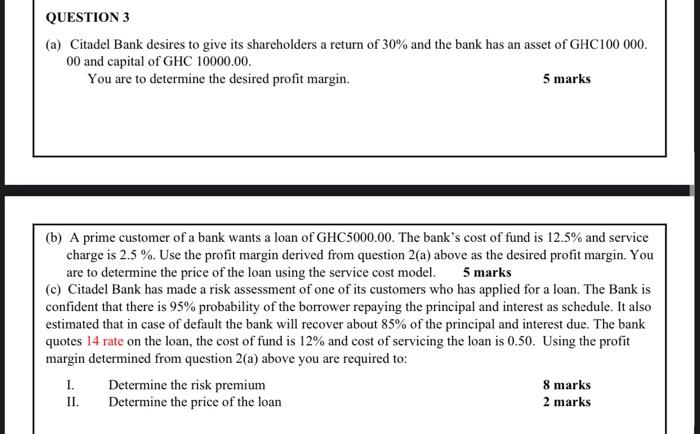

QUESTION 3 (a) Citadel Bank desires to give its shareholders a return of 30% and the bank has an asset of GHC100 000. 00 and capital of GHC 10000.00. You are to determine the desired profit margin. 5 marks (b) A prime customer of a bank wants a loan of GHC5000.00. The bank's cost of fund is 12.5% and service charge is 2.5 %. Use the profit margin derived from question 2(a) above as the desired profit margin. You are to determine the price of the loan using the service cost model. 5 marks (c) Citadel Bank has made a risk assessment of one of its customers who has applied for a loan. The Bank is confident that there is 95% probability of the borrower repaying the principal and interest as schedule. It also estimated that in case of default the bank will recover about 85% of the principal and interest due. The bank quotes 14 rate on the loan, the cost of fund is 12% and cost of servicing the loan is 0.50. Using the profit margin determined from question 2(a) above you are required to: 1. Determine the risk premium 8 marks II. Determine the price of the loan 2 marks QUESTION 3 (a) Citadel Bank desires to give its shareholders a return of 30% and the bank has an asset of GHC100 000. 00 and capital of GHC 10000.00. You are to determine the desired profit margin. 5 marks (b) A prime customer of a bank wants a loan of GHC5000.00. The bank's cost of fund is 12.5% and service charge is 2.5 %. Use the profit margin derived from question 2(a) above as the desired profit margin. You are to determine the price of the loan using the service cost model. 5 marks (c) Citadel Bank has made a risk assessment of one of its customers who has applied for a loan. The Bank is confident that there is 95% probability of the borrower repaying the principal and interest as schedule. It also estimated that in case of default the bank will recover about 85% of the principal and interest due. The bank quotes 14 rate on the loan, the cost of fund is 12% and cost of servicing the loan is 0.50. Using the profit margin determined from question 2(a) above you are required to: 1. Determine the risk premium 8 marks II. Determine the price of the loan 2 marks