Answered step by step

Verified Expert Solution

Question

1 Approved Answer

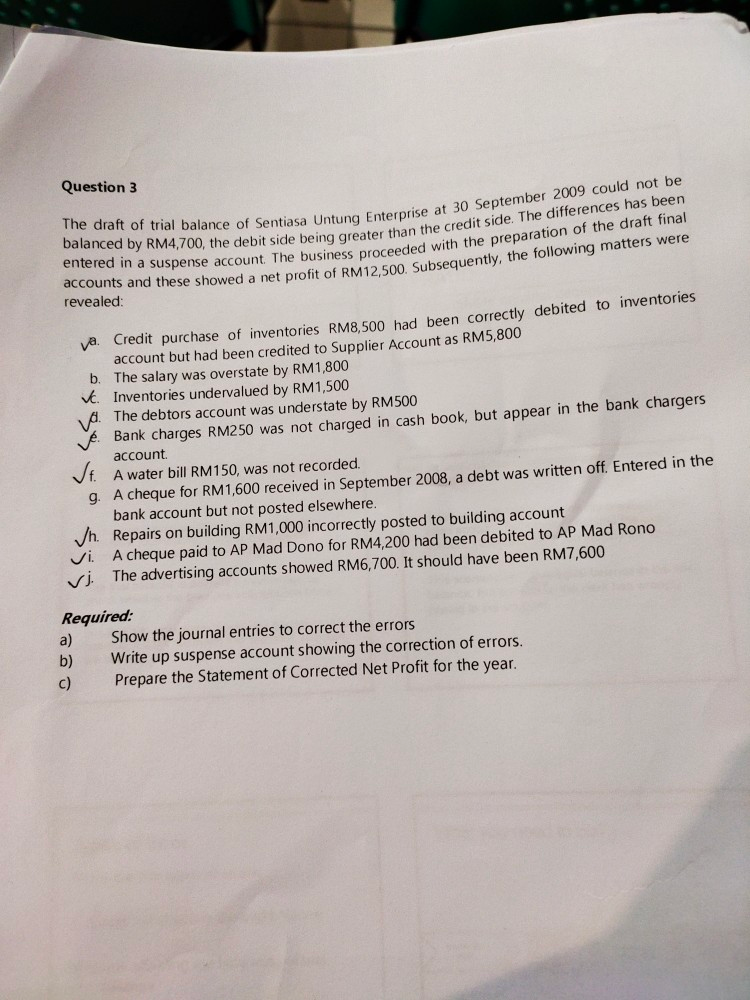

Question 3 alance of Sentiasa Untung Enterprise at 30 September 2009 cou he debit side being greater than the credit side. The differences has been

