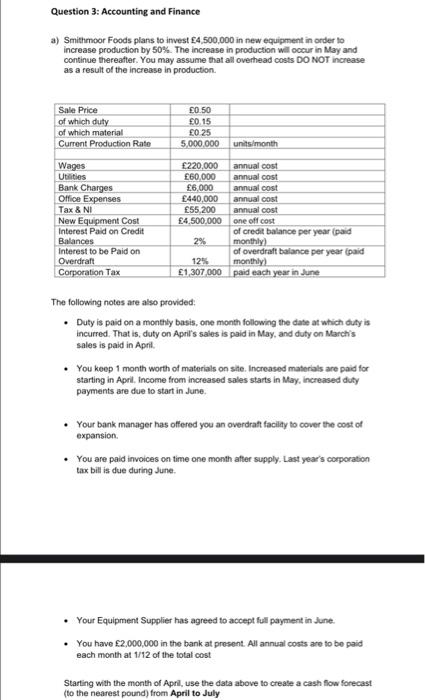

Question 3: Accounting and Finance a) Smithmoor Foods plans to invest 4,500,000 in new equipment in order to increase production by 50%. The increase in production will occur in May and continue thereafter. You may assume that all overhead costs DO NOT increase as a result of the increase in production. The following notes are also provided: - Duty is paid on a monthly basis, one month following the date at which duty is incurred. That is, duty on April's sales is paid in May, and duty on March's sales is paid in April. - You keep 1 month worth of materials on site. Increased materials are paid for starting in April. Income from increased sales starts in May, increased duty payments are due to start in dune. - Your bank manager has offered you an overdrat facilty to cover the cost of expansion. - You are paid invoices on time one month after supply. Last year's corporation tax bill is due during June. - Your Equipment Supplier has agreed to accept full payment in June. - You have 2,000,000 in the bank at present. All annual costs are to be paid each month at 1/12 of the total cost Starting with the month of April, use the data above to create a cash flow forecast (to the nearest pound) from April to July Question 3: Accounting and Finance a) Smithmoor Foods plans to invest 4,500,000 in new equipment in order to increase production by 50%. The increase in production will occur in May and continue thereafter. You may assume that all overhead costs DO NOT increase as a result of the increase in production. The following notes are also provided: - Duty is paid on a monthly basis, one month following the date at which duty is incurred. That is, duty on April's sales is paid in May, and duty on March's sales is paid in April. - You keep 1 month worth of materials on site. Increased materials are paid for starting in April. Income from increased sales starts in May, increased duty payments are due to start in dune. - Your bank manager has offered you an overdrat facilty to cover the cost of expansion. - You are paid invoices on time one month after supply. Last year's corporation tax bill is due during June. - Your Equipment Supplier has agreed to accept full payment in June. - You have 2,000,000 in the bank at present. All annual costs are to be paid each month at 1/12 of the total cost Starting with the month of April, use the data above to create a cash flow forecast (to the nearest pound) from April to July