Answered step by step

Verified Expert Solution

Question

1 Approved Answer

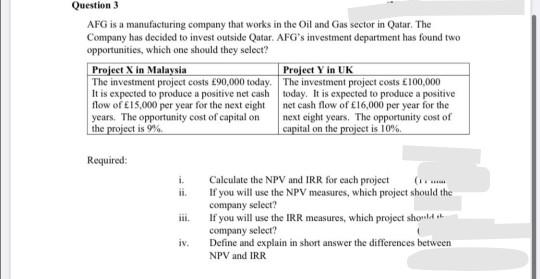

Question 3 AFG is a manufacturing company that works in the Oil and Gas sector in Qatar. The Company has decided to invest outside Qatar.

Question 3 AFG is a manufacturing company that works in the Oil and Gas sector in Qatar. The Company has decided to invest outside Qatar. AFG's investment department has found two opportunities, which one should they select? Project X in Malaysia Project Y in UK The investment project costs 90,000 today. The investment project costs E100,000 It is expected to produce a positive net cash today. It is expected to produce a positive flow of E15,000 per year for the next eight net cash flow of 16,000 per year for the years. The opportunity cost of capital on next eight years. The opportunity cost of the project is 9% capital on the project is 10% Required: ii. Calculate the NPV and IRR for each project If you will use the NPV measures, which project should the company select? If you will use the IRR measures, which project should company select? Define and explain in short answer the differences between NPV and IRR iv

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started