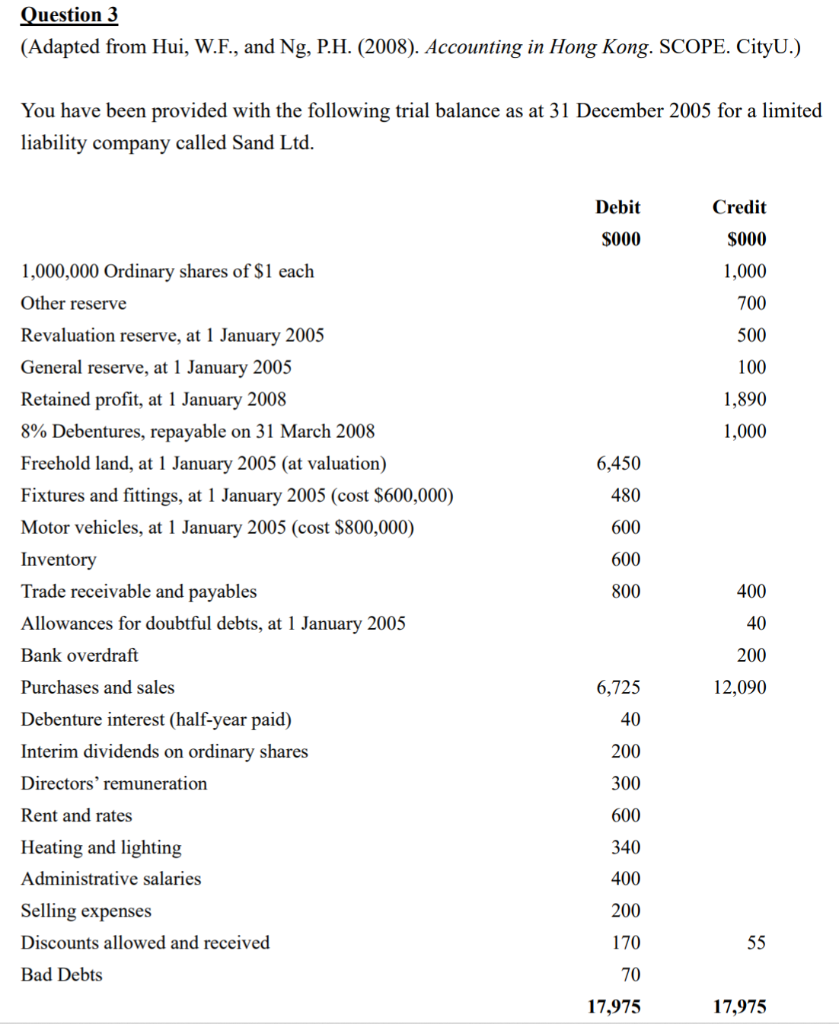

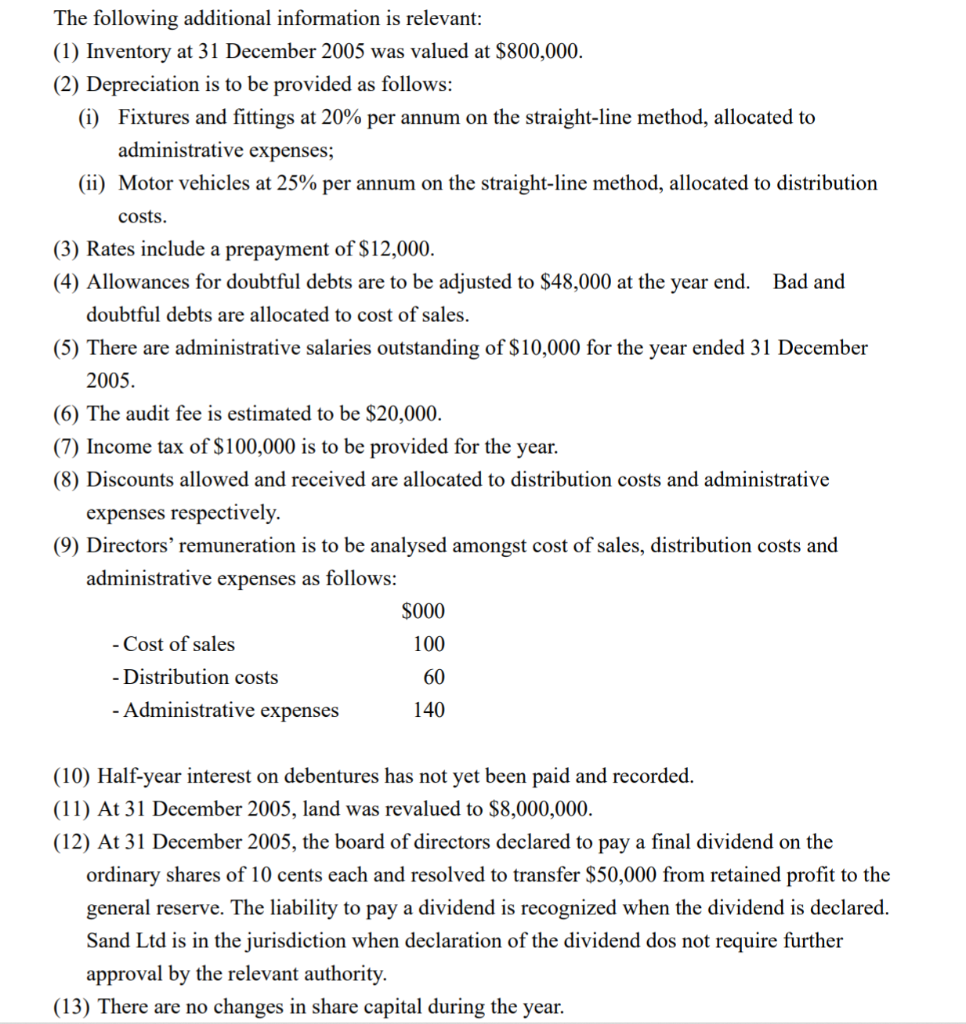

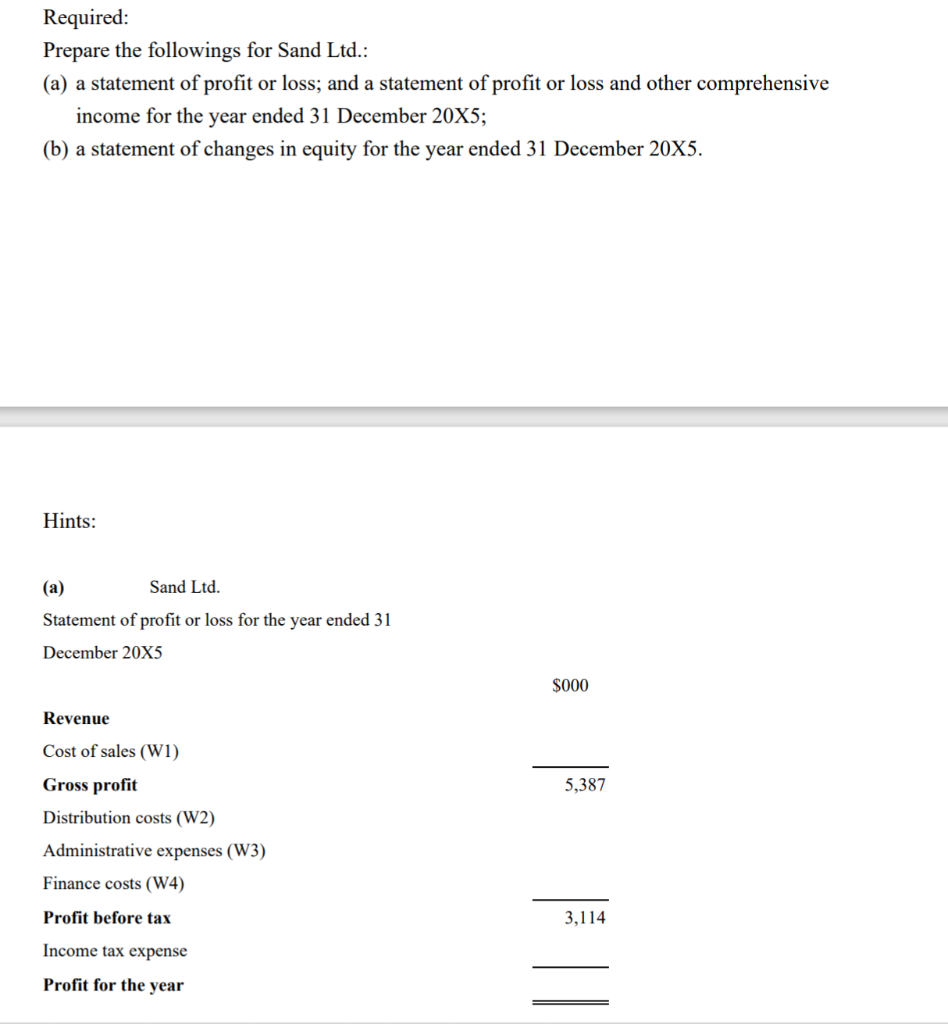

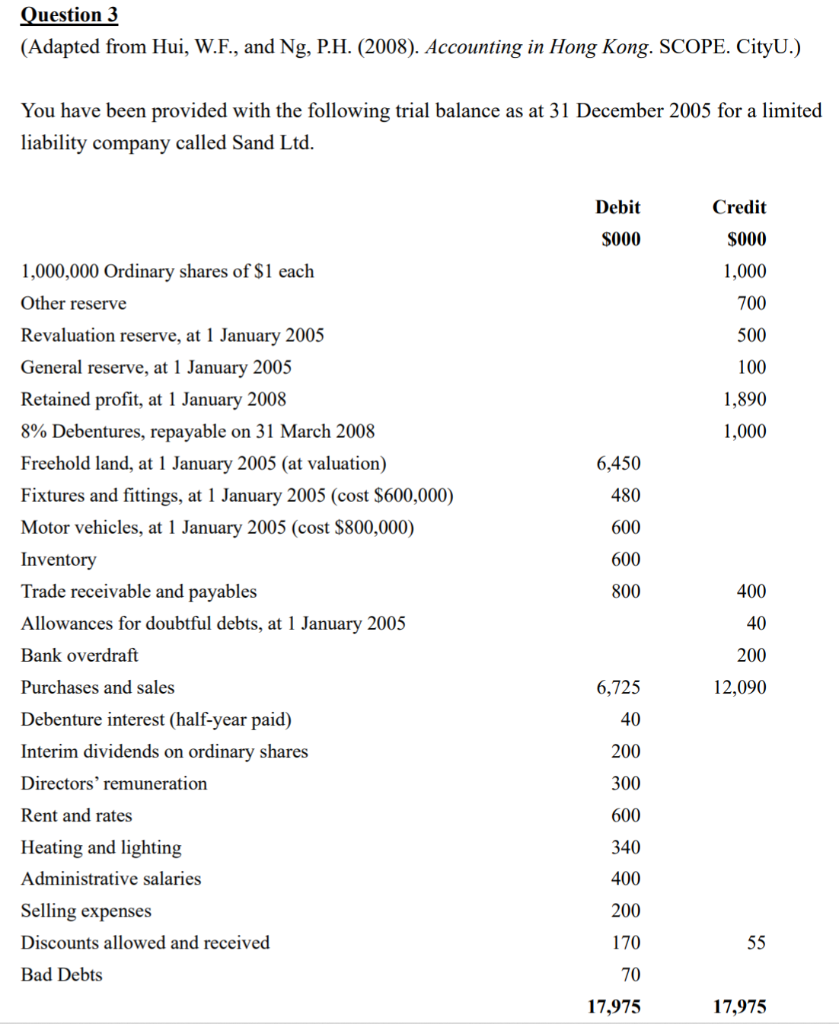

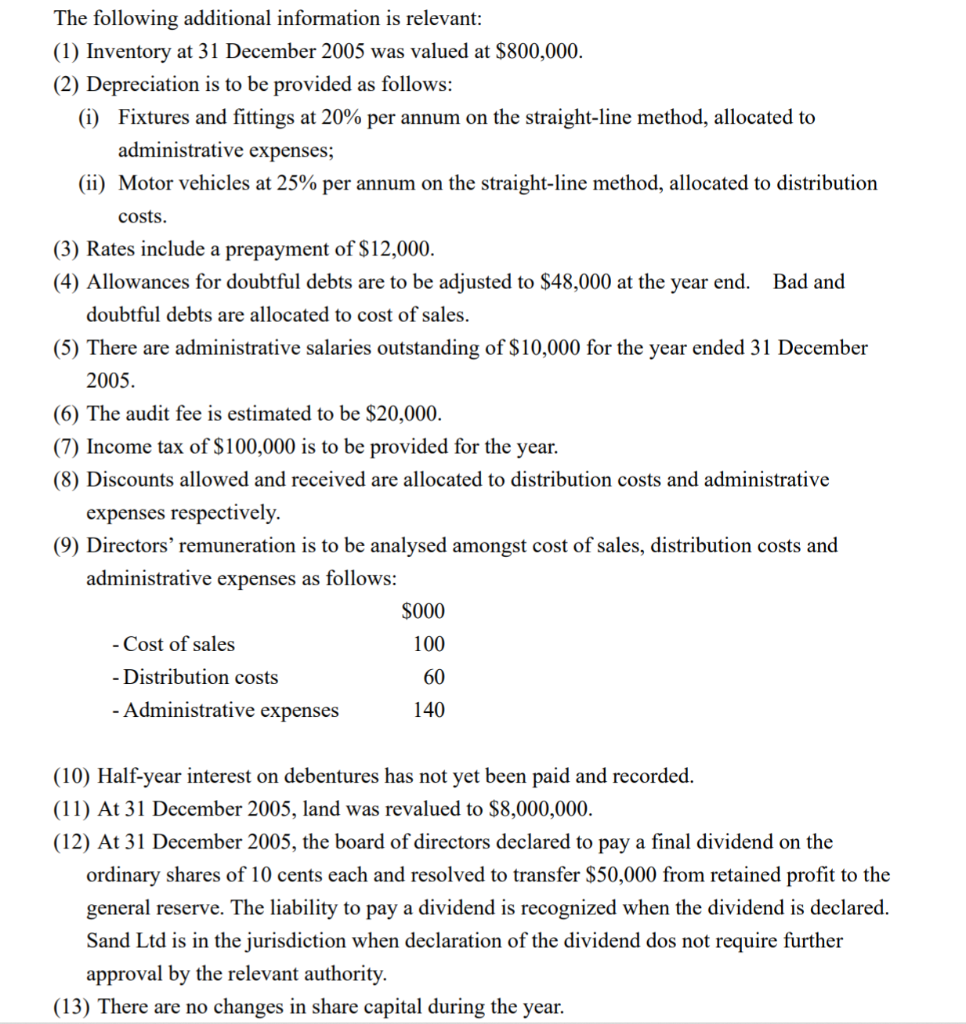

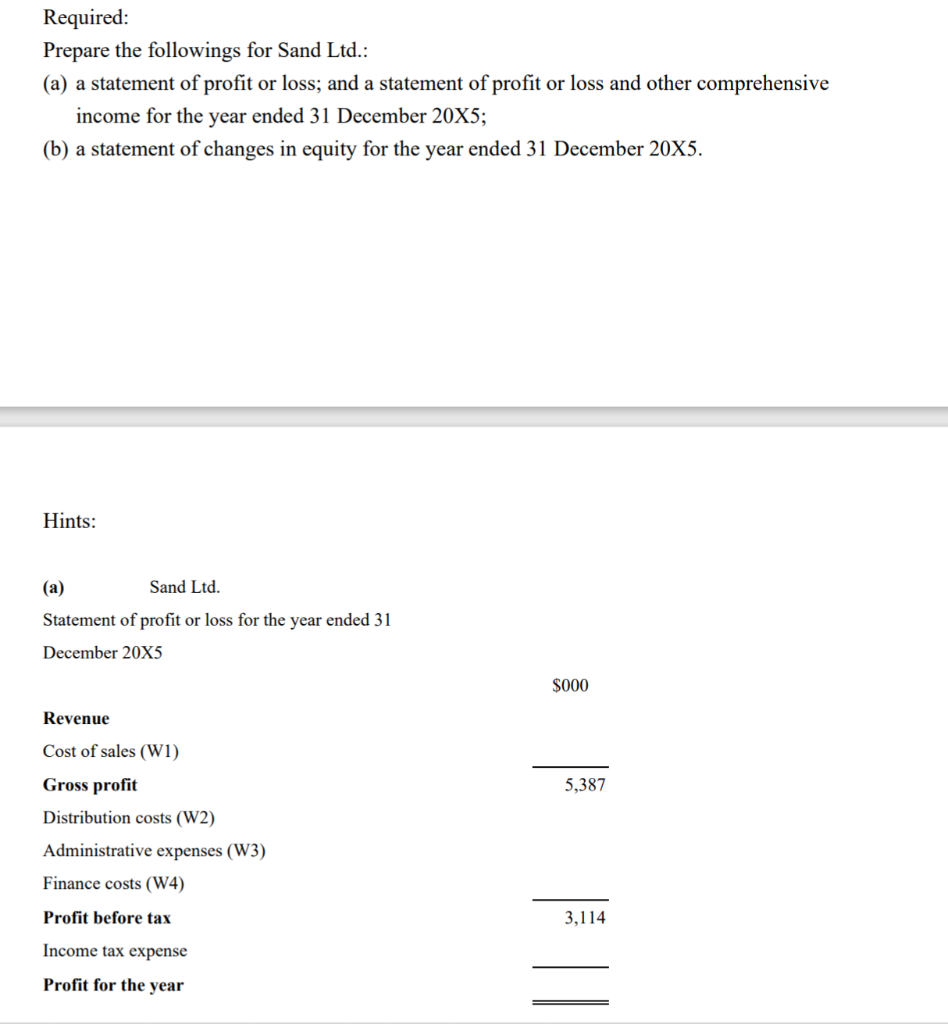

Question 3 (Adapted from Hui, W.F., and Ng, P.H. (2008). Accounting in Hong Kong. SCOPE. CityU.) You have been provided with the following trial balance as at 31 December 2005 for a limited liability company called Sand Ltd. Debit Credit $000 $000 1,000,000 Ordinary shares of $1 each 1,000 Other reserve 700 500 100 1,890 1,000 6,450 Revaluation reserve, at 1 January 2005 General reserve, at 1 January 2005 Retained profit, at 1 January 2008 