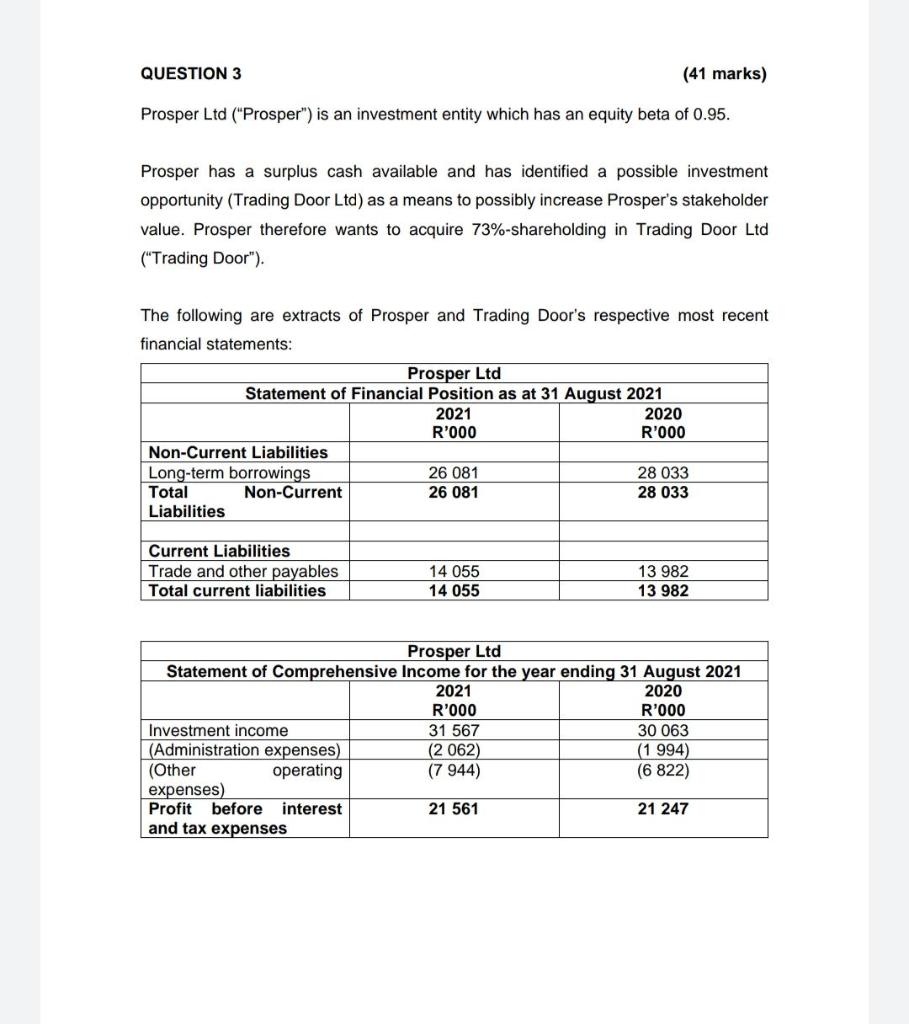

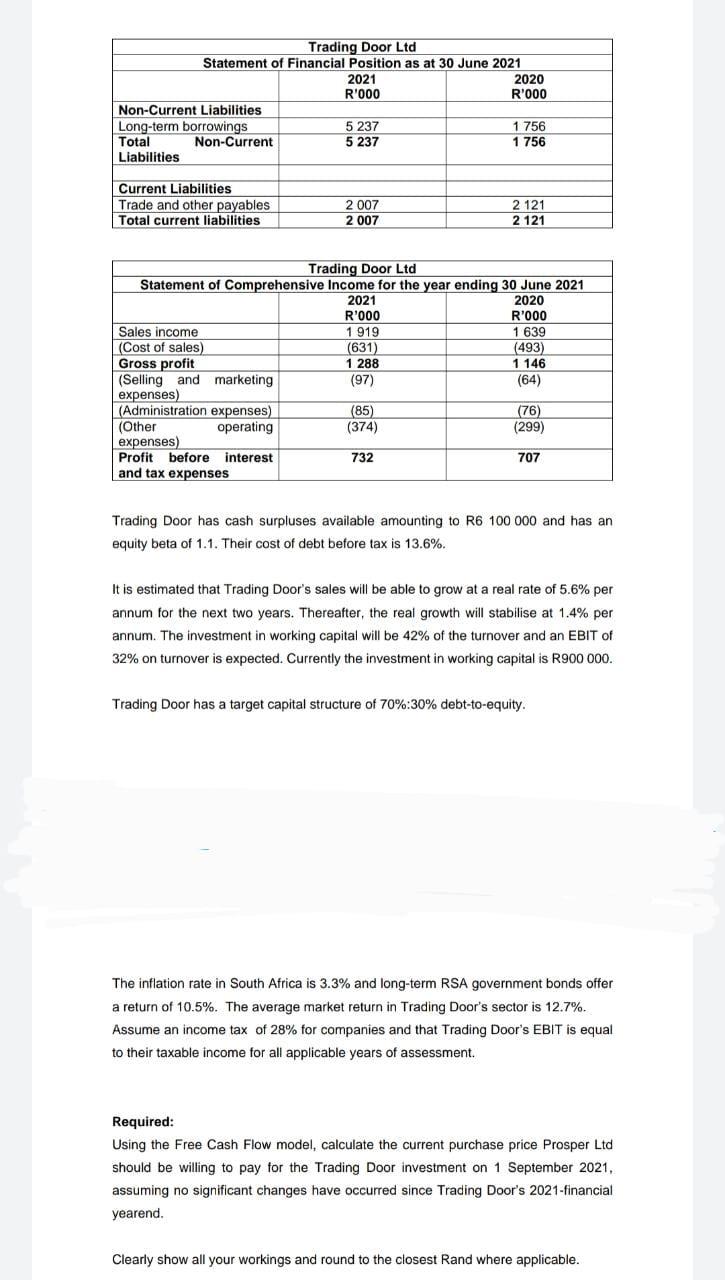

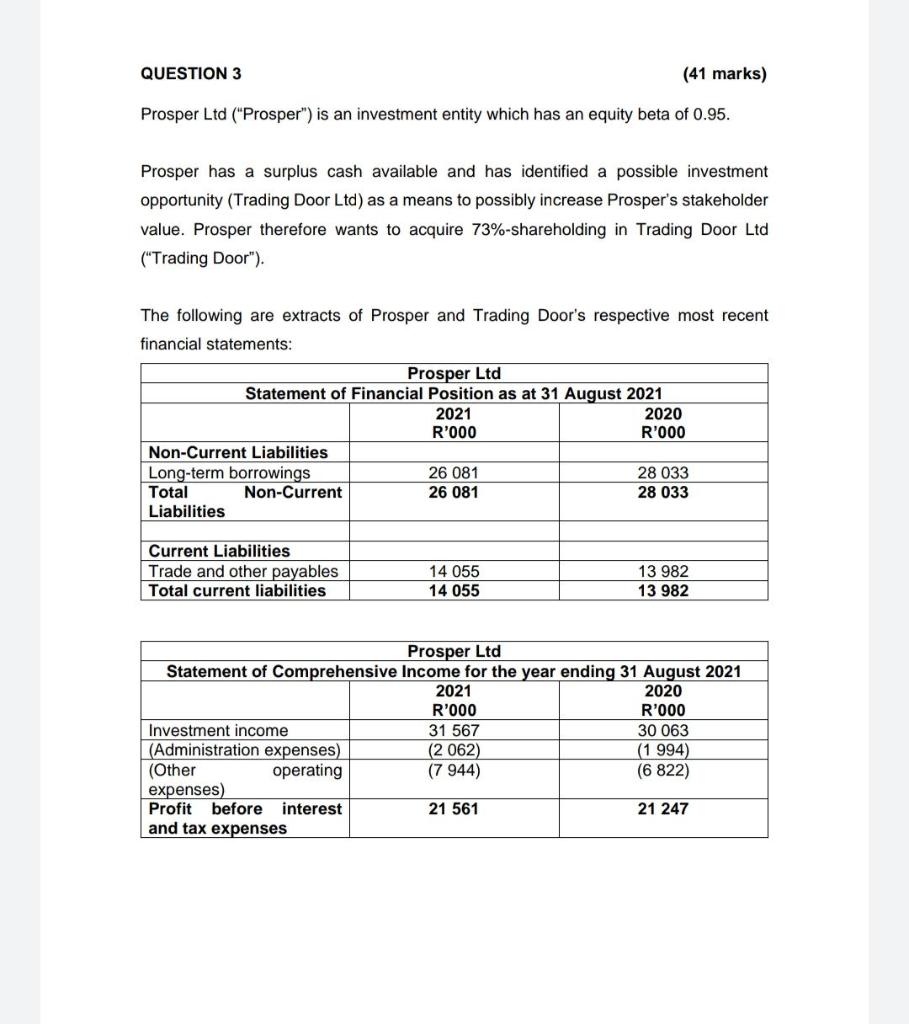

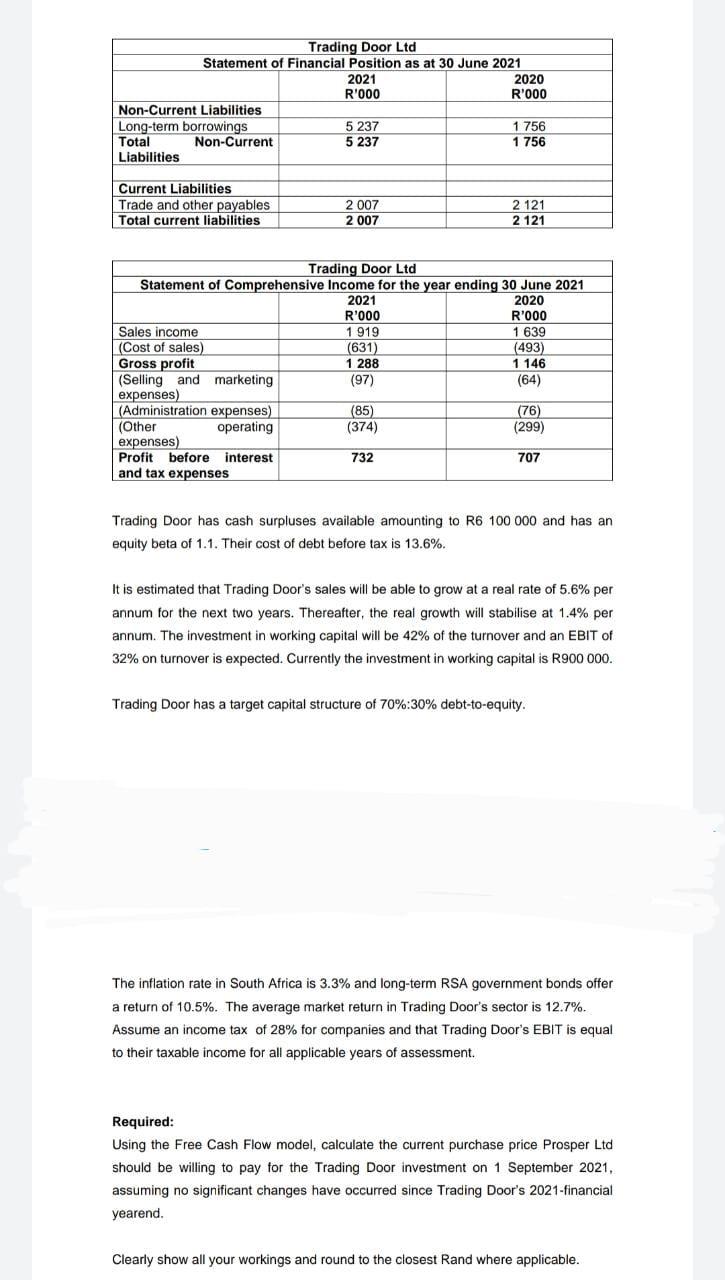

QUESTION 3 (41 marks) Prosper Ltd ("Prosper") is an investment entity which has an equity beta of 0.95. Prosper has a surplus cash available and has identified a possible investment opportunity (Trading Door Ltd) as a means to possibly increase Prosper's stakeholder value. Prosper therefore wants to acquire 73%-shareholding in Trading Door Ltd ("Trading Door"). The following are extracts of Prosper and Trading Door's respective most recent financial statements: Prosper Ltd Statement of Financial Position as at 31 August 2021 2021 2020 R'000 R'000 Non-Current Liabilities Long-term borrowings 26 081 28 033 Total Non-Current 26 081 28 033 Liabilities Current Liabilities Trade and other payables Total current liabilities 14 055 14 055 13 982 13 982 Prosper Ltd Statement of Comprehensive Income for the year ending 31 August 2021 2021 2020 R'000 R'000 Investment income 31 567 30 063 (Administration expenses) (2 062) (1 994) (Other operating (7 944) (6 822) expenses) Profit before interest 21 561 21 247 and tax expenses Trading Door Ltd Statement of Financial Position as at 30 June 2021 2021 2020 R'000 R'000 Non-Current Liabilities Long-term borrowings 5 237 1 756 Total Non-Current 5 237 1 756 Liabilities Current Liabilities Trade and other payables Total current liabilities 2007 2007 2 121 2 