Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 a) Consider a situation in which a manufacturing affiliate is selling to a distribution affiliate in another country. The relevant tax information, operating

Question 3

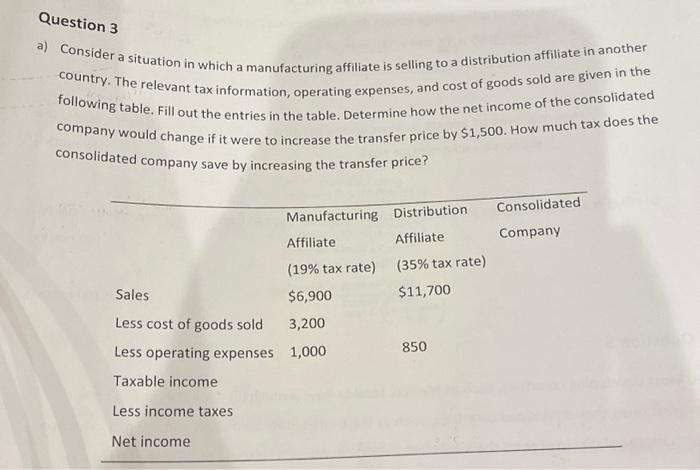

a) Consider a situation in which a manufacturing affiliate is selling to a distribution affiliate in another country. The relevant tax information, operating expenses, and cost of goods sold are given in the following table. Fill out the entries in the table. Determine how the net income of the consolidated company would change if it were to increase the transfer price by $1,500. How much tax does the consolidated company save by increasing the transfer price?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started