more than the minimum payment of 4% of his balance. The only assets he owns are a seven-year-old car and a RM2,500 certificate of deposit that has a 5% APR. 1. Calculate Maran's minimum payment? [6 marks] ii. If Maran buys a new television for RM800 this month and sends in a credit card payment of RM1,200 when he gets his statement, how much interest will he pay on the television for the month? [6 marks) Using the Adjusted Balance Method: If Maran sends in a payment for RM1,000, how much will the finance charge be on his remaining balance? (Use the RM6,000 balance for your calculations). [6 marks] It is now three months later and Maran has missed two payments in a row and he is now paying the default or penalty rate on his balance. How much interest per month will Musa be accruing on his unpaid balance? [6 marks] What advice would you give to Maran concerning his use of credit cards? [6 marks] iv. v

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started