Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3 (Answer all parts of the question.) a. Gaming plc produces a range of different sporting goods and sell them all over the world.

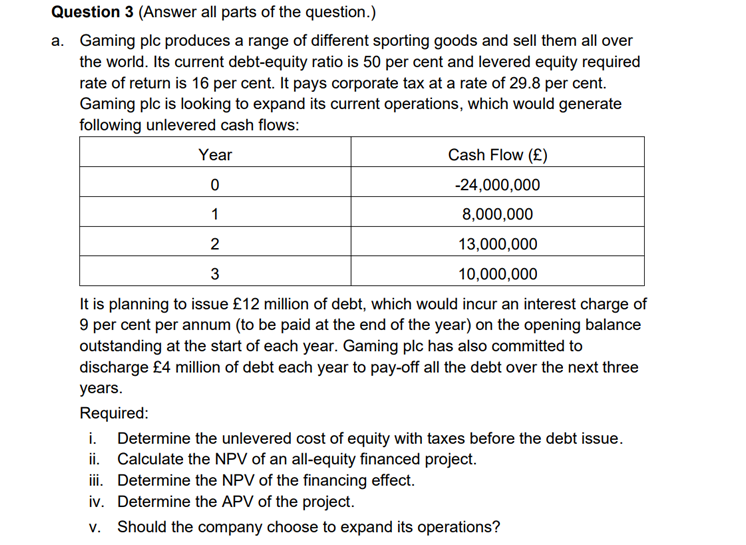

Question 3 (Answer all parts of the question.) a. Gaming plc produces a range of different sporting goods and sell them all over the world. Its current debt-equity ratio is 50 per cent and levered equity required rate of return is 16 per cent. It pays corporate tax at a rate of 29.8 per cent. Gaming plc is looking to expand its current operations, which would generate following unlevered cash flows: It is planning to issue 12 million of debt, which would incur an interest charge of 9 per cent per annum (to be paid at the end of the year) on the opening balance outstanding at the start of each year. Gaming plc has also committed to discharge 4 million of debt each year to pay-off all the debt over the next three years. Required: i. Determine the unlevered cost of equity with taxes before the debt issue. ii. Calculate the NPV of an all-equity financed project. iii. Determine the NPV of the financing effect. iv. Determine the APV of the project. v. Should the company choose to expand its operations

Question 3 (Answer all parts of the question.) a. Gaming plc produces a range of different sporting goods and sell them all over the world. Its current debt-equity ratio is 50 per cent and levered equity required rate of return is 16 per cent. It pays corporate tax at a rate of 29.8 per cent. Gaming plc is looking to expand its current operations, which would generate following unlevered cash flows: It is planning to issue 12 million of debt, which would incur an interest charge of 9 per cent per annum (to be paid at the end of the year) on the opening balance outstanding at the start of each year. Gaming plc has also committed to discharge 4 million of debt each year to pay-off all the debt over the next three years. Required: i. Determine the unlevered cost of equity with taxes before the debt issue. ii. Calculate the NPV of an all-equity financed project. iii. Determine the NPV of the financing effect. iv. Determine the APV of the project. v. Should the company choose to expand its operations Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started