Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 3: Accounting Concepts (15 marks) You are a graduate accountant working for Pickets and Pritchard Chartered Accountants. Mr Mercedes has had a meeting with

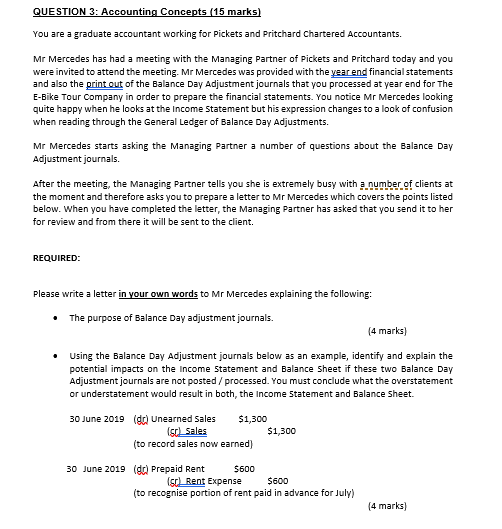

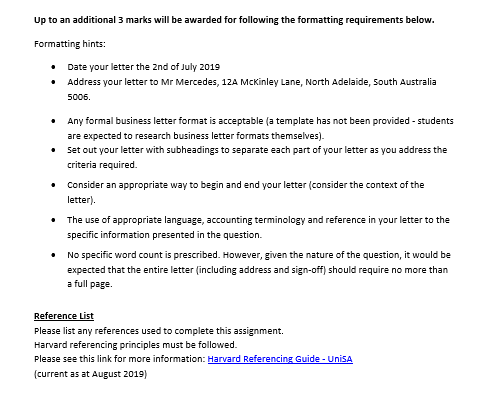

QUESTION 3: Accounting Concepts (15 marks) You are a graduate accountant working for Pickets and Pritchard Chartered Accountants. Mr Mercedes has had a meeting with the Managing Partner of Pickets and Pritchard today and you were invited to attend the meeting. Mr Mercedes was provided with the year end financial statements and also the print out of the Balance Day Adjustment journals that you processed at year end for The E-Bike Tour Company in order to prepare the financial statements. You notice Mr Mercedes looking quite happy when he looks at the Income Statement but his expression changes to a look of confusion when reading through the General Ledger of Balance Day Adjustments. Mr Mercedes starts asking the Managing Partner a number of questions about the Balance Day Adjustment journals. After the meeting, the Managing Partner tells you she is extremely busy with a number of clients at the moment and therefore asks you to prepare a letter to Mr Mercedes which covers the points listed below. When you have completed the letter, the Managing Partner has asked that you send it to her for review and from there it will be sent to the client. REQUIRED: Please write a letter in your own words to Mr Mercedes explaining the following The purpose of Balance Day adjustment journals. (4 marks) Using the Balance Day Adjustment journals below as an example, identify and explain the potential impacts on the Income Statement and Balance Sheet if these two Balance Day Adjustment journals are not posted / processed. You must conclude what the overstatement or understatement would result in both, the Income Statement and Balance Sheet (d) Unearned Sales (gr Sales (to record sales now earned) $1,300 30 June 2019 $1,300 30 June 2019 (dr Prepaid Rent $600 sCRent Expense $600 (to recognise portion of rent paid in advance for July) (4 marks) Up to an additional 3 marks will be awarded for following the formatting requirements below. Formatting hints: Date your letter the 2nd of July 2019 Address your letter to Mr Mercedes, 12A McKinley Lane, North Adelaide, South Australia 5006. Any formal business letter format is acceptable (a template has not been provided - students are expected to research business letter formats themselves) Set out your letter with subheadings to separate each part of your letter as you address the criteria required Consider an appropriate way to begin and end your letter (consider the context of the letter) The use of appropriate language, accounting terminology and reference in your letter to the specific information presented in the question No specific word count is prescribed. However, given the nature of the question, it would be expected that the entire letter (including address and sign-off) should require no more than a full page Reference List Please list any references used to complete this assignment Harvard referencing principles must be followed. Please see this link for more information: Harvard Referencing Guide-UnisA (current as at August 2019) QUESTION 3: Accounting Concepts (15 marks) You are a graduate accountant working for Pickets and Pritchard Chartered Accountants. Mr Mercedes has had a meeting with the Managing Partner of Pickets and Pritchard today and you were invited to attend the meeting. Mr Mercedes was provided with the year end financial statements and also the print out of the Balance Day Adjustment journals that you processed at year end for The E-Bike Tour Company in order to prepare the financial statements. You notice Mr Mercedes looking quite happy when he looks at the Income Statement but his expression changes to a look of confusion when reading through the General Ledger of Balance Day Adjustments. Mr Mercedes starts asking the Managing Partner a number of questions about the Balance Day Adjustment journals. After the meeting, the Managing Partner tells you she is extremely busy with a number of clients at the moment and therefore asks you to prepare a letter to Mr Mercedes which covers the points listed below. When you have completed the letter, the Managing Partner has asked that you send it to her for review and from there it will be sent to the client. REQUIRED: Please write a letter in your own words to Mr Mercedes explaining the following The purpose of Balance Day adjustment journals. (4 marks) Using the Balance Day Adjustment journals below as an example, identify and explain the potential impacts on the Income Statement and Balance Sheet if these two Balance Day Adjustment journals are not posted / processed. You must conclude what the overstatement or understatement would result in both, the Income Statement and Balance Sheet (d) Unearned Sales (gr Sales (to record sales now earned) $1,300 30 June 2019 $1,300 30 June 2019 (dr Prepaid Rent $600 sCRent Expense $600 (to recognise portion of rent paid in advance for July) (4 marks) Up to an additional 3 marks will be awarded for following the formatting requirements below. Formatting hints: Date your letter the 2nd of July 2019 Address your letter to Mr Mercedes, 12A McKinley Lane, North Adelaide, South Australia 5006. Any formal business letter format is acceptable (a template has not been provided - students are expected to research business letter formats themselves) Set out your letter with subheadings to separate each part of your letter as you address the criteria required Consider an appropriate way to begin and end your letter (consider the context of the letter) The use of appropriate language, accounting terminology and reference in your letter to the specific information presented in the question No specific word count is prescribed. However, given the nature of the question, it would be expected that the entire letter (including address and sign-off) should require no more than a full page Reference List Please list any references used to complete this assignment Harvard referencing principles must be followed. Please see this link for more information: Harvard Referencing Guide-UnisA (current as at August 2019)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started