Answered step by step

Verified Expert Solution

Question

1 Approved Answer

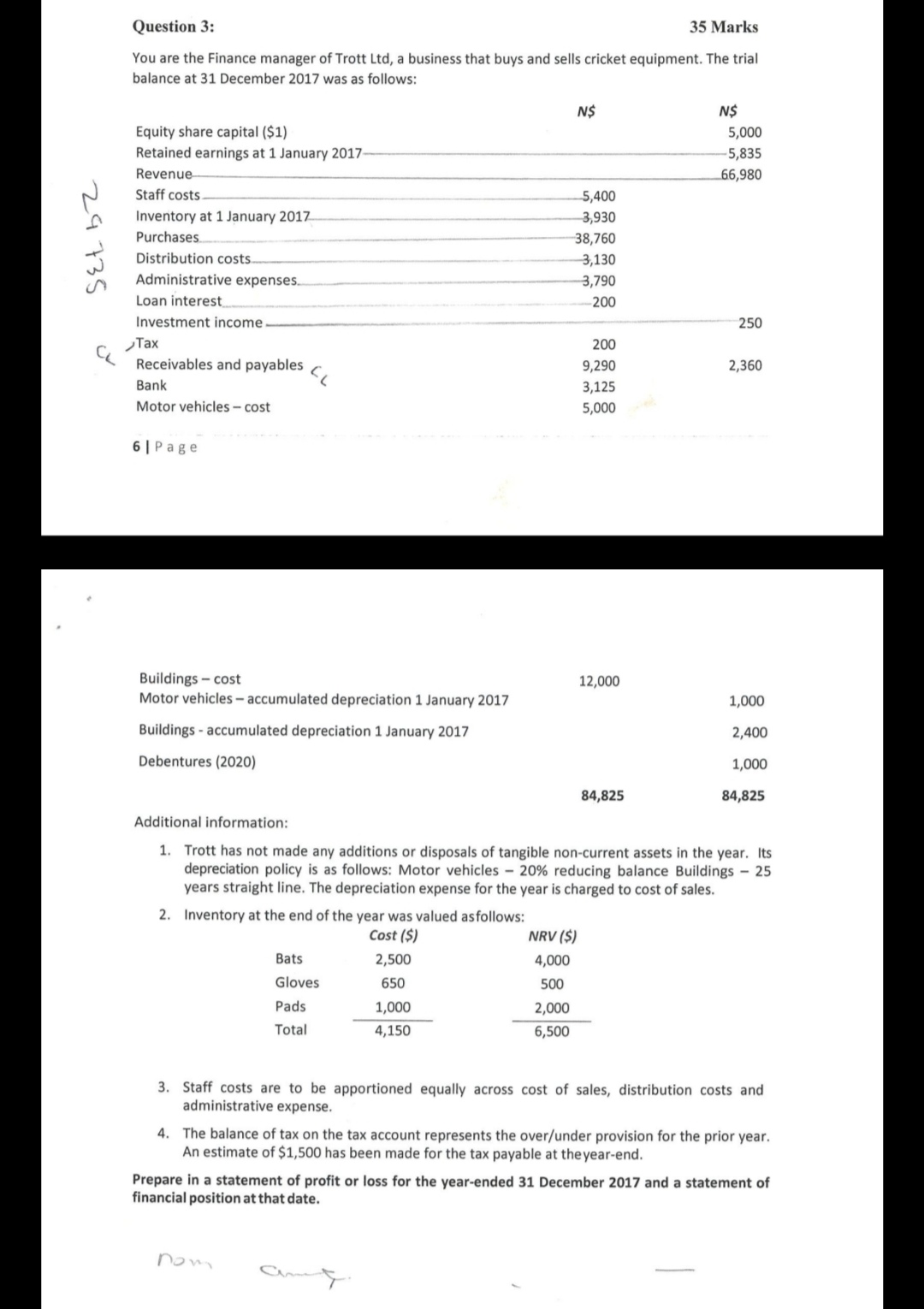

Question 3: 35 Marks You are the Finance manager of Trott Ltd, a business that buys and sells cricket equipment. The trial balance at

Question 3: 35 Marks You are the Finance manager of Trott Ltd, a business that buys and sells cricket equipment. The trial balance at 31 December 2017 was as follows: 29735 Equity share capital ($1) N$ N$ 5,000 -5,835 66,980 5,400 3,930 38,760 3,130 3,790 200 250 200 9,290 2,360 "L 3,125 5,000 Retained earnings at 1 January 2017 Revenue Staff costs. Inventory at 1 January 2017 Purchases Distribution costs. Administrative expenses. Loan interest Investment income. Tax Receivables and payables Bank Motor vehicles-cost 6 Page Buildings cost 12,000 Motor vehicles accumulated depreciation 1 January 2017 1,000 Buildings accumulated depreciation 1 January 2017 2,400 Debentures (2020) 1,000 84,825 84,825 Additional information: 1. Trott has not made any additions or disposals of tangible non-current assets in the year. Its depreciation policy is as follows: Motor vehicles -20% reducing balance Buildings - 25 years straight line. The depreciation expense for the year is charged to cost of sales. 2. Inventory at the end of the year was valued as follows: Cost ($) 2,500 Bats NRV ($) 4,000 Gloves 650 500 Pads 1,000 2,000 Total 4,150 6,500 3. Staff costs are to be apportioned equally across cost of sales, distribution costs and administrative expense. 4. The balance of tax on the tax account represents the over/under provision for the prior year. An estimate of $1,500 has been made for the tax payable at the year-end. Prepare in a statement of profit or loss for the year-ended 31 December 2017 and a statement of financial position at that date. nom

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Trott Ltd Financial Statements for the Year Ended December 31 2017 Statement of Profit or Loss Descr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started