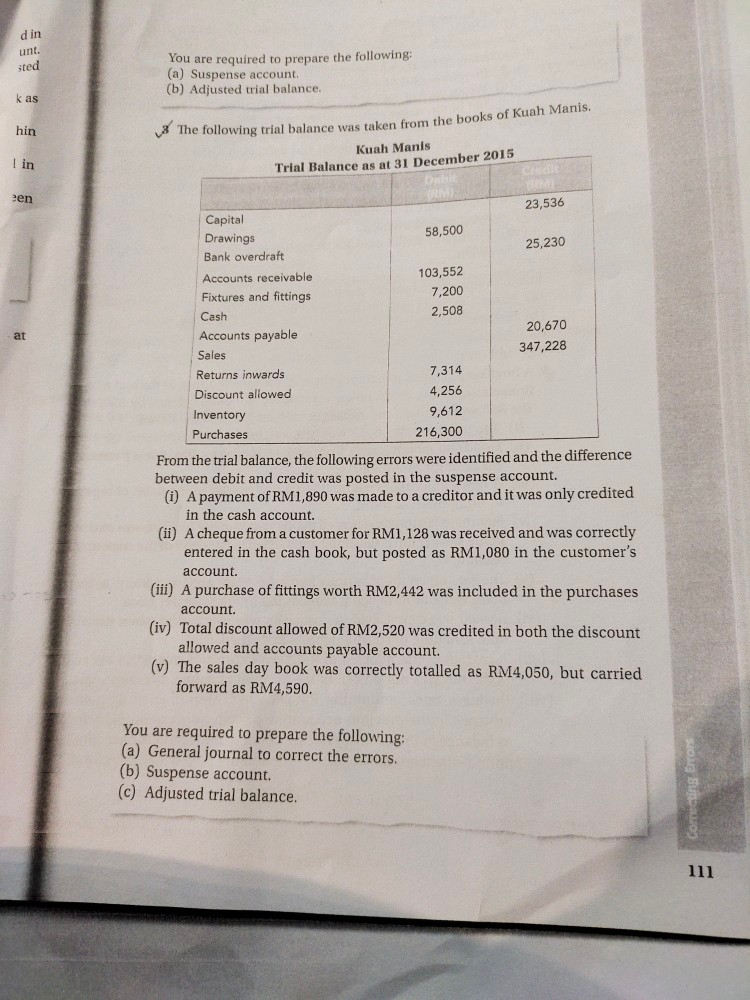

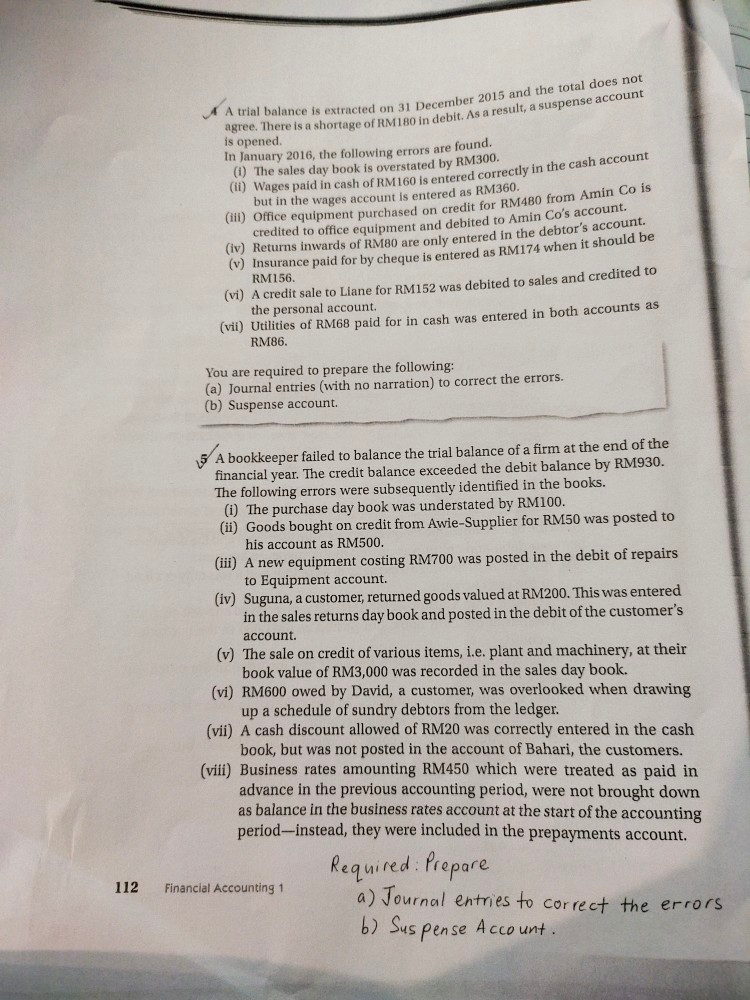

Question 3 alance of Sentiasa Untung Enterprise at 30 September 2009 cou he debit side being greater than the credit side. The differences has been business proceeded with the preparation of the draft final se showed a net profit of RM12,500. Subsequently, the following matters were The draft of trial balance of Sentiasa balanced by RM4,700, the debit side being greater entered in a suspense account. The business proceeded with accounts and these showed a net profit of RM revealed: vacredit purchase of inventories RM8.500 had been correctly debited to inventories account but had been credited to Supplier Account as RM5,800 b. The salary was overstate by RM1,800 vt. Inventories undervalued by RM1,500 a. The debtors account was understate by RM500 Bank charges RM250 was not charged in cash book, but appear in the bank chargers account Jf. A water bill RM150, was not recorded. g. A cheque for RM1,600 received in September 2008, a debt was written off. Entered in the bank account but not posted elsewhere. Jh. Repairs on building RM1,000 incorrectly posted to building account vi. A cheque paid to AP Mad Dono for RM4,200 had been debited to AP Mad Rono vi. The advertising accounts showed RM6,700. It should have been RM7,600 Required: Show the journal entries to correct the errors b) Write up suspense account showing the correction of errors. Prepare the Statement of Corrected Net Profit for the year. d in unt. sted You are required to prepare the following: (a) Suspense account. (b) Adjusted trial balance. kas hin me following trial balance was taken from the books of Kuah Manis. I in Kuah Manis Trial Balance as at 31 December 2015 een at 23,536 Capital Drawings 58,500 25,230 Bank overdraft Accounts receivable 103,552 Fixtures and fittings 7,200 Cash 2,508 20,670 Accounts payable 347,228 Sales Returns inwards 7,314 Discount allowed 4,256 Inventory 9,612 Purchases 216,300 From the trial balance, the following errors were identified and the difference between debit and credit was posted in the suspense account. (i) A payment of RM1,890 was made to a creditor and it was only credited in the cash account. (ii) A cheque from a customer for RM1,128 was received and was correctly entered in the cash book, but posted as RM1,080 in the customer's account. (iii) A purchase of fittings worth RM2,442 was included in the purchases account. (iv) Total discount allowed of RM2,520 was credited in both the discount allowed and accounts payable account. (v) The sales day book was correctly totalled as RM4,050, but carried forward as RM4,590. You are required to prepare the following: (a) General journal to correct the errors. (b) Suspense account. (c) Adjusted trial balance. 