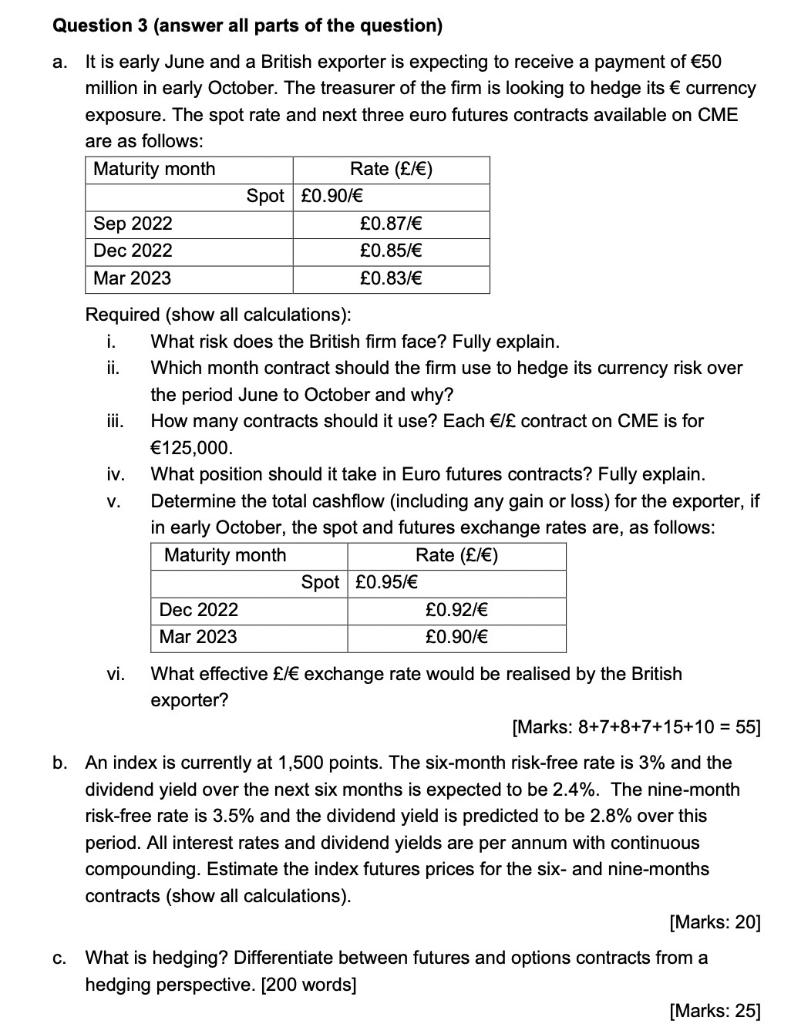

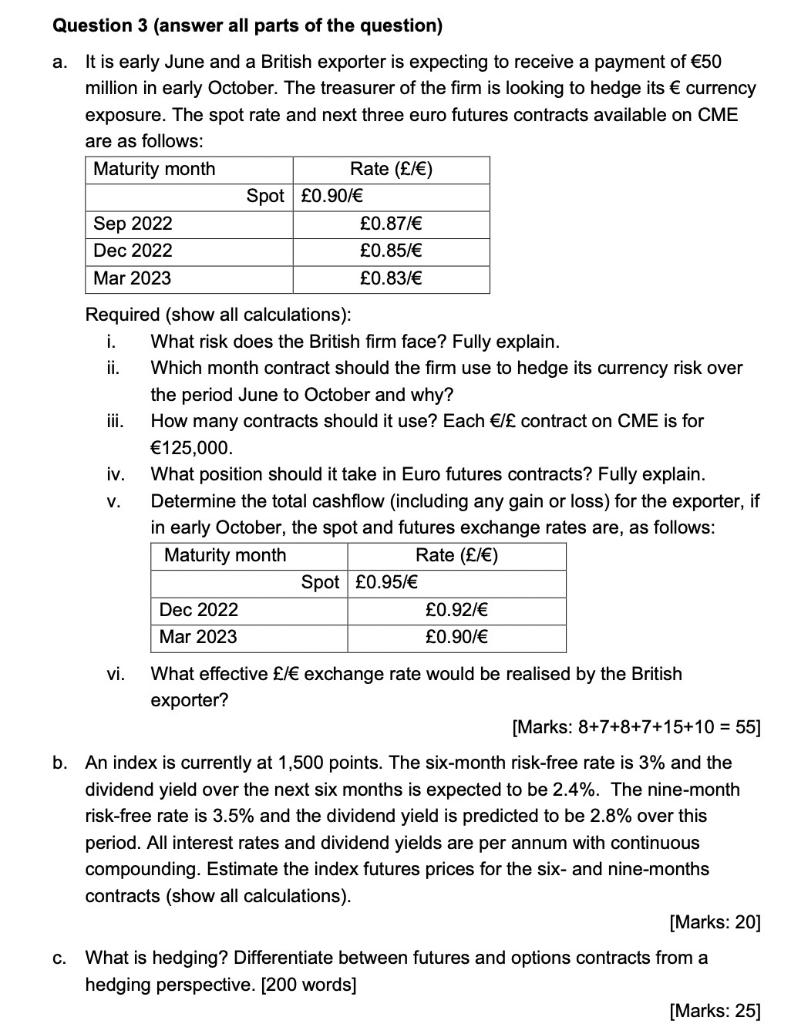

Question 3 (answer all parts of the question) a. It is early June and a British exporter is expecting to receive a payment of 50 million in early October. The treasurer of the firm is looking to hedge its currency exposure. The spot rate and next three euro futures contracts available on CME are as follows: Maturity month Rate (/) Spot 0.90/ Sep 2022 0.87/ Dec 2022 0.85/ Mar 2023 0.83/ Required (show all calculations): i. What risk does the British firm face? Fully explain. ii. Which month contract should the firm use to hedge its currency risk over the period June to October and why? iii. How many contracts should it use? Each / contract on CME is for 125,000. iv. V. What position should it take in Euro futures contracts? Fully explain. Determine the total cashflow (including any gain or loss) for the exporter, if in early October, the spot and futures exchange rates are, as follows: Maturity month Rate (/) Spot 0.95/ Dec 2022 0.92/ 0.90/ Mar 2023 vi. What effective / exchange rate would be realised by the British exporter? [Marks: 8+7+8+7+15+10 = 55] b. An index is currently at 1,500 points. The six-month risk-free rate is 3% and the dividend yield over the next six months is expected to be 2.4%. The nine-month risk-free rate is 3.5% and the dividend yield is predicted to be 2.8% over this period. All interest rates and dividend yields are per annum with continuous compounding. Estimate the index futures prices for the six- and nine-months contracts (show all calculations). [Marks: 20] C. What is hedging? Differentiate between futures and options contracts from a