Answered step by step

Verified Expert Solution

Question

1 Approved Answer

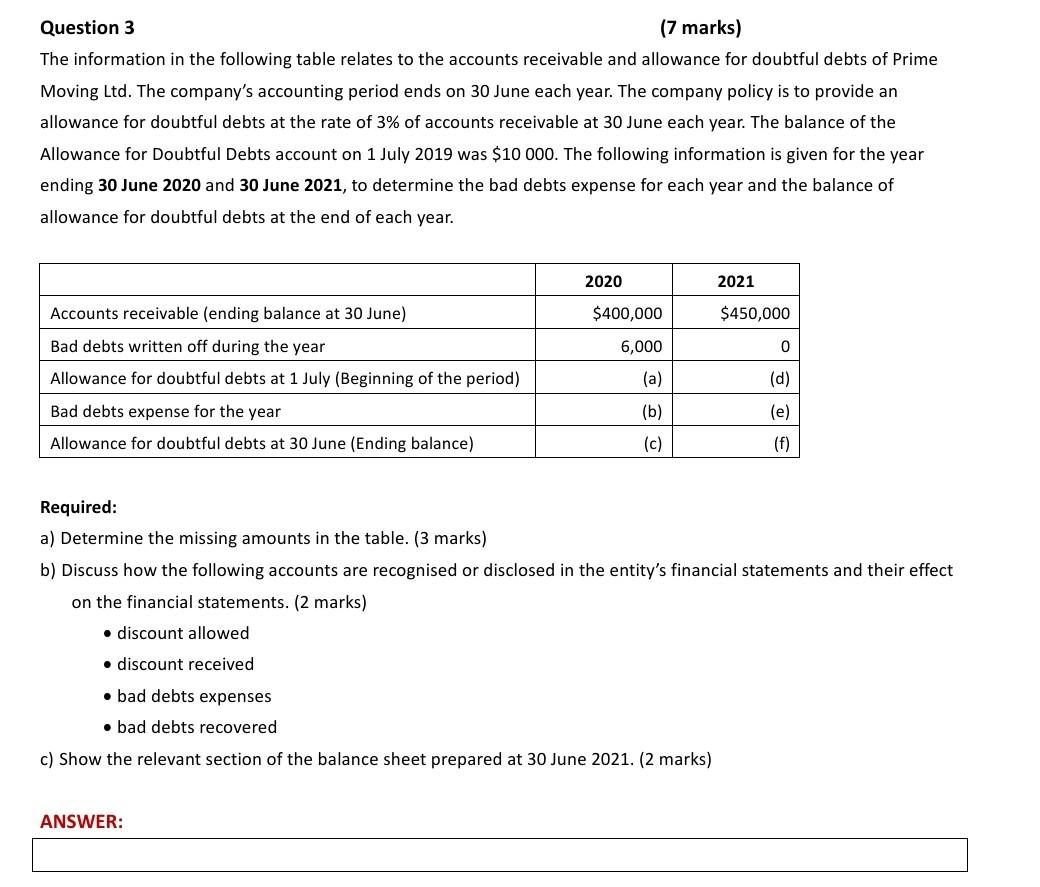

Question 3 (7 marks) The information in the following table relates to the accounts receivable and allowance for doubtful debts of Prime Moving Ltd. The

