Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company manufactures three types of products for sale to retailers, namely: Hand sanitiser Face masks Rubber gloves The company operates a standard absorption

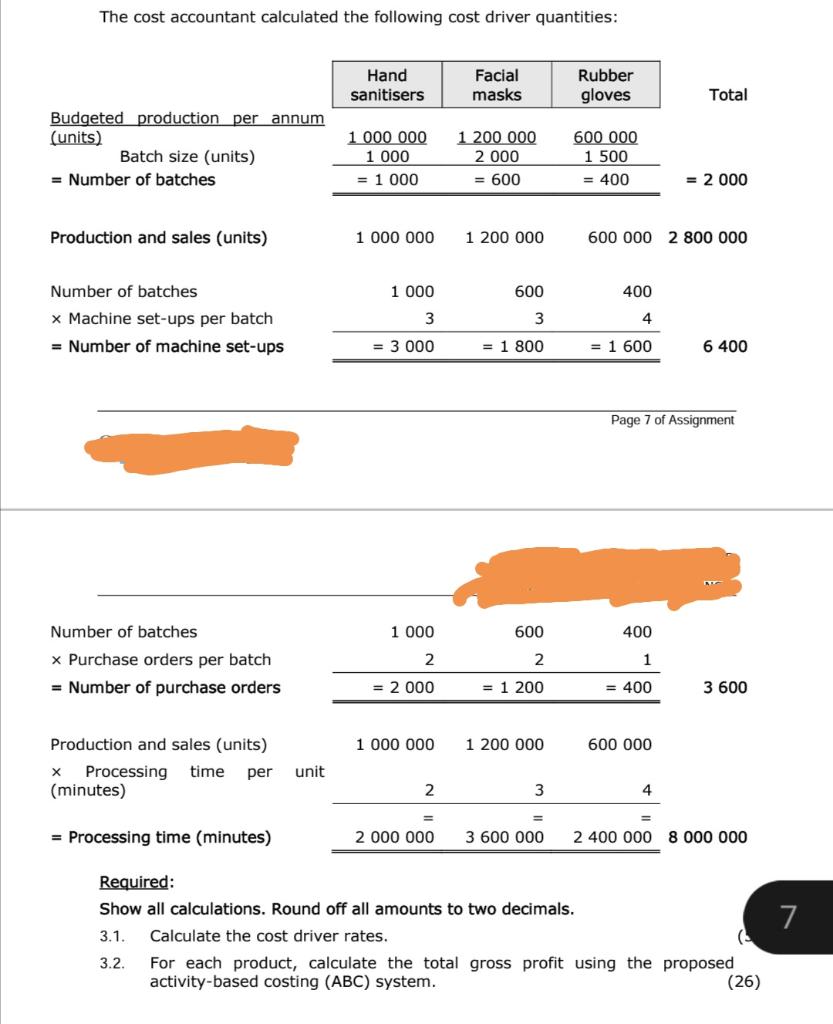

A company manufactures three types of products for sale to retailers, namely: Hand sanitiser Face masks Rubber gloves The company operates a standard absorption costing system. Budgeted information for the next year is given below: Face masks R60 000 000 R38 000 000 R22 000 000 R6 200 000 R2 400 000 Hand sanitiser Rubber gloves Products Sales Direct material Direct labour Fixed production overheads Total R120 000 000 R22 000 000 R8 000 000 R11 800 000 R3 700 000 R4 000 000 R1 900 000 R15 400 000 R74 600 000 Production and sales (in units) 1 000 000 units 1 200 000 units 600 000 units Page 6 of Assignment Fixed production overheads are absorbed using a direct material cost percentage rate. The management accountant of the company is proposing changing to an activity-based costing system (ABC). The main activities and their associated cost drivers and overhead costs have been identified as follows: Cost driver Number of set-ups Production overhead cost (R) R3 600 000 Activity Machine set-up Quality inspection Processing Purchasing Packaging Number of quality inspections Processing time Number of purchase orders Number of units of products Total production overhead cost R1 200 000 R6 500 000 R1 800 000 R2 300 000 R15 400 000 Further details have been ascertained as follows: Hand sanitisers 1 000 Rubber gloves 1 500 Face masks Batch size (in units) Machine set-ups per batch Purchase orders per batch Processing time (minutes) Quality inspections per batch 2 000 3. 1 per unit 2 4 1 1 1 The cost accountant calculated the following cost driver quantities: Facial masks Hand Rubber sanitisers gloves Total Budgeted production per annum (units) 1 000 000 1 000 1 200 000 2 000 = 600 600 000 1 500 Batch size (units) = Number of batches = 1 000 = 400 = 2 000 Production and sales (units) 1 000 000 1 200 000 600 000 2 800 000 Number of batches 1 000 600 400 x Machine set-ups per batch = Number of machine set-ups = 3 000 = 1 800 = 1 600 6 400 Page 7 of Assignment Number of batches 1 000 600 400 x Purchase orders per batch 2 1 = Number of purchase orders = 2 000 = 1 200 = 400 3 600 Production and sales (units) 1 000 000 1 200 000 600 000 Processing (minutes) time per unit 3 = Processing time (minutes) 2 000 000 3 600 000 2 400 000 8 000 000 Required: Show all calculations. Round off all amounts to two decimals. 7 3.1. Calculate the cost driver rates. For each product, calculate the total gross profit using the proposed activity-based costing (ABC) system. 3.2. (26)

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculation of Overhead Cost Rate Activity Overhead Cost Cost Driver Cost Driv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started