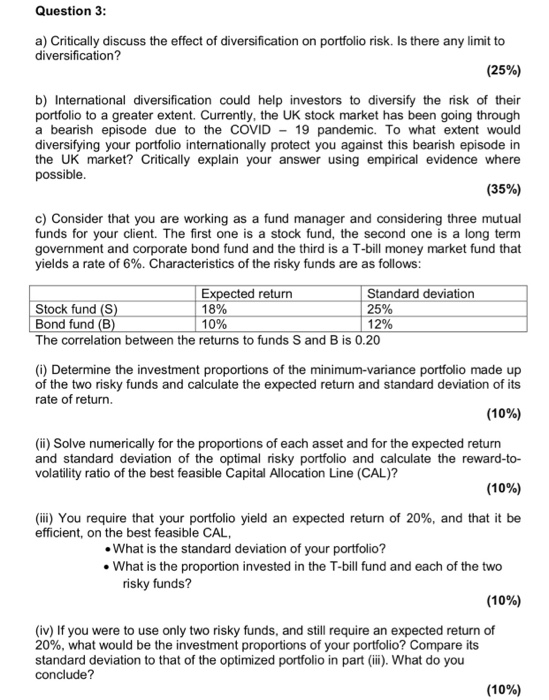

Question 3: a) Critically discuss the effect of diversification on portfolio risk. Is there any limit to diversification? (25%) b) International diversification could help investors to diversify the risk of their portfolio to a greater extent. Currently, the UK stock market has been going through a bearish episode due to the COVID - 19 pandemic. To what extent would diversifying your portfolio internationally protect you against this bearish episode in the UK market? Critically explain your answer using empirical evidence where possible. (35%) c) Consider that you are working as a fund manager and considering three mutual funds for your client. The first one is a stock fund, the second one is a long term government and corporate bond fund and the third is a T-bill money market fund that yields a rate of 6%. Characteristics of the risky funds are as follows: Expected return Standard deviation Stock fund (S) 18% 25% Bond fund (B) 10% 12% The correlation between the returns to funds S and B is 0.20 ) Determine the investment proportions of the minimum-variance portfolio made up of the two risky funds and calculate the expected return and standard deviation of its rate of return. (10%) (ii) Solve numerically for the proportions of each asset and for the expected return and standard deviation of the optimal risky portfolio and calculate the reward-to- volatility ratio of the best feasible Capital Allocation Line (CAL)? (10%) (iii) You require that your portfolio yield an expected return of 20%, and that it be efficient, on the best feasible CAL, What is the standard deviation of your portfolio? What is the proportion invested in the T-bill fund and each of the two risky funds? (10%) (iv) If you were to use only two risky funds, and still require an expected return of 20%, what would be the investment proportions of your portfolio? Compare its standard deviation to that of the optimized portfolio in part (ii). What do you conclude? (10%) Question 3: a) Critically discuss the effect of diversification on portfolio risk. Is there any limit to diversification? (25%) b) International diversification could help investors to diversify the risk of their portfolio to a greater extent. Currently, the UK stock market has been going through a bearish episode due to the COVID - 19 pandemic. To what extent would diversifying your portfolio internationally protect you against this bearish episode in the UK market? Critically explain your answer using empirical evidence where possible. (35%) c) Consider that you are working as a fund manager and considering three mutual funds for your client. The first one is a stock fund, the second one is a long term government and corporate bond fund and the third is a T-bill money market fund that yields a rate of 6%. Characteristics of the risky funds are as follows: Expected return Standard deviation Stock fund (S) 18% 25% Bond fund (B) 10% 12% The correlation between the returns to funds S and B is 0.20 ) Determine the investment proportions of the minimum-variance portfolio made up of the two risky funds and calculate the expected return and standard deviation of its rate of return. (10%) (ii) Solve numerically for the proportions of each asset and for the expected return and standard deviation of the optimal risky portfolio and calculate the reward-to- volatility ratio of the best feasible Capital Allocation Line (CAL)? (10%) (iii) You require that your portfolio yield an expected return of 20%, and that it be efficient, on the best feasible CAL, What is the standard deviation of your portfolio? What is the proportion invested in the T-bill fund and each of the two risky funds? (10%) (iv) If you were to use only two risky funds, and still require an expected return of 20%, what would be the investment proportions of your portfolio? Compare its standard deviation to that of the optimized portfolio in part (ii). What do you conclude? (10%)