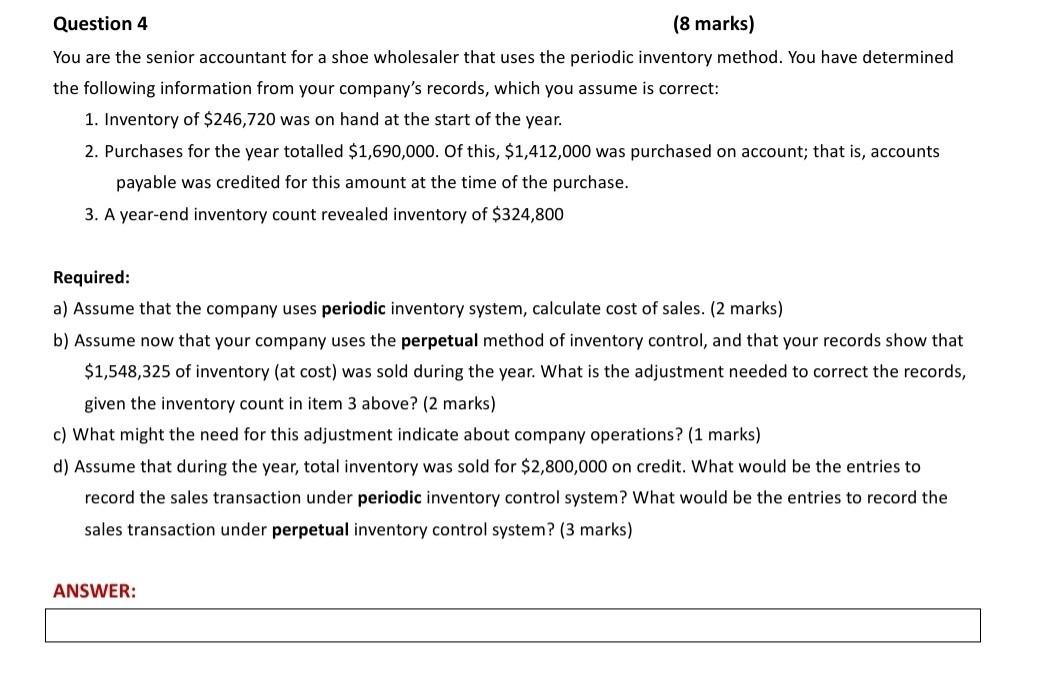

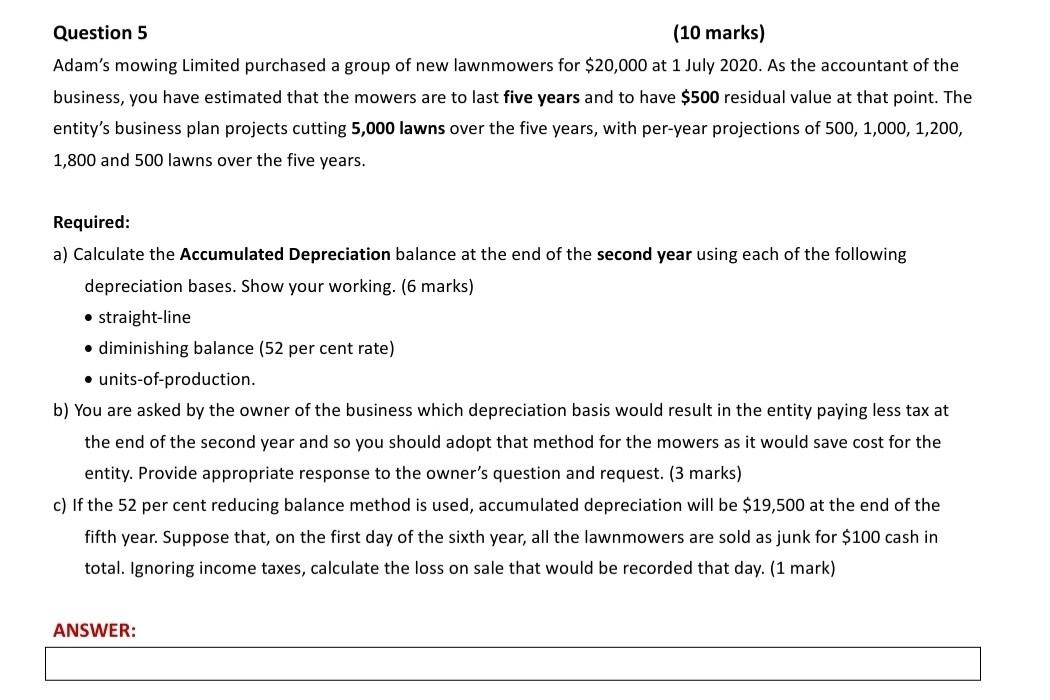

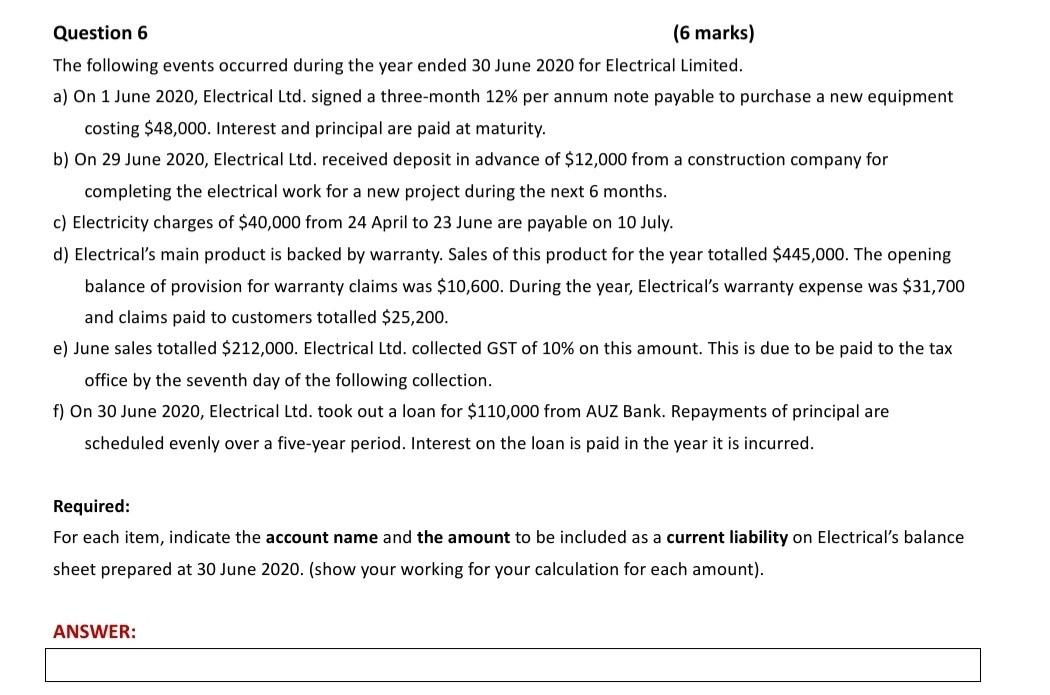

Question 3 (7 marks) The information in the following table relates to the accounts receivable and allowance for doubtful debts of Prime Moving Ltd. The company's accounting period ends on 30 June each year. The company policy is to provide an allowance for doubtful debts at the rate of 3% of accounts receivable at 30 June each year. The balance of the Allowance for Doubtful Debts account on 1 July 2019 was $10 000. The following information is given for the year ending 30 June 2020 and 30 June 2021, to determine the bad debts expense for each year and the balance of allowance for doubtful debts at the end of each year. 2020 2021 Accounts receivable (ending balance at 30 June) $400,000 $450,000 Bad debts written off during the year 6,000 0 Allowance for doubtful debts at 1 July (Beginning of the period) (a) (d) Bad debts expense for the year (b) (e) Allowance for doubtful debts at 30 June (Ending balance) (c) (f) Required: a) Determine the missing amounts in the table. (3 marks) b) Discuss how the following accounts are recognised or disclosed in the entity's financial statements and their effect on the financial statements. (2 marks) discount allowed discount received bad debts expenses bad debts recovered c) Show the relevant section of the balance sheet prepared at 30 June 2021. (2 marks) ANSWER: Question 4 (8 marks) You are the senior accountant for a shoe wholesaler that uses the periodic inventory method. You have determined the following information from your company's records, which you assume is correct: 1. Inventory of $246,720 was on hand at the start of the year. 2. Purchases for the year totalled $1,690,000. Of this, $1,412,000 was purchased on account; that is, accounts payable was credited for this amount at the time of the purchase. 3. A year-end inventory count revealed inventory of $324,800 Required: a) Assume that the company uses periodic inventory system, calculate cost of sales. (2 marks) b) Assume now that your company uses the perpetual method of inventory control, and that your records show that $1,548,325 of inventory (at cost) was sold during the year. What is the adjustment needed to correct the records, given the inventory count in item 3 above? (2 marks) c) What might the need for this adjustment indicate about company operations? (1 marks) d) Assume that during the year, total inventory was sold for $2,800,000 on credit. What would be the entries to record the sales transaction under periodic inventory control system? What would be the entries to record the sales transaction under perpetual inventory control system? (3 marks) ANSWER: Question 5 (10 marks) Adam's