121 Trading Door Ltd Statement of Comprehensive Income for the year ending 30 June 2021 2021 2020 R'000 R'000 Sales income 1 919 1 639 (Cost of sales) (631) (493) Gross profit 1 288 | 146 (Selling and marketing (97) (64) expenses) (Administration expenses) (85) (76) Other (Other operating (374) (299) expenses) 732 707 Profit before interest and tax expenses Trading Door has cash surpluses available amounting to R6 100 000 and has an equity beta of 1.1. Their cost of debt before tax is 13.6%. It is estimated that Trading Door's sales will be able to grow at a real rate of 5.6% per annum for the next two years. Thereafter, the real growth will stabilise at 1.4% per annum. The investment in working capital will be 42% of the turnover and an EBIT of 32% on turnover is expected. Currently the investment in working capital is R900 000. Trading Door has a target capital structure of 70%:30% debt-to-equity. The inflation rate in South Africa is 3.3% and long-term RSA government bonds offer a return of 10.5%. The average market return in Trading Door's sector is 12.7%. Assume an income tax of 28% for companies and that Trading Door's EBIT is equal to their taxable income for all applicable years of assessment. Required: Using the Free Cash Flow model, calculate the current purchase price Prosper Ltd should be willing to pay for the Trading Door investment on 1 September 2021, assuming no significant changes have occurred since Trading Door's 2021-financial