Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 6 ( 1 point ) Saved Lakeman Ltd in Alberta paid a $ 2 8 , 0 0 0 death benefit to the

Question point

Saved

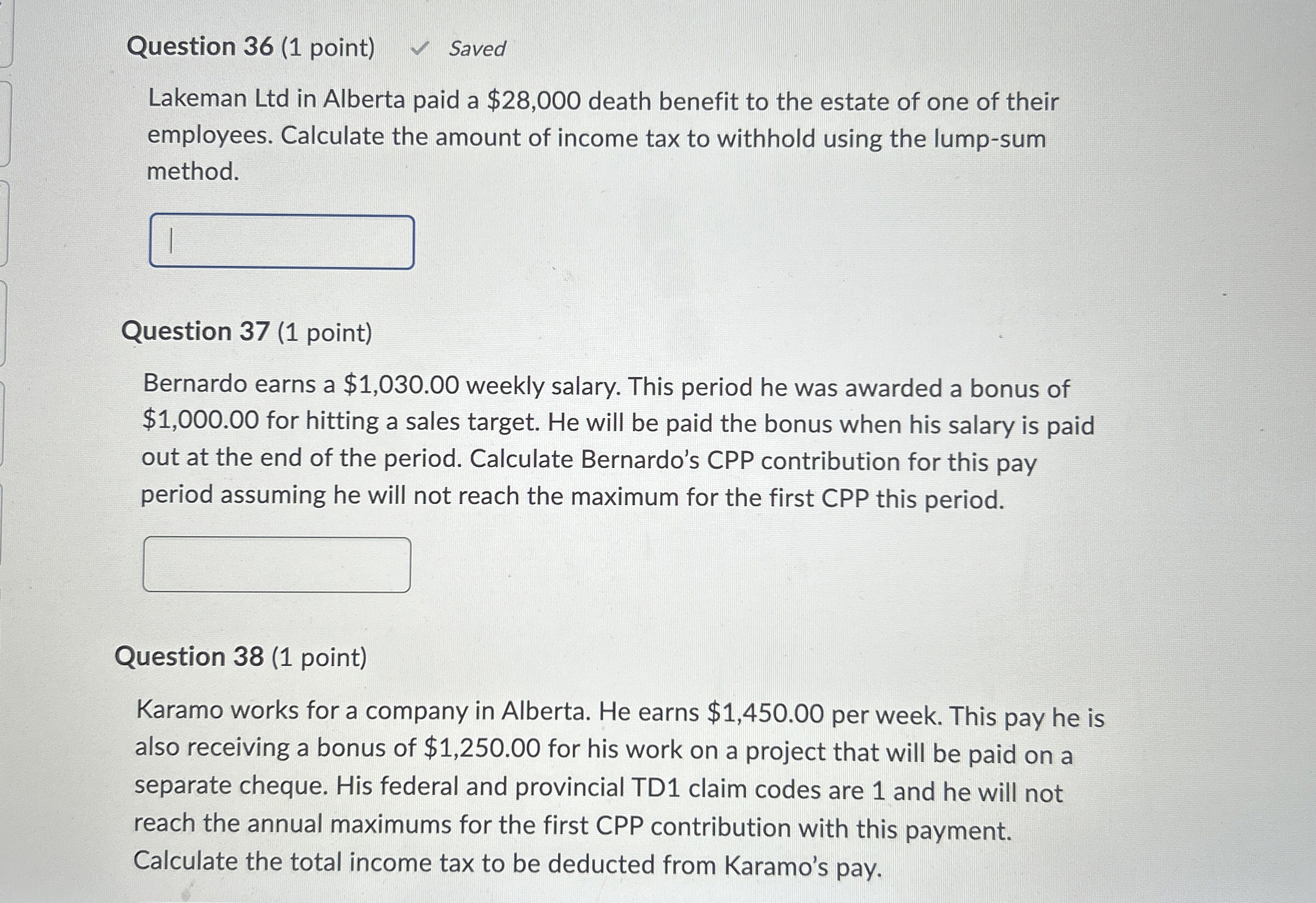

Lakeman Ltd in Alberta paid a $ death benefit to the estate of one of their employees. Calculate the amount of income tax to withhold using the lumpsum method.

Question point

Bernardo earns a $ weekly salary. This period he was awarded a bonus of $ for hitting a sales target. He will be paid the bonus when his salary is paid out at the end of the period. Calculate Bernardo's CPP contribution for this pay period assuming he will not reach the maximum for the first CPP this period.

Question point

Karamo works for a company in Alberta. He earns $ per week. This pay he is also receiving a bonus of $ for his work on a project that will be paid on a separate cheque. His federal and provincial TD claim codes are and he will not reach the annual maximums for the first CPP contribution with this payment. Calculate the total income tax to be deducted from Karamo's pay.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started