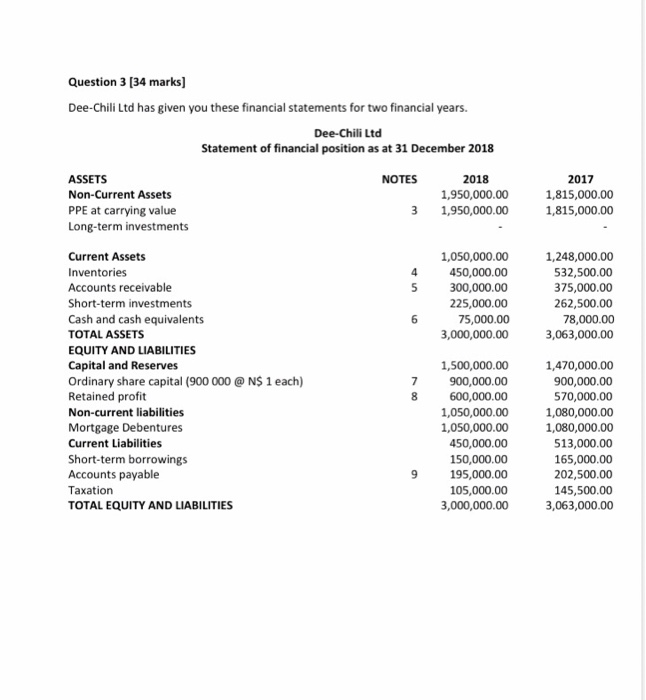

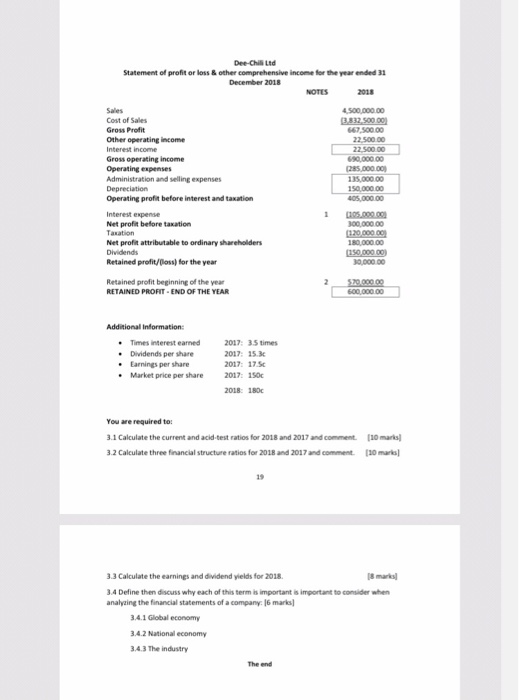

Question 3 [34 marks) Dee-Chili Ltd has given you these financial statements for two financial years. Dee-Chili Ltd Statement of financial position as at 31 December 2018 NOTES ASSETS Non-Current Assets PPE at carrying value Long-term investments 2018 1,950,000.00 1,950,000.00 2017 1,815,000.00 1,815,000.00 3 1,050,000.00 450,000.00 300,000.00 225,000.00 75,000.00 3,000,000.00 1,248,000.00 532,500.00 375,000.00 262,500.00 78,000.00 3,063,000.00 Current Assets Inventories Accounts receivable Short-term investments Cash and cash equivalents TOTAL ASSETS EQUITY AND LIABILITIES Capital and Reserves Ordinary share capital (900 000 @ N$ 1 each) Retained profit Non-current liabilities Mortgage Debentures Current Liabilities Short-term borrowings Accounts payable Taxation TOTAL EQUITY AND LIABILITIES 1,500,000.00 900,000.00 600,000.00 1,050,000.00 1,050,000.00 450,000.00 150,000.00 195,000.00 105,000.00 3,000,000.00 1,470,000.00 900,000.00 570,000.00 1,080,000.00 1,080,000.00 513,000.00 165,000.00 202,500.00 145,500.00 3,063,000.00 Dee Chi Ltd Statement of profit or loss & other comprehensive income for the year ended 31 December 2018 NOTES 2018 Cost of Sales Gross Profit Other operating income Interest income Gross operating income Operating expenses Administration and selling expenses Depreciation Operating profit before interest and taxation 4.500.000.00 3.832 500 00) 67 500 00 22 500 00 22 500 00 690.00000 1285 000.00 135.00000 150,000.00 05.000.00 105.000.00 300 000 00 (120.000,00 180,000.00 (150,000.00 30,000.00 Interest expense Net profit before taxation Net profit attributable to ordinary shareholders Dividends Retained profit/loss) for the year Retained profit beginning of the year RETAINED PROFIT - END OF THE YEAR 600,000.00 Additional Information Times interest earned Dividends per share Earnings per share Market price per share 2017: 35 times 2017: 15.3 2017: 175 2017: 150 2018: 180c You are required to: 3.1 Calculate the current and acid-test ratios for 2018 and 2017 and comment 3.2 Calculate three financial structure ratios for 2018 and 2017 and comment. 10 marks [10 marks] 3.3 Calculate the earnings and dividend yields for 2018 3.4 Define then discuss why each of this term is important is important to consider when analyzing the financial statements of a company 16 marts 3.4.1 Global economy 3.4.2 National economy 3.4.3 The industry