Question

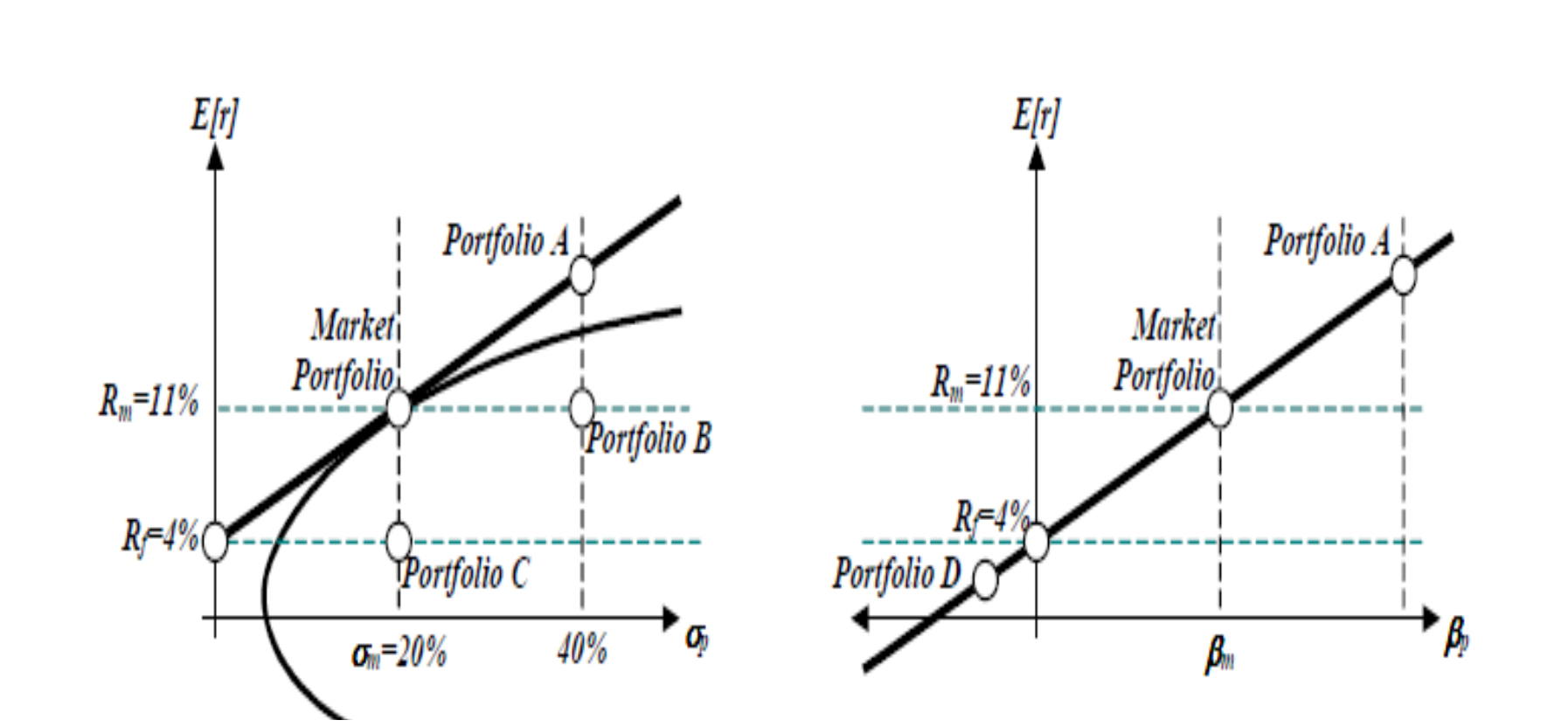

Question 3 (5 points 2.5+2.5) : Assume that the CAPM holds and refer to the graphs below. Circle the best answer for each question and

Question 3 (5 points 2.5+2.5) :

Assume that the CAPM holds and refer to the graphs below. Circle the best answer for each question and justify in 1-2 sentences (an unjustified answer will not receive any credit). When answering these questions please consider both graphs as proportional.

(A)

Portfolio A is comprised of a positive weight in the risk free asset and a positive weight in the market portfolio:

i) true

ii) false

iii) 10% in the risk free asset + 90% in risky asset iv) cant tell for information given

Justification:

(B) The beta of portfolio B is = ____ i) -1

ii) 0

iii) +1

iv) cant tell for information given

Justification:

Question 4 (10 points 2.5 each)

Circle 1 answer for each of the following questions. Explain in 1 or 2 sentences your choice (unjustified answers will not receive credit).

Which portfolio has the lowest risk?

A) A portfolio of t-bills

B) A portfolio of t-bonds

C) A portfolio of t-notes D) S&P 500 E) Gold only

Justification:

For a two-stock portfolio, the maximum reduction in risk occurs when the correlation coefficient between the two stocks is

A) 0

B) 0.5

C) -1

D) +1

Justification:

What is the cost of capital for a firm with market value of debt of $20 million and market value of equity of $80 million, given a cost of equity at 12% and a cost of debt at 5%? Assume no taxes.

A) 5.8%

B) 8.5%

C) 10.5%

D) 12%

Justification:

Given a beta of 1.3, Rf of 6% and market risk premium of 7%, the return expected is:

A) 22.9%

B) 13.3%

C) 14.2%

D) 15.1%

Justification:

E[V] E[v] Portfolio 4 Portfolio 4 | Market Portfolio Market Portfolio R,=11% Ry=11% Portfolio B R=4% R=4% Portfolio D Portfolio C 1 0=20% 40% 0 Bu B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started