mowing Limited purchased a group of new lawnmowers for $20,000 at 1 July 2020. As the accountant of the business, you have estimated that the mowers are to last five years and to have $500 residual value at that point. The entity's business plan projects cutting 5,000 lawns over the five years, with per-year projections of 500, 1,000,1,200, 1,800 and 500 lawns over the five years. Required: a) Calculate the Accumulated Depreciation balance at the end of the second year using each of the following depreciation bases. Show your working. (6 marks) straight-line diminishing balance (52 per cent rate) units-of-production. b) You are asked by the owner of the business which depreciation basis would result in the entity paying less tax at the end of the second year and so you should adopt that method for the mowers as it would save cost for the entity. Provide appropriate response to the owner's question and request. (3 marks) c) If the 52 per cent reducing balance method is used, accumulated depreciation will be $19,500 at the end of the fifth year. Suppose that, on the first day of the sixth year, all the lawnmowers are sold as junk for $100 cash in total. Ignoring income taxes, calculate the loss on sale that would be recorded that day. (1 mark) ANSWER: Question 6 (6 marks) The following events occurred during the year ended 30 June 2020 for Electrical Limited. a) On 1 June 2020, Electrical Ltd. signed a three-month 12% per annum note payable to purchase a new equipment costing $48,000. Interest and principal are paid at maturity. b) On 29 June 2020, Electrical Ltd. received deposit in advance of $12,000 from a construction company for completing the electrical work for a new project during the next 6 months. c) Electricity charges of $40,000 from 24 April to 23 June are payable on 10 July. d) Electrical's main product is backed by warranty. Sales of this product for the year totalled $445,000. The opening balance of provision for warranty claims was $10,600. During the year, Electrical's warranty expense was $31,700 and claims paid to customers totalled $25,200. e) June sales totalled $212,000. Electrical Ltd. collected GST of 10% on this amount. This is due to be paid to the tax office by the seventh day of the following collection. f) On 30 June 2020, Electrical Ltd. took out a loan for $110,000 from AUZ Bank. Repayments of principal are scheduled evenly over a five-year period. Interest on the loan is paid in the year it is incurred. Required: For each item, indicate the account name and the amount to be included as a current liability on Electrical's balance sheet prepared at 30 June 2020. (show your working for your calculation for each amount)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started