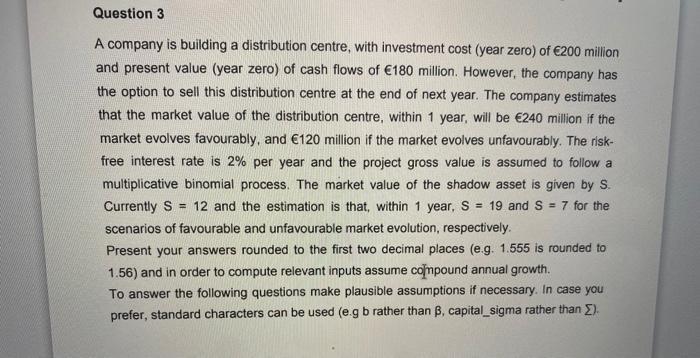

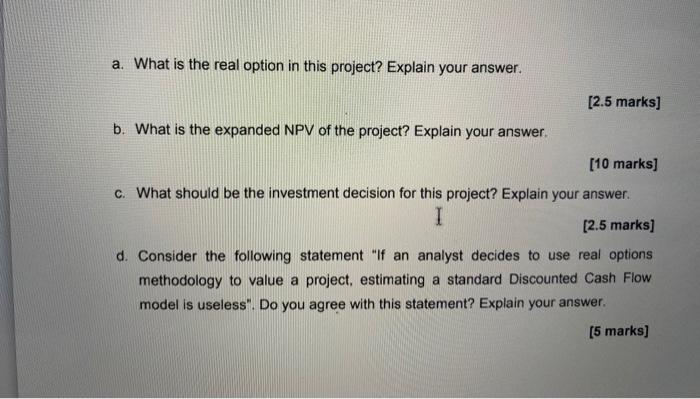

Question 3 A company is building a distribution centre, with investment cost (year zero) of 200 million and present value (year zero) of cash flows of 180 million. However, the company has the option to sell this distribution centre at the end of next year. The company estimates that the market value of the distribution centre, within 1 year, will be 240 million if the market evolves favourably, and 120 million if the market evolves unfavourably. The risk- free interest rate is 2% per year and the project gross value is assumed to follow a multiplicative binomial process. The market value of the shadow asset is given by S. Currently S = 12 and the estimation is that, within 1 year, S = 19 and S = 7 for the scenarios of favourable and unfavourable market evolution, respectively. Present your answers rounded to the first two decimal places (e.g. 1.555 is rounded to 1.56) and in order to compute relevant inputs assume compound annual growth. To answer the following questions make plausible assumptions if necessary. In case you prefer, standard characters can be used (e.gb rather than B, capital_sigma rather than ) a. What is the real option in this project? Explain your answer. [2.5 marks] b. What is the expanded NPV of the project? Explain your answer. [10 marks] C. What should be the investment decision for this project? Explain your answer. I [2.5 marks] d. Consider the following statement "If an analyst decides to use real options methodology to value a project, estimating a standard Discounted Cash Flow model is useless". Do you agree with this statement? Explain your answer. [5 marks] Question 3 A company is building a distribution centre, with investment cost (year zero) of 200 million and present value (year zero) of cash flows of 180 million. However, the company has the option to sell this distribution centre at the end of next year. The company estimates that the market value of the distribution centre, within 1 year, will be 240 million if the market evolves favourably, and 120 million if the market evolves unfavourably. The risk- free interest rate is 2% per year and the project gross value is assumed to follow a multiplicative binomial process. The market value of the shadow asset is given by S. Currently S = 12 and the estimation is that, within 1 year, S = 19 and S = 7 for the scenarios of favourable and unfavourable market evolution, respectively. Present your answers rounded to the first two decimal places (e.g. 1.555 is rounded to 1.56) and in order to compute relevant inputs assume compound annual growth. To answer the following questions make plausible assumptions if necessary. In case you prefer, standard characters can be used (e.gb rather than B, capital_sigma rather than ) a. What is the real option in this project? Explain your answer. [2.5 marks] b. What is the expanded NPV of the project? Explain your answer. [10 marks] C. What should be the investment decision for this project? Explain your answer. I [2.5 marks] d. Consider the following statement "If an analyst decides to use real options methodology to value a project, estimating a standard Discounted Cash Flow model is useless". Do you agree with this statement? Explain your answer. [5 marks]