yearend. Clearly show all your workings and round to the closest Rand where applicable. QUESTION 3 (41 marks) Prosper Ltd ("Prosper") is an investment entity which has an equity beta of 0.95. Prosper has a surplus cash available and has identified a possible investment opportunity (Trading Door Ltd) as a means to possibly increase Prosper's stakeholder value. Prosper therefore wants to acquire 73%-shareholding in Trading Door Ltd ("Trading Door"). The following are extracts of Prosper and Trading Door's respective most recent financial statements: Prosper Ltd Statement of Financial Position as at 31 August 2021 2021 2020 R'000 R'000 Non-Current Liabilities Long-term borrowings 26 081 28 033 Total Non-Current 26 081 28 033 Liabilities Current Liabilities Trade and other payables Total current liabilities 14 055 14 055 13 982 13 982 Prosper Ltd Statement of Comprehensive Income for the year ending 31 August 2021 2021 2020 R'000 R'000 Investment income 31 567 30 063 (Administration expenses) (2 062) (1 994) (Other operating (7 944) (6 822) expenses) Profit before interest 21 561 21 247 and tax expenses Trading Door Ltd Statement of Financial Position as at 30 June 2021 2021 2020 R'000 R'000 Non-Current Liabilities Long-term borrowings 5 237 1 756 Total Non-Current 5 237 1 756 Liabilities Current Liabilities Trade and other payables Total current liabilities 2007 2007 2 121 2 121 Trading Door Ltd Statement of Comprehensive Income for the year ending 30 June 