Answered step by step

Verified Expert Solution

Question

1 Approved Answer

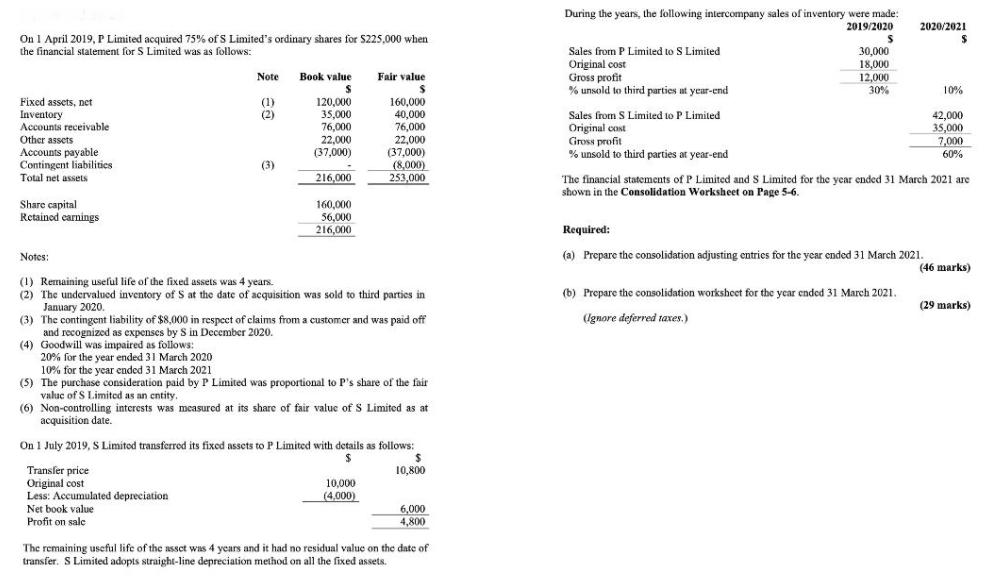

During the years, the following intercompany sales of inventory were made: 2019/2020 2020/2021 On 1 April 2019, P Limited acquired 75% of S Limited's

During the years, the following intercompany sales of inventory were made: 2019/2020 2020/2021 On 1 April 2019, P Limited acquired 75% of S Limited's ordinary shares for S225,000 when the financial statement for S Limited was as follows: Sales from P Limited to S Limited Original cost Gross profit % unsold to third parties at year-end 30,000 18,000 12,000 30% Note Book value Fair value 10% Fixed assets, net Inventory Accounts receivable (1) (2) 120,000 35,000 76,000 160,000 40,000 76,000 22,000 (37,000) Sales from S Limited to P Limited Original cost Gross profit % unsold to third parties at year-end 42,000 35,000 Other assets Accounts payable Contingent liabilitics Total net assets 22,000 (37,000) 7,000 60% (3) 216,000 (8,000) 253,000 The financial statements of P Limited and S Limited for the year ended 31 March 2021 are shown in the Consolidation Worksheet on Page 5-6. Share capital 160,000 56.000 Retained earnings 216,000 Required: Notes: (a) Prepare the consolidation adjusting entrics for the year ended 31 March 2021. (46 marks) (1) Remaining useful life of the fixed assets was 4 years. (2) The undervalued inventory of S at the date of acquisition was sold to third parties in January 2020. (3) The contingent liability of $8,000 in respect of claims from a customer and was paid off and recognized as expenses by S in December 2020. (4) Goodwill was impaired as follows: 20% for the year ended 31 March 2020 10% for the year ended 31 March 2021 (5) The purchase consideration paid by P Limited was proportional to P's share of the fair valuc of S Limited as an entity. (6) Non-controlling interests was measured at its share of fair valuc of S Limited as at acquisition date. (b) Prepare the consolidation worksheet for the year ended 31 March 2021. (29 marks) Ugnore deferred taxes.) On 1 July 2019, S Limitod transferred its fixed assets to P Limited with details as follows: Transfer price Original cost Less: Accumulated depreciation Net book value Profit on sale 10,800 10,000 (4,000) 6,000 4,800 The remaining useful life of the asset was 4 years and it had no residual value on the date of transfer. S Limited adopts straight-line depreciation method on all the fixed assets.

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a CONSOLIDATION ENTRIES DEBIT AMOUNTS CREDIT AMOUNTS Investment in S Ltd 225000 To Bank 225000 Being amount invested in acquiring 75 Controlling interest in S Ltd Goodwill account 35250 Fixed Assets 4...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started