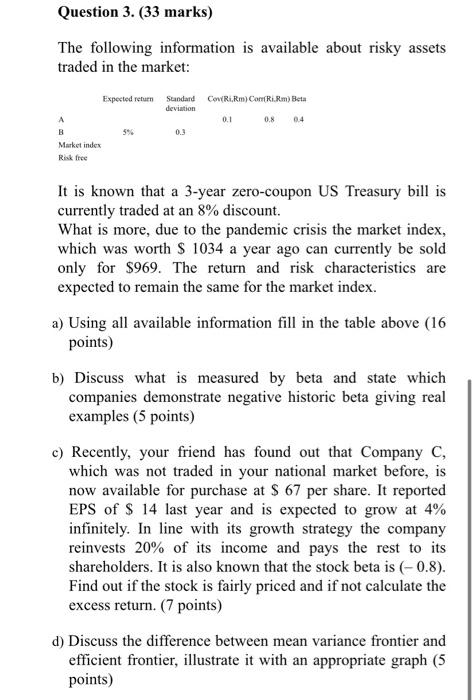

Question 3. (33 marks) The following information is available about risky assets traded in the market: Expected return Standard CovRi.Rm) Com Rm) Beta deviation 0.1 0.8 0.4 0.3 B Market index Risk free It is known that a 3-year zero-coupon US Treasury bill is currently traded at an 8% discount What is more, due to the pandemic crisis the market index, which was worth $ 1034 a year ago can currently be sold only for $969. The return and risk characteristics are expected to remain the same for the market index, a) Using all available information fill in the table above (16 points) b) Discuss what is measured by beta and state which companies demonstrate negative historic beta giving real examples (5 points) c) Recently, your friend has found out that Company C, which was not traded in your national market before, is now available for purchase at $ 67 per share. It reported EPS of $ 14 last year and is expected to grow at 4% infinitely. In line with its growth strategy the company reinvests 20% of its income and pays the rest to its shareholders. It is also known that the stock beta is (-0.8). Find out if the stock is fairly priced and if not calculate the excess return. (7 points) d) Discuss the difference between mean variance frontier and efficient frontier, illustrate it with an appropriate graph (5 points) Question 3. (33 marks) The following information is available about risky assets traded in the market: Expected return Standard CovRi.Rm) Com Rm) Beta deviation 0.1 0.8 0.4 0.3 B Market index Risk free It is known that a 3-year zero-coupon US Treasury bill is currently traded at an 8% discount What is more, due to the pandemic crisis the market index, which was worth $ 1034 a year ago can currently be sold only for $969. The return and risk characteristics are expected to remain the same for the market index, a) Using all available information fill in the table above (16 points) b) Discuss what is measured by beta and state which companies demonstrate negative historic beta giving real examples (5 points) c) Recently, your friend has found out that Company C, which was not traded in your national market before, is now available for purchase at $ 67 per share. It reported EPS of $ 14 last year and is expected to grow at 4% infinitely. In line with its growth strategy the company reinvests 20% of its income and pays the rest to its shareholders. It is also known that the stock beta is (-0.8). Find out if the stock is fairly priced and if not calculate the excess return. (7 points) d) Discuss the difference between mean variance frontier and efficient frontier, illustrate it with an appropriate graph (5 points)