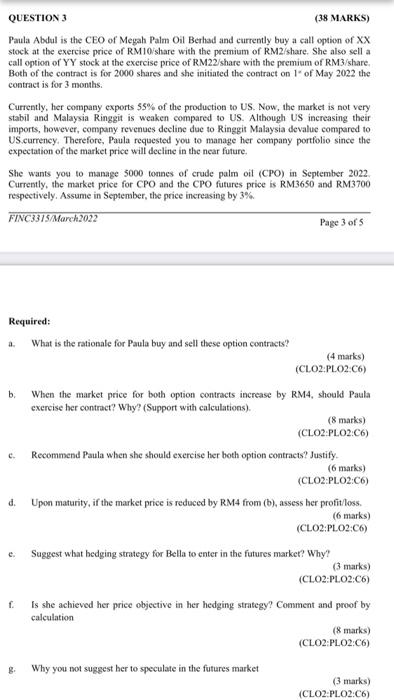

QUESTION 3 (38 MARKS) Paula Abdul is the CEO of Megah Palm Oil Berhad and currently buy a call option of XX stock at the exercise price of RM10/share with the premium of RM2/share. She also sell a call option of YY stock at the exercise price of RM22/share with the premium of RM3/share. Both of the contract is for 2000 shares and she initiated the contract on 1" of May 2022 the contract is for 3 months. Currently, her company exports 55% of the production to US. Now, the market is not very stabil and Malaysia Ringgit is weaken compared to US. Although US increasing their imports, however, company revenues decline due to Ringgit Malaysia devalue compared to US currency. Therefore, Paula requested you to manage her company portfolio since the expectation of the market price will decline in the near future. She wants you to manage 5000 tonnes of crude palm oil (CPO) in September 2022. Currently, the market price for CPO and the CPO futures price is RM3650 and RM3700 respectively. Assume in September, the price increasing by 3% FINC3315/March2022 Page 3 of 5 Required: a. What is the rationale for Paula buy and sell these option contracts? (4 marks) (CLO2:PLO2:C6) b. When the market price for both option contracts increase by RM4, should Paula exercise her contract? Why? (Support with calculations). (8 marks) (CLO2:PLO2:C6) c. Recommend Paula when she should exercise her both option contracts? Justify. (6 marks) (CLO2:PLO2:C6) d. Upon maturity, if the market price is reduced by RM4 from (b), assess her profit/loss. (6 marks) (CLO2:PLO2:C6) e. Suggest what hedging strategy for Bella to enter in the futures market? Why? (3 marks) (CLO2:PLO2:C6) f. Is she achieved her price objective in her hedging strategy? Comment and proof by calculation (8 marks) (CLO2:PLO2 Why you not suggest her to speculate in the futures market (3 marks) (CLO2:PLO2:C6) g. QUESTION 3 (38 MARKS) Paula Abdul is the CEO of Megah Palm Oil Berhad and currently buy a call option of XX stock at the exercise price of RM10/share with the premium of RM2/share. She also sell a call option of YY stock at the exercise price of RM22/share with the premium of RM3/share. Both of the contract is for 2000 shares and she initiated the contract on 1" of May 2022 the contract is for 3 months. Currently, her company exports 55% of the production to US. Now, the market is not very stabil and Malaysia Ringgit is weaken compared to US. Although US increasing their imports, however, company revenues decline due to Ringgit Malaysia devalue compared to US currency. Therefore, Paula requested you to manage her company portfolio since the expectation of the market price will decline in the near future. She wants you to manage 5000 tonnes of crude palm oil (CPO) in September 2022. Currently, the market price for CPO and the CPO futures price is RM3650 and RM3700 respectively. Assume in September, the price increasing by 3% FINC3315/March2022 Page 3 of 5 Required: a. What is the rationale for Paula buy and sell these option contracts? (4 marks) (CLO2:PLO2:C6) b. When the market price for both option contracts increase by RM4, should Paula exercise her contract? Why? (Support with calculations). (8 marks) (CLO2:PLO2:C6) c. Recommend Paula when she should exercise her both option contracts? Justify. (6 marks) (CLO2:PLO2:C6) d. Upon maturity, if the market price is reduced by RM4 from (b), assess her profit/loss. (6 marks) (CLO2:PLO2:C6) e. Suggest what hedging strategy for Bella to enter in the futures market? Why? (3 marks) (CLO2:PLO2:C6) f. Is she achieved her price objective in her hedging strategy? Comment and proof by calculation (8 marks) (CLO2:PLO2 Why you not suggest her to speculate in the futures market (3 marks) (CLO2:PLO2:C6) g