Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3: As an independent public company, the Bauxite Division will have the same tax rate and capitalization ratios as OMCs. However, it is anticipated

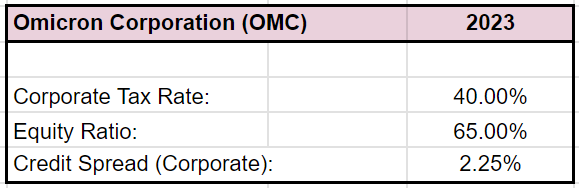

Question 3: As an independent public company, the Bauxite Division will have the same tax rate and capitalization ratios as OMCs. However, it is anticipated that the Bauxite Divisions Cost of Debt will be 0.25% higher than OMCs. Below is a financial snapshot for OMC:

|

Based upon this information and the Asset Beta you have already calculated, what is the expected Equity Beta for the Bauxite Division?

\begin{tabular}{|l|c|} \hline Omicron Corporation (OMC) & 2023 \\ \hline & \\ \hline Corporate Tax Rate: & 40.00% \\ \hline Equity Ratio: & 65.00% \\ \hline Credit Spread (Corporate): & 2.25% \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started