8% Debentures, repayable on 31 March 2008 Freehold land, at 1 January 2005 (at valuation) Fixtures and fittings, at 1 January 2005 (cost $600,000) Motor vehicles, at 1 January 2005 (cost $800,000) Inventory Trade receivable and payables Allowances for doubtful debts, at 1 January 2005 Bank overdraft 480 600 600 800 400 40 200 6,725 12,090 40 Purchases and sales Debenture interest (half-year paid) Interim dividends on ordinary shares Directors' remuneration 200 300 Rent and rates 600 340 400 Heating and lighting Administrative salaries Selling expenses Discounts allowed and received 200 170 55 Bad Debts 70 17,975 17,975 The following additional information is relevant: (1) Inventory at 31 December 2005 was valued at $800,000. (2) Depreciation is to be provided as follows: (i) Fixtures and fittings at 20% per annum on the straight-line method, allocated to administrative expenses; (ii) Motor vehicles at 25% per annum on the straight-line method, allocated to distribution costs. (3) Rates include a prepayment of $12,000. (4) Allowances for doubtful debts are to be adjusted to $48,000 at the year end. Bad and doubtful debts are allocated to cost of sales. (5) There are administrative salaries outstanding of $10,000 for the year ended 31 December 2005. (6) The audit fee is estimated to be $20,000. (7) Income tax of $100,000 is to be provided for the year. (8) Discounts allowed and received are allocated to distribution costs and administrative expenses respectively. (9) Directors' remuneration is to be analysed amongst cost of sales, distribution costs and administrative expenses as follows: $000 - Cost of sales 100 - Distribution costs 60 - Administrative expenses 140 (10) Half-year interest on debentures has not yet been paid and recorded. (11) At 31 December 2005, land was revalued to $8,000,000. (12) At 31 December 2005, the board of directors declared to pay a final dividend on the ordinary sha 10 cents each and resolved to transfer $50,000 from retained profit to general reserve. The liability to pay a dividend is recognized when the dividend is declared. Sand Ltd is in the jurisdiction when declaration of the dividend dos not require further approval by the relevant authority. (13) There are no changes in share capital during the year. Required: Prepare the followings for Sand Ltd.: (a) a statement of profit or loss; and a statement of profit or loss and other comprehensive income for the year ended 31 December 20X5; (b) a statement of changes in equity for the year ended 31 December 20X5. Hints: (a) Sand Ltd. Statement of profit or loss for the year ended 31 December 20X5 $000 Revenue Cost of sales (61) 5,387 Gross profit Distribution costs (W2) Administrative expenses (W3) Finance costs (W4) Profit before tax 3,114 Income tax expense Profit for the year