2021 2021 2020 R'000 R'000 Sales income 1 919 1 639 (Cost of sales) (631) (493) Gross profit 1 288 | 146 (Selling and marketing (97) (64) expenses) (Administration expenses) (85) (76) Other (Other operating (374) (299) expenses) 732 707 Profit before interest and tax expenses Trading Door has cash surpluses available amounting to R6 100 000 and has an equity beta of 1.1. Their cost of debt before tax is 13.6%. It is estimated that Trading Door's sales will be able to grow at a real rate of 5.6% per annum for the next two years. Thereafter, the real growth will stabilise at 1.4% per annum. The investment in working capital will be 42% of the turnover and an EBIT of 32% on turnover is expected. Currently the investment in working capital is R900 000. Trading Door has a target capital structure of 70%:30% debt-to-equity. The inflation rate in South Africa is 3.3% and long-term RSA government bonds offer a return of 10.5%. The average market return in Trading Door's sector is 12.7%. Assume an income tax of 28% for companies and that Trading Door's EBIT is equal to their taxable income for all applicable years of assessment. Required: Using the Free Cash Flow model, calculate the current purchase price Prosper Ltd should be willing to pay for the Trading Door investment on 1 September 2021, assuming no significant changes have occurred since Trading Door's 2021-financial yearend. Clearly show all your workings and round to the closest Rand where applicable