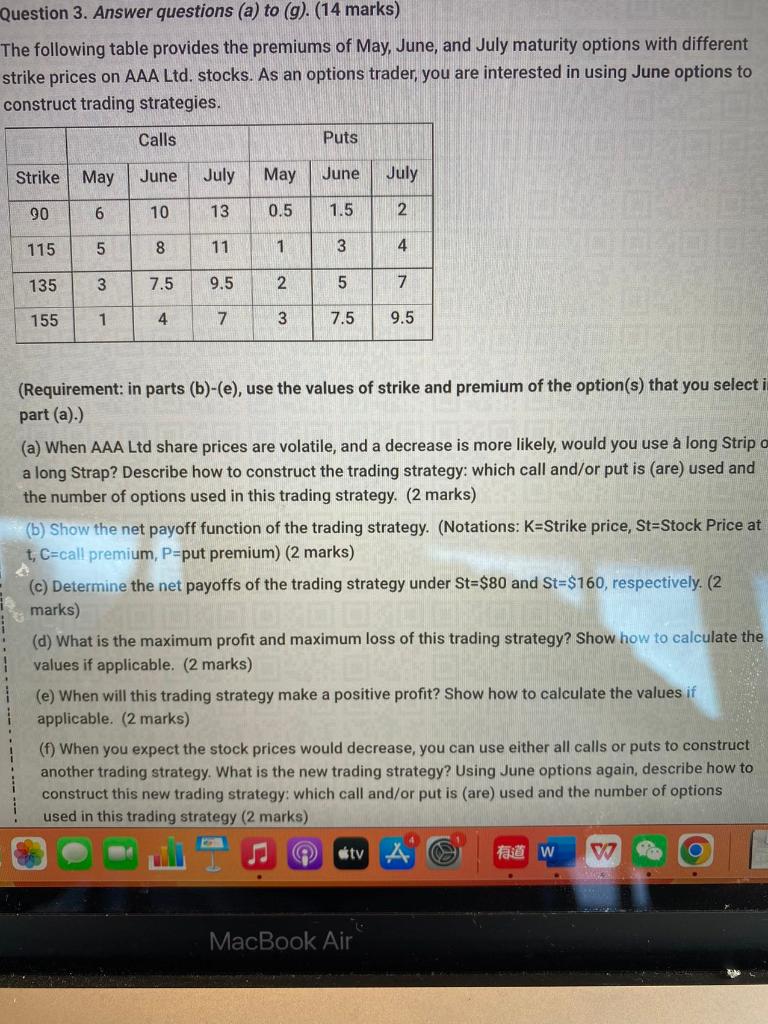

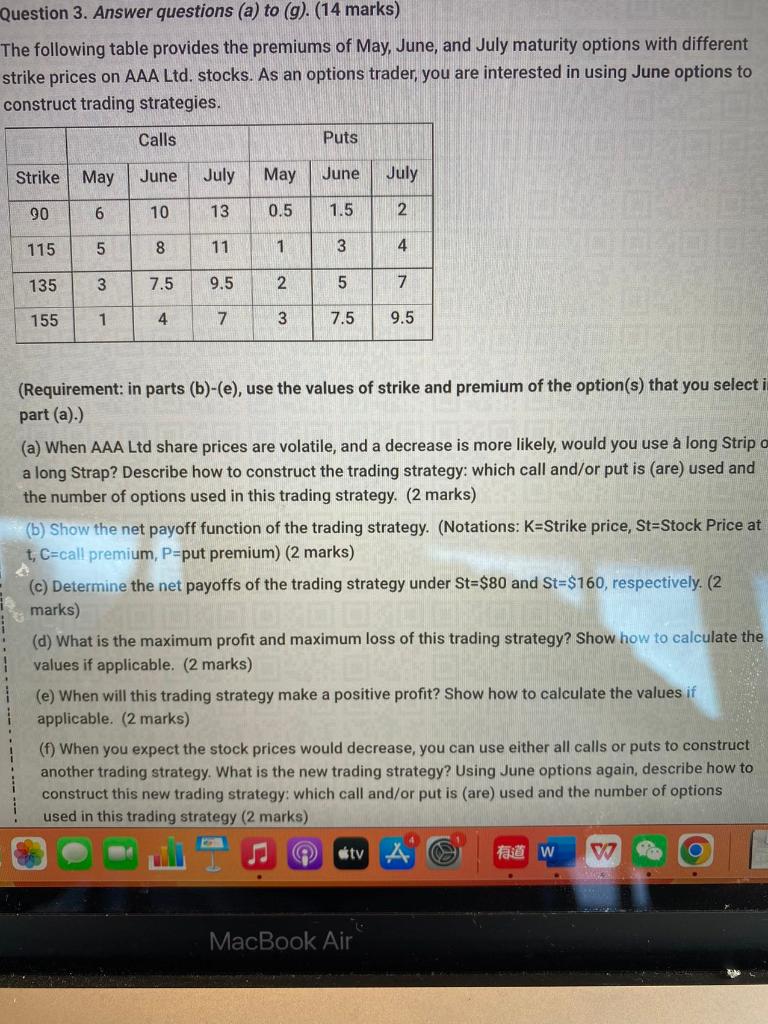

Question 3. Answer questions (a) to (g). (14 marks) The following table provides the premiums of May, June, and July maturity options with different strike prices on AAA Ltd. stocks. As an options trader, you are interested in using June options to construct trading strategies. (Requirement: in parts (b)-(e), use the values of strike and premium of the option(s) that you select i part(a). (a) When AAA Ltd share prices are volatile, and a decrease is more likely, would you use a long Strip o a long Strap? Describe how to construct the trading strategy: which call and/or put is (are) used and the number of options used in this trading strategy. ( 2 marks) (b) Show the net payoff function of the trading strategy. (Notations: K= Strike price, St=Stock Price at t,C= call premium, P= put premium) ( 2 marks) (c) Determine the net payoffs of the trading strategy under St=$80 and St=$160, respectively. (2 marks) (d) What is the maximum profit and maximum loss of this trading strategy? Show how to calculate the values if applicable. ( 2 marks) (e) When will this trading strategy make a positive profit? Show how to calculate the values if applicable. ( 2 marks) (f) When you expect the stock prices would decrease, you can use either all calls or puts to construct another trading strategy. What is the new trading strategy? Using June options again, describe how to construct this new trading strategy: which call and/or put is (are) used and the number of options used in this trading strategy ( 2 marks) another trading strategy. What is the new trading strategy? Using June options again, describe how th construct this new trading strategy: which call and/or put is (are) used and the number of options used in this trading strategy ( 2 marks) (g) Determine the net payoffs of the new trading strategy under