Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 A. A project involves initial expenditure of $120 000 .The annual net receipts for each of the first five years are estimated to

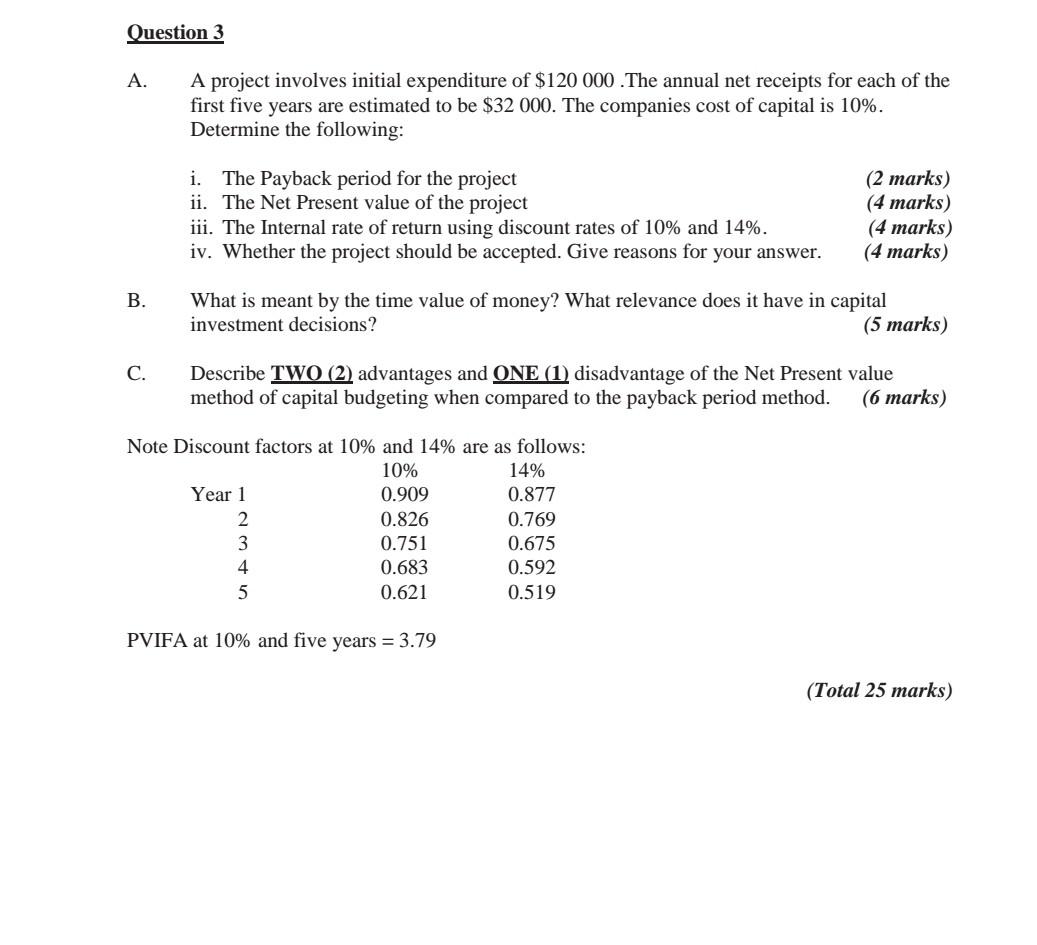

Question 3 A. A project involves initial expenditure of $120 000 .The annual net receipts for each of the first five years are estimated to be $32 000. The companies cost of capital is 10%. Determine the following: i. The Payback period for the project ii. The Net Present value of the project iii. The Internal rate of return using discount rates of 10% and 14%. iv. Whether the project should be accepted. Give reasons for your answer. (2 marks) (4 marks) (4 marks) (4 marks) B. What is meant by the time value of money? What relevance does it have in capital investment decisions? (5 marks) C. Describe TWO (2) advantages and ONE (1) disadvantage of the Net Present value method of capital budgeting when compared to the payback period method. (6 marks) Note Discount factors at 10% and 14% are as follows: 10% 14% Year 1 0.909 0.877 2 0.826 0.769 3 0.751 0.675 4 0.683 0.592 5 0.621 0.519 PVIFA at 10% and five years = 3.79 (Total 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started