Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 (a) If an investor can construct a portfolio of stocks that has a long-run mean return that is reliably above the mean return

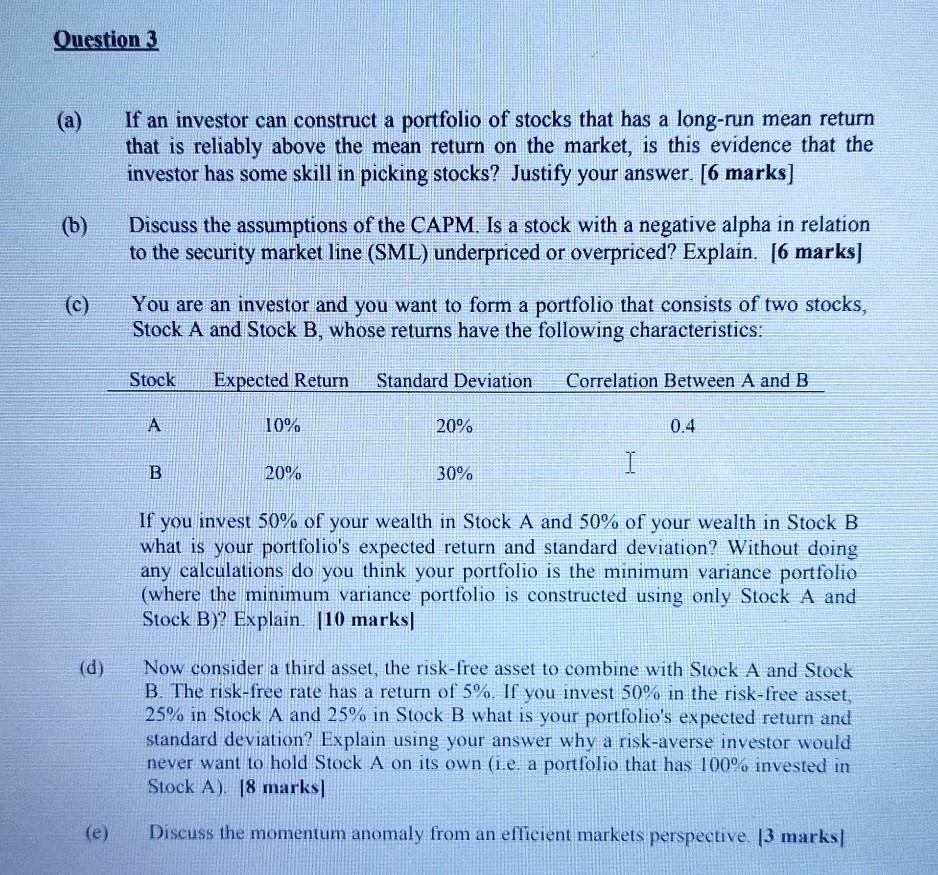

Question 3 (a) If an investor can construct a portfolio of stocks that has a long-run mean return that is reliably above the mean return on the market, is this evidence that the investor has some skill in picking stocks? Justify your answer. [6 marks] (b) Discuss the assumptions of the CAPM. Is a stock with a negative alpha in relation to the security market line (SML) underpriced or overpriced? Explain. [6 marks] You are an investor and you want to form a portfolio that consists of two stocks, Stock A and Stock B, whose returns have the following characteristics: Stock Expected Return Standard Deviation Correlation Between A and B A 10% 20% 0.4 I I B 20% 30% If you invest 50% of your wealth in Stock A and 50% of your wealth in Stock B what is your portfolio's expected return and standard deviation? Without doing any calculations do you think your portfolio is the minimum variance portfolio (where the minimum variance portfolio is constructed using only Slock A and Stock B)? Explain. [10 marks (d) Now consider a third asset, the risk-free asset to combine with Stock A and Stock B. The risk-free rate has a return of 5%. If you invest 50% in the risk-free asset, 25% in Stock A and 25% in Stock B what is your portfolio's expected return and standard deviation? Explain using your answer why a risk-averse investor would never want to hold Stock A on its own (i.e. a portfolio that has 100% invested in Stock A). 18 marks] (e) Discuss the momentum anomaly from an efficient markets perspective [3 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started