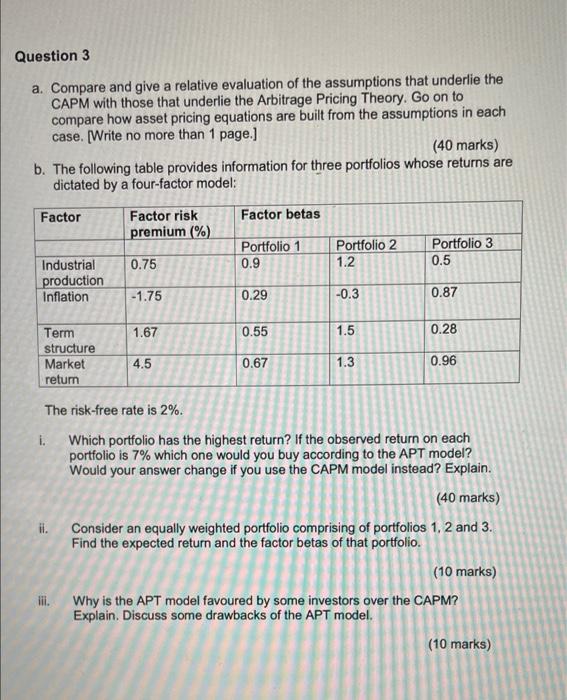

Question 3 a. Compare and give a relative evaluation of the assumptions that underlie the CAPM with those that underlie the Arbitrage Pricing Theory. Go on to compare how asset pricing equations are built from the assumptions in each case. [Write no more than 1 page.] (40 marks) b. The following table provides information for three portfolios whose returns are dictated by a four-factor model: Factor Factor risk Factor betas premium (%) Portfolio 1 Portfolio 2 1.2 Portfolio 3 0.5 Industrial 0.75 0.9 production Inflation -1.75 0.29 -0.3 0.87 Term 1.67 0.55 1.5 0.28 structure Market 4.5 0.67 1.3 0.96 return The risk-free rate is 2%. i. Which portfolio has the highest return? If the observed return on each portfolio is 7% which one would you buy according to the APT model? Would your answer change if you use the CAPM model instead? Explain. (40 marks) ii. Consider an equally weighted portfolio comprising of portfolios 1, 2 and 3. Find the expected return and the factor betas of that portfolio. (10 marks) iii. Why is the APT model favoured by some investors over the CAPM? Explain. Discuss some drawbacks of the APT model. (10 marks) Question 3 a. Compare and give a relative evaluation of the assumptions that underlie the CAPM with those that underlie the Arbitrage Pricing Theory. Go on to compare how asset pricing equations are built from the assumptions in each case. [Write no more than 1 page.] (40 marks) b. The following table provides information for three portfolios whose returns are dictated by a four-factor model: Factor Factor risk Factor betas premium (%) Portfolio 1 Portfolio 2 1.2 Portfolio 3 0.5 Industrial 0.75 0.9 production Inflation -1.75 0.29 -0.3 0.87 Term 1.67 0.55 1.5 0.28 structure Market 4.5 0.67 1.3 0.96 return The risk-free rate is 2%. i. Which portfolio has the highest return? If the observed return on each portfolio is 7% which one would you buy according to the APT model? Would your answer change if you use the CAPM model instead? Explain. (40 marks) ii. Consider an equally weighted portfolio comprising of portfolios 1, 2 and 3. Find the expected return and the factor betas of that portfolio. (10 marks) iii. Why is the APT model favoured by some investors over the CAPM? Explain. Discuss some drawbacks of the APT model. (10 marks)