Answered step by step

Verified Expert Solution

Question

1 Approved Answer

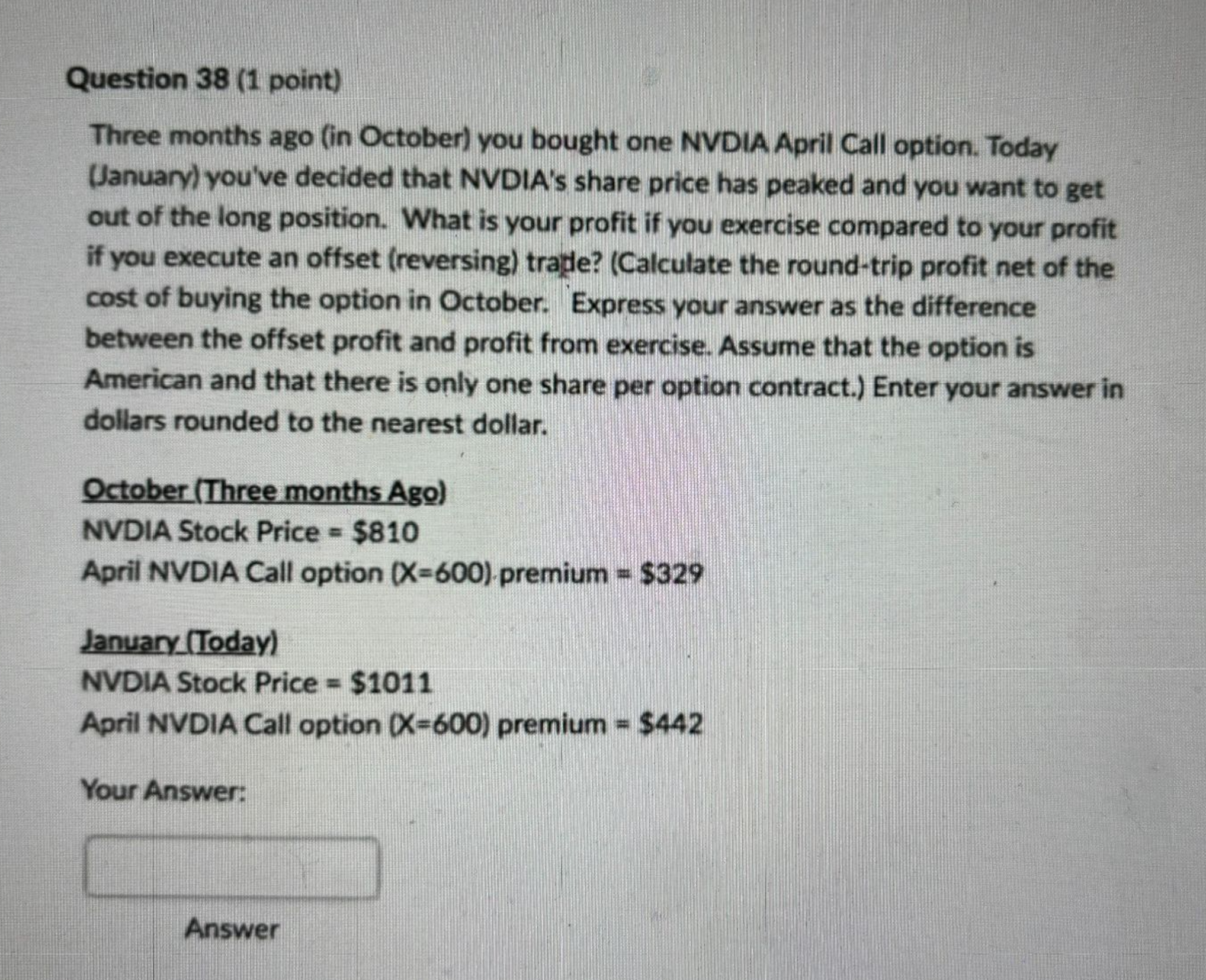

Question 3 8 ( 1 point ) Three months ago ( in October ) you bought one NVDIA April Call option. Today ( January )

Question point

Three months ago in October you bought one NVDIA April Call option. Today

January you've decided that NVDIA's share price has peaked and you want to get

out of the long position. What is your profit if you exercise compared to your profit

if you execute an offset reversing traple? Calculate the roundtrip profit net of the

cost of buying the option in October. Express your answer as the difference

between the offset profit and profit from exercise. Assume that the option is

American and that there is only one share per option contract. Enter your answer in

dollars rounded to the nearest dollar.

October Three months Ago

NVDIA Stock Price $

April NVDIA Call option premium $

JanuaryToday

NVDIA Stock Price $

April NVDIA Call option premium $

Your Answer:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started