Question: Question 3 As an arbitrage trader, you are contemplating to arbitrage based on the following quotes FBM KLCI Index = 750 points 3-month SIF =

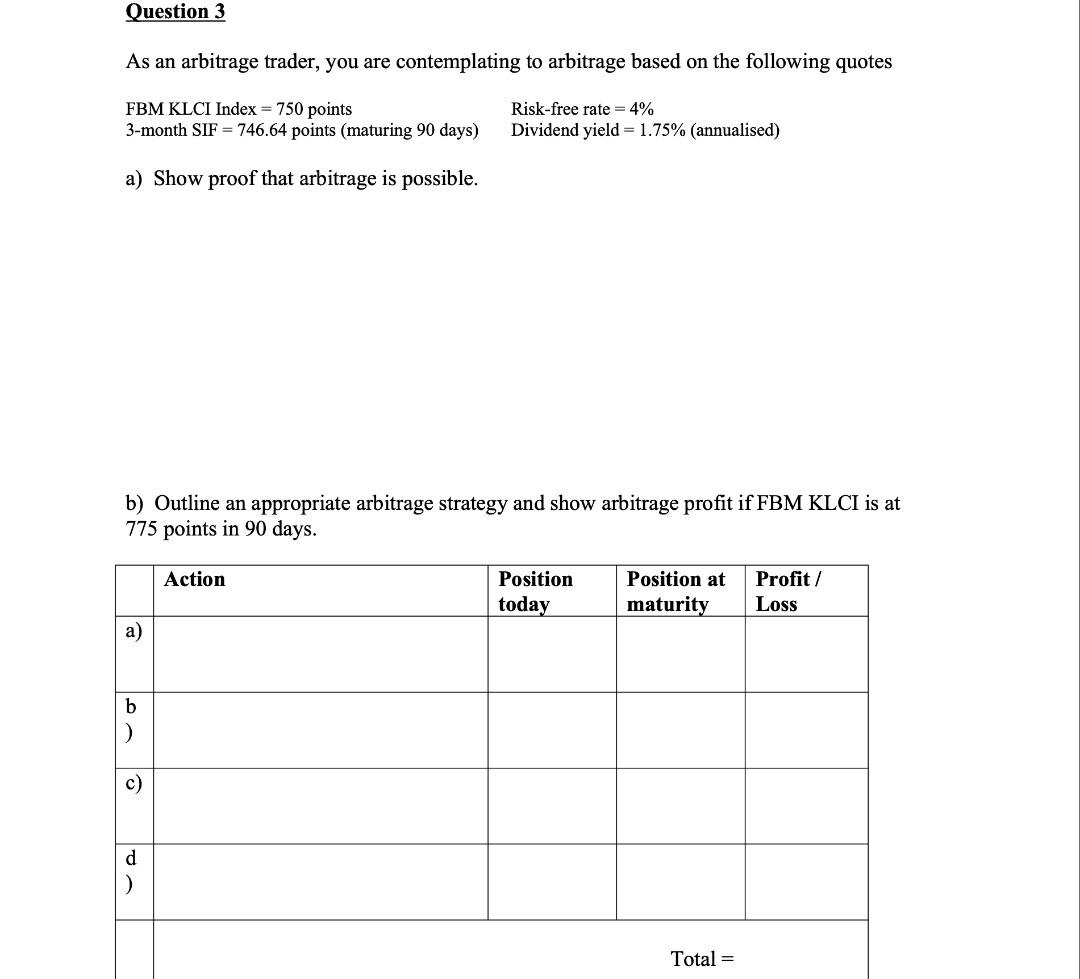

Question 3 As an arbitrage trader, you are contemplating to arbitrage based on the following quotes FBM KLCI Index = 750 points 3-month SIF = 746.64 points (maturing 90 days) Risk-free rate = 4% Dividend yield = 1.75% (annualised) a) Show proof that arbitrage is possible. b) Outline an appropriate arbitrage strategy and show arbitrage profit if FBM KLCI is at 775 points in 90 days. Action Position today Position at maturity Profit/ Loss a) b c) d Total = Question 3 As an arbitrage trader, you are contemplating to arbitrage based on the following quotes FBM KLCI Index = 750 points 3-month SIF = 746.64 points (maturing 90 days) Risk-free rate = 4% Dividend yield = 1.75% (annualised) a) Show proof that arbitrage is possible. b) Outline an appropriate arbitrage strategy and show arbitrage profit if FBM KLCI is at 775 points in 90 days. Action Position today Position at maturity Profit/ Loss a) b c) d Total =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts