Answered step by step

Verified Expert Solution

Question

1 Approved Answer

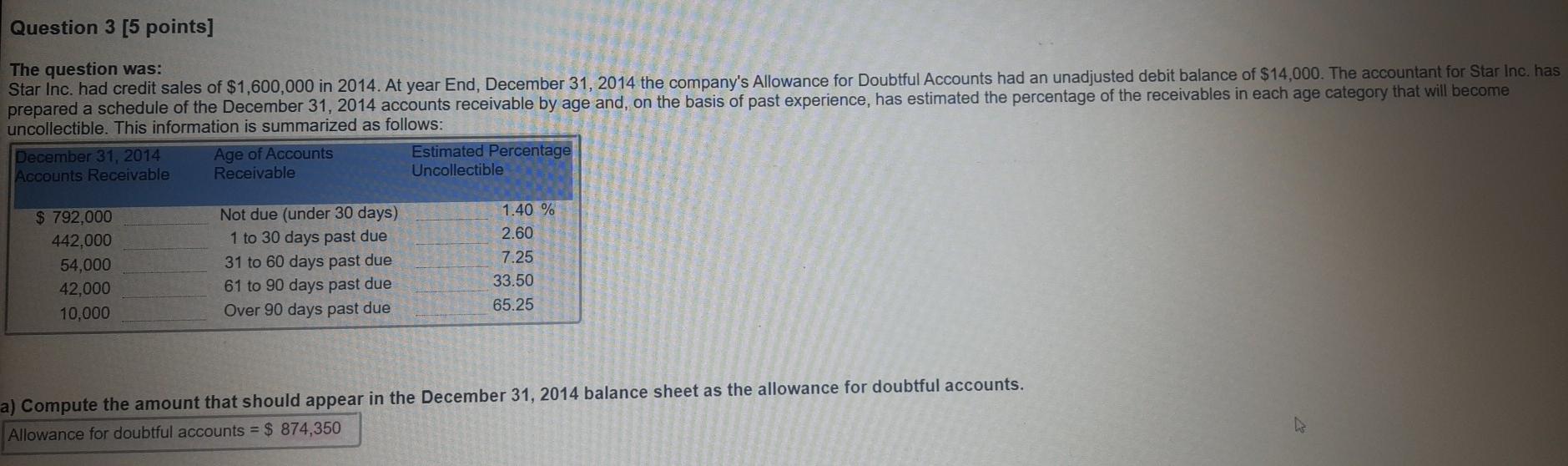

Question 3 [5 points] The question was: Star Inc. had credit sales of $1,600,000 in 2014. At year End, December 31, 2014 the company's Allowance

Question 3 [5 points] The question was: Star Inc. had credit sales of $1,600,000 in 2014. At year End, December 31, 2014 the company's Allowance for Doubtful Accounts had an unadjusted debit balance of $14,000. The accountant for Star Inc. has prepared a schedule of the December 31, 2014 accounts receivable by age and, on the basis of past experience, has estimated the percentage of the receivables in each age category that will become uncollectible. This information is summarized as follows: December 31, 2014 Age of Accounts Estimated Percentage Accounts Receivable Receivable Uncollectible $ 792,000 442,000 54,000 42,000 10,000 Not due (under 30 days) 1 to 30 days past due 31 to 60 days past due 61 to 90 days past due Over 90 days past due 1.40 % 2.60 7.25 33.50 65.25 a) Compute the amount that should appear in the December 31, 2014 balance sheet as the allowance for doubtful accounts. Allowance for doubtful accounts = $ 874,350

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started