St=$80 and St=$160, respectively. marks) Question 3. Answer questions (a) to (g). (14 marks) The following table provides the premiums of May, June, and July maturity options with different strike prices on AAA Ltd. stocks. As an options trader, you are interested in using June options to construct trading strategies. (Requirement: in parts (b)-(e), use the values of strike and premium of the option(s) that you select i part(a). (a) When AAA Ltd share prices are volatile, and a decrease is more likely, would you use a long Strip o a long Strap? Describe how to construct the trading strategy: which call and/or put is (are) used and the number of options used in this trading strategy. ( 2 marks) (b) Show the net payoff function of the trading strategy. (Notations: K= Strike price, St=Stock Price at t,C= call premium, P= put premium) ( 2 marks) (c) Determine the net payoffs of the trading strategy under St=$80 and St=$160, respectively. (2 marks) (d) What is the maximum profit and maximum loss of this trading strategy? Show how to calculate the values if applicable. ( 2 marks) (e) When will this trading strategy make a positive profit? Show how to calculate the values if applicable. ( 2 marks) (f) When you expect the stock prices would decrease, you can use either all calls or puts to construct another trading strategy. What is the new trading strategy? Using June options again, describe how to construct this new trading strategy: which call and/or put is (are) used and the number of options used in this trading strategy ( 2 marks) another trading strategy. What is the new trading strategy? Using June options again, describe how th construct this new trading strategy: which call and/or put is (are) used and the number of options used in this trading strategy ( 2 marks) (g) Determine the net payoffs of the new trading strategy under St=$80 and St=$160, respectively. marks)