Answered step by step

Verified Expert Solution

Question

1 Approved Answer

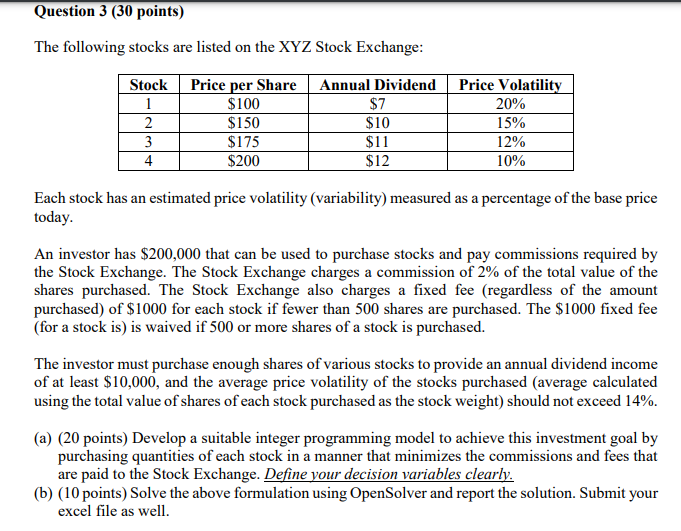

Question 3 (30 points) The following stocks are listed on the XYZ Stock Exchange: Each stock has an estimated price volatility (variability) measured as a

Question 3 (30 points) The following stocks are listed on the XYZ Stock Exchange: Each stock has an estimated price volatility (variability) measured as a percentage of the base price today. An investor has $200,000 that can be used to purchase stocks and pay commissions required by the Stock Exchange. The Stock Exchange charges a commission of 2% of the total value of the shares purchased. The Stock Exchange also charges a fixed fee (regardless of the amount purchased) of $1000 for each stock if fewer than 500 shares are purchased. The $1000 fixed fee (for a stock is) is waived if 500 or more shares of a stock is purchased. The investor must purchase enough shares of various stocks to provide an annual dividend income of at least $10,000, and the average price volatility of the stocks purchased (average calculated using the total value of shares of each stock purchased as the stock weight) should not exceed 14%. (a) (20 points) Develop a suitable integer programming model to achieve this investment goal by purchasing quantities of each stock in a manner that minimizes the commissions and fees that are paid to the Stock Exchange. Define your decision variables clearly. (b) (10 points) Solve the above formulation using OpenSolver and report the solution. Submit your excel file as well

Question 3 (30 points) The following stocks are listed on the XYZ Stock Exchange: Each stock has an estimated price volatility (variability) measured as a percentage of the base price today. An investor has $200,000 that can be used to purchase stocks and pay commissions required by the Stock Exchange. The Stock Exchange charges a commission of 2% of the total value of the shares purchased. The Stock Exchange also charges a fixed fee (regardless of the amount purchased) of $1000 for each stock if fewer than 500 shares are purchased. The $1000 fixed fee (for a stock is) is waived if 500 or more shares of a stock is purchased. The investor must purchase enough shares of various stocks to provide an annual dividend income of at least $10,000, and the average price volatility of the stocks purchased (average calculated using the total value of shares of each stock purchased as the stock weight) should not exceed 14%. (a) (20 points) Develop a suitable integer programming model to achieve this investment goal by purchasing quantities of each stock in a manner that minimizes the commissions and fees that are paid to the Stock Exchange. Define your decision variables clearly. (b) (10 points) Solve the above formulation using OpenSolver and report the solution. Submit your excel file as well Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started