hedging perspective. [200 words] [Marks: 25] Question 3 (answer all parts of the question) a. It is early June and a British exporter is expecting to receive a payment of 50 million in early October. The treasurer of the firm is looking to hedge its currency exposure. The spot rate and next three euro futures contracts available on CME are as follows: Maturity month Rate (/) Spot 0.90/ Sep 2022 0.87/ Dec 2022 0.85/ Mar 2023 0.83/ Required (show all calculations): i. What risk does the British firm face? Fully explain. ii. Which month contract should the firm use to hedge its currency risk over the period June to October and why? iii. How many contracts should it use? Each / contract on CME is for 125,000. iv. V. What position should it take in Euro futures contracts? Fully explain. Determine the total cashflow (including any gain or loss) for the exporter, if in early October, the spot and futures exchange rates are, as follows: Maturity month Rate (/) Spot 0.95/ Dec 2022 0.92/ 0.90/ Mar 2023 vi. What effective / exchange rate would be realised by the British exporter? [Marks: 8+7+8+7+15+10 = 55] b. An index is currently at 1,500 points. The six-month risk-free rate is 3% and the dividend yield over the next six months is expected to be 2.4%. The nine-month risk-free rate is 3.5% and the dividend yield is predicted to be 2.8% over this period. All interest rates and dividend yields are per annum with continuous compounding. Estimate the index futures prices for the six- and nine-months contracts (show all calculations). [Marks: 20] C. What is hedging? Differentiate between futures and options contracts from a hedging perspective. [200 words] [Marks: 25]