111 RM180 in debit. As a result, a suspense account A trial balance is extracted on 31 ice is extracted on 31 December 2015 and the total does not agree. There is a shortage of RM180 in debit. As a re is opened In January 2016, the following errors are found. (1) The sales day book is overstated by RM300. lur in the cash account ( Wages paid in cash of RM160 is entered correctly in the cash account but in the wages account is entered as RM360. (fin) Office equipment purchased on credit for RM480 from Amin credit for RMARO from Amin Co is credited to office equipment and debited to Amin Co's account. (iv) Returns inwards of RM80 are only entered in the debtor's account. insurance paid for by cheque is entered as RM174 when it should be RM156. (vi) A credit sale to Liane for RM152 was debited to sales and credited to the personal account. (vii) Utilities of RM68 paid for in cash was entered in both accounts as RM86. You are required to prepare the following: (a) Journal entries (with no narration) to correct the errors. (b) Suspense account. 5 A bookkeeper failed to balance the trial balance of a firm at the end of the financial year. The credit balance exceeded the debit balance by RM930. The following errors were subsequently identified in the books. (1) The purchase day book was understated by RM100. (11) Goods bought on credit from Awie-Supplier for RM50 was posted to his account as RM500. (iii) A new equipment costing RM700 was posted in the debit of repairs to Equipment account. (iv) Suguna, a customer, returned goods valued at RM200. This was entered in the sales returns day book and posted in the debit of the customer's account. (v) The sale on credit of various items, i.e. plant and machinery, at their book value of RM3,000 was recorded in the sales day book. (vi) RM600 owed by David, a customer, was overlooked when drawing up a schedule of sundry debtors from the ledger. (vii) A cash discount allowed of RM20 was correctly entered in the cash book, but was not posted in the account of Bahari, the customers. (viii) Business rates amounting RM450 which were treated as paid in advance in the previous accounting period, were not brought down as balance in the business rates account at the start of the accounting period-instead, they were included in the prepayments account. Required. Prepare Financial Accounting 1 a) Journal entries to correct the errors b) Suspense Account. 112

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started